- Australia

- /

- Capital Markets

- /

- ASX:NWL

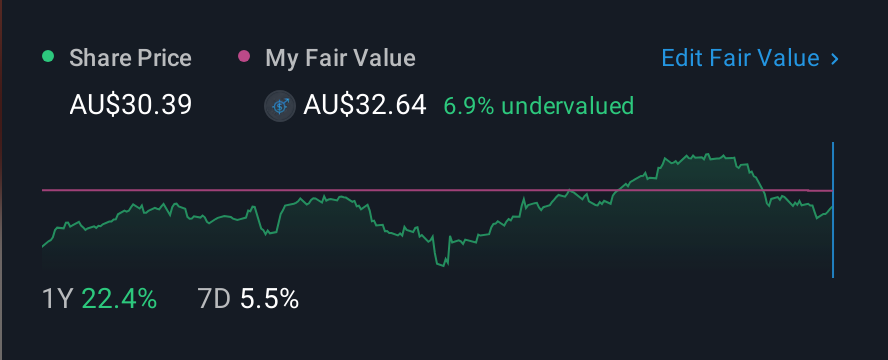

Netwealth Group Limited's (ASX:NWL) Popularity With Investors Is Clear

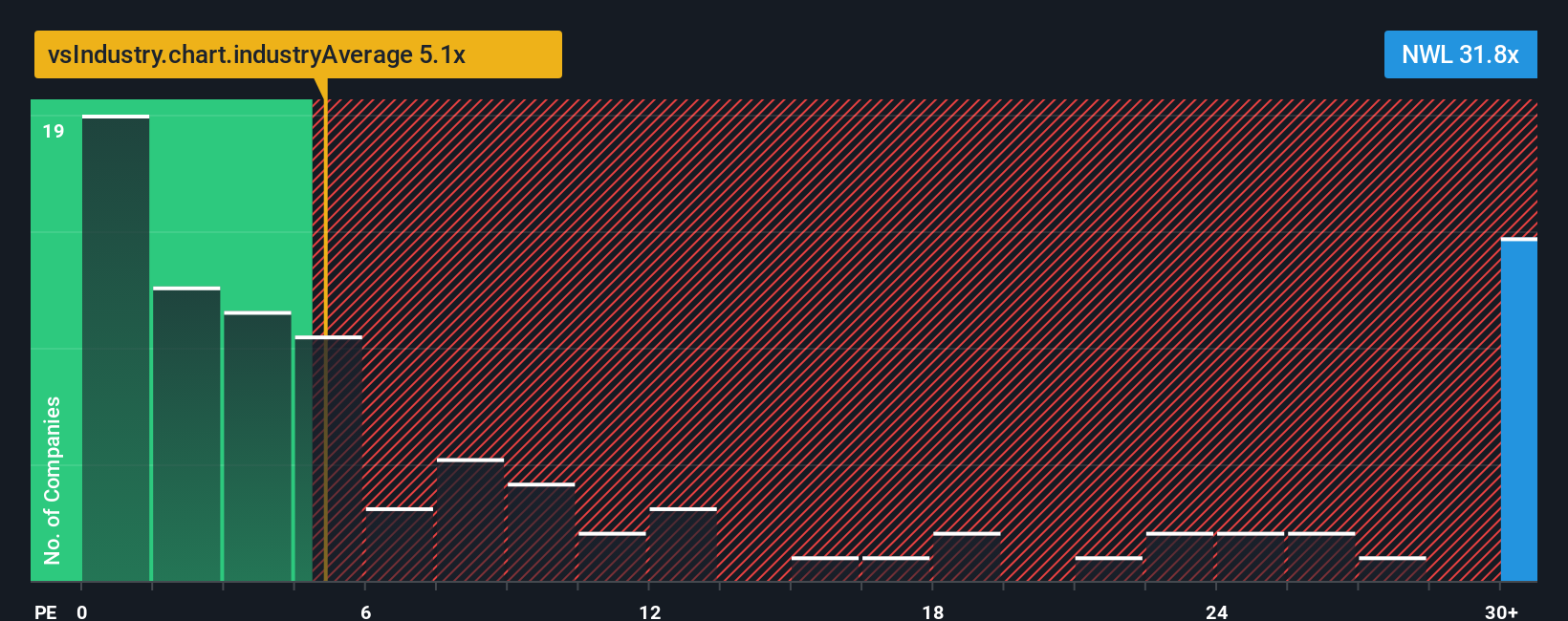

With a price-to-sales (or "P/S") ratio of 31.8x Netwealth Group Limited (ASX:NWL) may be sending very bearish signals at the moment, given that almost half of all the Capital Markets companies in Australia have P/S ratios under 5.1x and even P/S lower than 2x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

View our latest analysis for Netwealth Group

How Netwealth Group Has Been Performing

With revenue growth that's superior to most other companies of late, Netwealth Group has been doing relatively well. The P/S is probably high because investors think this strong revenue performance will continue. If not, then existing shareholders might be a little nervous about the viability of the share price.

Keen to find out how analysts think Netwealth Group's future stacks up against the industry? In that case, our free report is a great place to start.How Is Netwealth Group's Revenue Growth Trending?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Netwealth Group's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 22% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 81% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next three years should generate growth of 19% per annum as estimated by the analysts watching the company. That's shaping up to be materially higher than the 6.3% each year growth forecast for the broader industry.

With this information, we can see why Netwealth Group is trading at such a high P/S compared to the industry. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What Does Netwealth Group's P/S Mean For Investors?

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Netwealth Group maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Capital Markets industry, as expected. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

You always need to take note of risks, for example - Netwealth Group has 1 warning sign we think you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Netwealth Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:NWL

Netwealth Group

A financial services company, engages in the wealth management business in Australia.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives