- Australia

- /

- Capital Markets

- /

- ASX:SWF

Investors Aren't Entirely Convinced By SelfWealth Limited's (ASX:SWF) Revenues

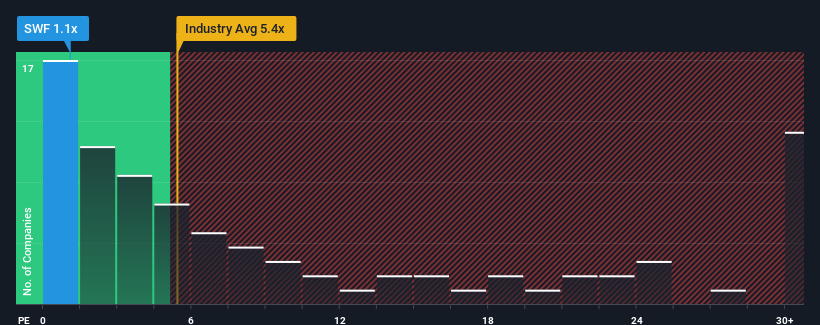

You may think that with a price-to-sales (or "P/S") ratio of 1.1x SelfWealth Limited (ASX:SWF) is definitely a stock worth checking out, seeing as almost half of all the Capital Markets companies in Australia have P/S ratios greater than 5.4x and even P/S above 17x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

View our latest analysis for SelfWealth

How Has SelfWealth Performed Recently?

SelfWealth has been doing a good job lately as it's been growing revenue at a solid pace. It might be that many expect the respectable revenue performance to degrade substantially, which has repressed the P/S. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on SelfWealth will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, SelfWealth would need to produce anemic growth that's substantially trailing the industry.

Retrospectively, the last year delivered a decent 15% gain to the company's revenues. The latest three year period has also seen an excellent 103% overall rise in revenue, aided somewhat by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

When compared to the industry's one-year growth forecast of 6.0%, the most recent medium-term revenue trajectory is noticeably more alluring

With this in mind, we find it intriguing that SelfWealth's P/S isn't as high compared to that of its industry peers. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

The Bottom Line On SelfWealth's P/S

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We're very surprised to see SelfWealth currently trading on a much lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. When we see strong revenue with faster-than-industry growth, we assume there are some significant underlying risks to the company's ability to make money which is applying downwards pressure on the P/S ratio. At least price risks look to be very low if recent medium-term revenue trends continue, but investors seem to think future revenue could see a lot of volatility.

Before you settle on your opinion, we've discovered 2 warning signs for SelfWealth (1 is a bit concerning!) that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:SWF

SelfWealth

Engages in online share trading services on the Australian, the United States, and Hong Kong stock exchanges.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives