- Australia

- /

- Consumer Finance

- /

- ASX:PLT

Independent Non-Executive Director Susan Forrester Just Bought 206% More Shares In Plenti Group Limited (ASX:PLT)

Investors who take an interest in Plenti Group Limited (ASX:PLT) should definitely note that the Independent Non-Executive Director, Susan Forrester, recently paid AU$1.03 per share to buy AU$205k worth of the stock. That certainly has us anticipating the best, especially since they thusly increased their own holding by 206%, potentially signalling some real optimism.

View our latest analysis for Plenti Group

The Last 12 Months Of Insider Transactions At Plenti Group

Notably, that recent purchase by Susan Forrester is the biggest insider purchase of Plenti Group shares that we've seen in the last year. That means that an insider was happy to buy shares at around the current price of AU$1.10. That means they have been optimistic about the company in the past, though they may have changed their mind. While we always like to see insider buying, it's less meaningful if the purchases were made at much lower prices, as the opportunity they saw may have passed. Happily, the Plenti Group insiders decided to buy shares at close to current prices.

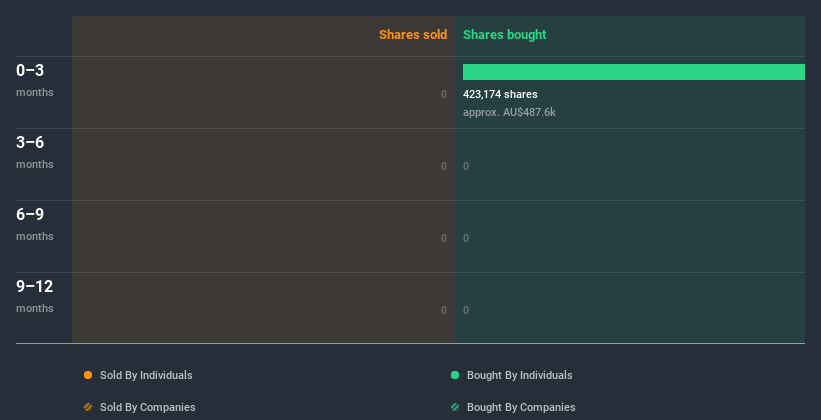

Plenti Group insiders may have bought shares in the last year, but they didn't sell any. You can see the insider transactions (by companies and individuals) over the last year depicted in the chart below. By clicking on the graph below, you can see the precise details of each insider transaction!

There are always plenty of stocks that insiders are buying. So if that suits your style you could check each stock one by one or you could take a look at this free list of companies. (Hint: insiders have been buying them).

Insider Ownership of Plenti Group

Looking at the total insider shareholdings in a company can help to inform your view of whether they are well aligned with common shareholders. Usually, the higher the insider ownership, the more likely it is that insiders will be incentivised to build the company for the long term. Plenti Group insiders own about AU$64m worth of shares. That equates to 36% of the company. This level of insider ownership is good but just short of being particularly stand-out. It certainly does suggest a reasonable degree of alignment.

So What Does This Data Suggest About Plenti Group Insiders?

The recent insider purchases are heartening. And the longer term insider transactions also give us confidence. However, we note that the company didn't make a profit over the last twelve months, which makes us cautious. Given that insiders also own a fair bit of Plenti Group we think they are probably pretty confident of a bright future. I like to dive deeper into how a company has performed in the past. You can access this interactive graph of past earnings, revenue and cash flow for free.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

When trading Plenti Group or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:PLT

Plenti Group

Engages in the fintech lending and investment business in Australia.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success