- Australia

- /

- Diversified Financial

- /

- ASX:MPR

What We Learned About MPower Group's (ASX:MPR) CEO Compensation

This article will reflect on the compensation paid to Nathan Wise who has served as CEO of MPower Group Limited (ASX:MPR) since 2012. This analysis will also assess whether MPower Group pays its CEO appropriately, considering recent earnings growth and total shareholder returns.

Check out our latest analysis for MPower Group

Comparing MPower Group Limited's CEO Compensation With the industry

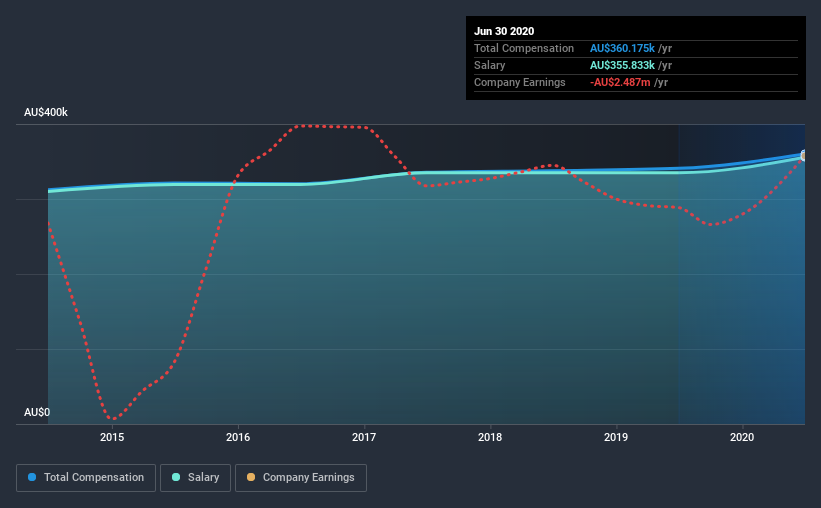

Our data indicates that MPower Group Limited has a market capitalization of AU$8.6m, and total annual CEO compensation was reported as AU$360k for the year to June 2020. That's just a smallish increase of 5.7% on last year. Notably, the salary which is AU$355.8k, represents most of the total compensation being paid.

In comparison with other companies in the industry with market capitalizations under AU$260m, the reported median total CEO compensation was AU$593k. That is to say, Nathan Wise is paid under the industry median.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | AU$356k | AU$335k | 99% |

| Other | AU$4.3k | AU$5.9k | 1% |

| Total Compensation | AU$360k | AU$341k | 100% |

Speaking on an industry level, nearly 61% of total compensation represents salary, while the remainder of 39% is other remuneration. Investors will find it interesting that MPower Group pays the bulk of its rewards through a traditional salary, instead of non-salary benefits. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

MPower Group Limited's Growth

MPower Group Limited saw earnings per share stay pretty flat over the last three years. Its revenue is down 50% over the previous year.

Its a bit disappointing to see that the company has failed to grow its EPS. And the fact that revenue is down year on year arguably paints an ugly picture. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has MPower Group Limited Been A Good Investment?

Since shareholders would have lost about 48% over three years, some MPower Group Limited investors would surely be feeling negative emotions. So shareholders would probably want the company to be lessto generous with CEO compensation.

In Summary...

MPower Group pays its CEO a majority of compensation through a salary. As previously discussed, Nathan is compensated less than what is normal for CEOs of companies of similar size, and which belong to the same industry. Over the last three years, shareholder returns have been downright disappointing, and EPSgrowth has been equally disappointing. Although we wouldn’t say CEO compensation is high, it’s tough to foresee shareholders warming up to thoughts of a bump anytime soon.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. We identified 2 warning signs for MPower Group (1 doesn't sit too well with us!) that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

When trading MPower Group or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:MPR

MPR Australia

Provides on-grid and off-grid power solutions for blue chip corporate and government customers in Australia.

Slight risk with weak fundamentals.

Market Insights

Community Narratives