- Australia

- /

- Capital Markets

- /

- ASX:MQG

Assessing Macquarie Group (ASX:MQG) Valuation After Profit Growth Disappoints Market Expectations

Reviewed by Simply Wall St

Macquarie Group (ASX:MQG) released its half-year earnings, posting a 3% profit increase supported by solid banking and asset management performance. However, the growth was overshadowed by misses against market expectations.

See our latest analysis for Macquarie Group.

Macquarie Group’s shares took a near 7% tumble after earnings missed market forecasts, even as the company posted a 3% profit increase. The market’s response shows how expectations and short-term sentiment can outweigh steady operational gains, especially in a year where the share price return is down more than 7%, despite three- and five-year total shareholder returns of 25% and 72% respectively.

If you’re curious to see what else is on the move, now’s a great time to broaden your search and discover fast growing stocks with high insider ownership

With shares under pressure and recent profits missing consensus forecasts, the key question is whether Macquarie Group's current valuation reflects all these crosscurrents or if there is a genuine buying opportunity for long-term investors.

Most Popular Narrative: 8% Undervalued

Macquarie Group’s last close price stands below the narrative’s fair value estimate, setting the scene for strongly held expectations about future profit margins and top-line growth. This perspective hinges on projected improvements that could reshape the company's valuation outlook.

The continued investment in digitization within the Banking and Financial Services division is expected to drive operational efficiencies, potentially benefiting net margins over time by reducing costs and enhancing scalability. Macquarie Capital's growing private credit portfolio, alongside increasing activity in M&A and asset realization, could positively impact earnings and revenue growth as markets recover, providing more opportunities for capital deployment.

Curious what’s behind this bullish stance? The driving force of the valuation is a bold call for better-than-expected profit margins and accelerating revenues. Only by seeing the full narrative will you uncover the quantitative assumptions fueling this valuation story and why analysts are placing such high confidence in Macquarie Group’s future profitability. What exactly are they banking on? Dive in now to see what could change investors’ minds.

Result: Fair Value of $223.80 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, including margin pressures in banking and market volatility. These factors could put revenue and earnings growth under further strain.

Find out about the key risks to this Macquarie Group narrative.

Another View: What Does the DCF Model Say?

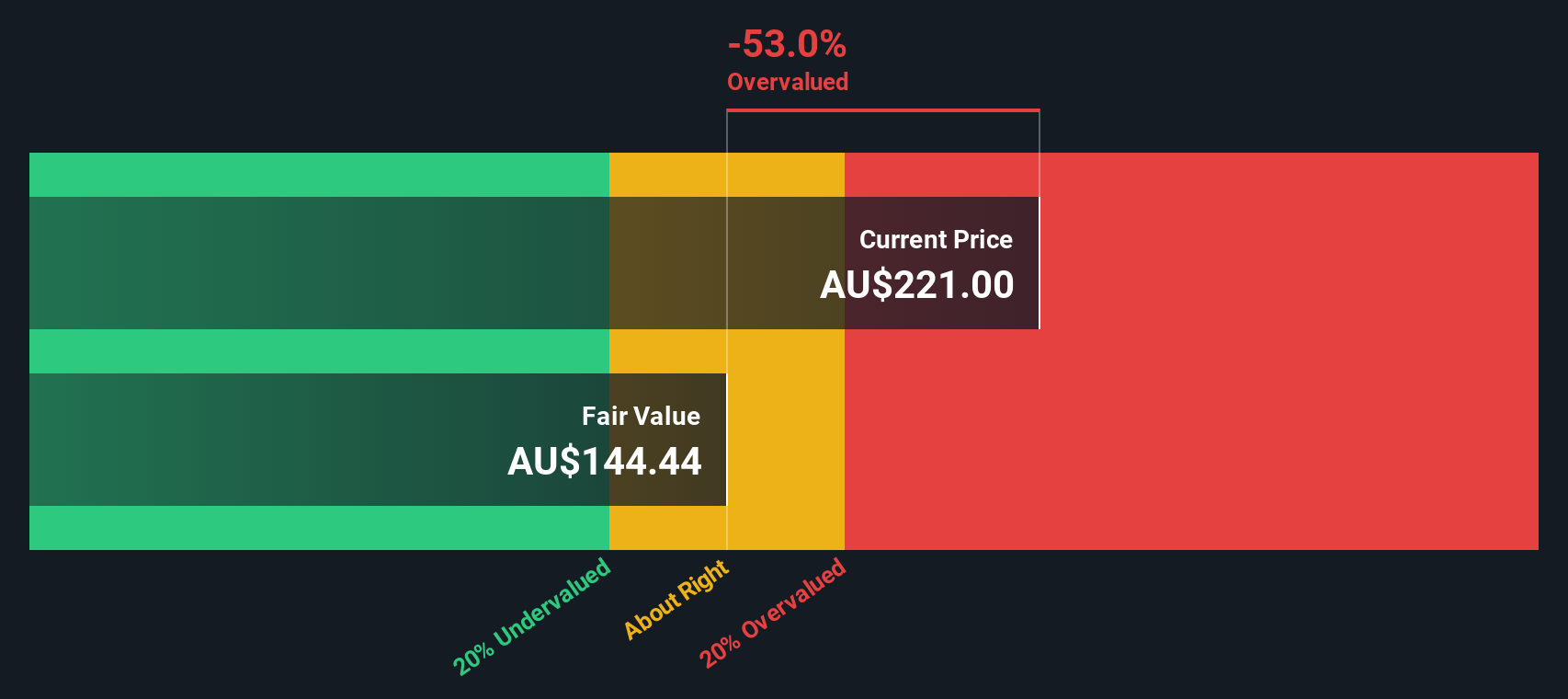

While analyst forecasts suggest Macquarie Group is currently undervalued, our SWS DCF model paints a less optimistic picture. It estimates fair value at A$147.26, which is well below where shares trade today. Could the market be factoring in more growth than is realistically achievable, or is the DCF model overly conservative?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Macquarie Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 870 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Macquarie Group Narrative

If this perspective doesn't match your own or you prefer to dig into the numbers yourself, you can craft your own take in just a few minutes. Do it your way.

A great starting point for your Macquarie Group research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors always keep an eye on fresh opportunities. Supercharge your portfolio by tapping into specialized themes and trends that others might overlook.

- Spot stocks with robust cash flows that are trading below fair value by checking out these 870 undervalued stocks based on cash flows before the rest of the market catches on.

- Boost your passive income strategy and uncover companies offering strong, reliable yields through these 16 dividend stocks with yields > 3%.

- Jump into game-changing innovation by scanning these 24 AI penny stocks, which power breakthroughs in automation, data analytics, and artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:MQG

Macquarie Group

Provides diversified financial services in Australia, New Zealand the Americas, Europe, the Middle East, Africa, and Asia.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives