- Australia

- /

- Capital Markets

- /

- ASX:HM1

ASX Penny Stocks To Watch: 3 Picks Under A$700M Market Cap

Reviewed by Simply Wall St

Australian shares are experiencing a challenging period, with the market facing its fifth consecutive day of losses amid global geopolitical tensions. In such uncertain times, investors often look towards smaller or newer companies for potential opportunities, which is where penny stocks come into play. Although the term "penny stocks" may seem outdated, it still captures the essence of investing in less-established firms that can offer value and growth potential when backed by solid financials and a clear trajectory.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| GTN (ASX:GTN) | A$0.60 | A$114.46M | ✅ 3 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.70 | A$416.29M | ✅ 4 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$2.17 | A$2.47B | ✅ 4 ⚠️ 1 View Analysis > |

| Southern Cross Electrical Engineering (ASX:SXE) | A$1.74 | A$460.07M | ✅ 4 ⚠️ 1 View Analysis > |

| Tasmea (ASX:TEA) | A$3.20 | A$753.99M | ✅ 3 ⚠️ 2 View Analysis > |

| Regal Partners (ASX:RPL) | A$2.06 | A$692.5M | ✅ 4 ⚠️ 2 View Analysis > |

| Navigator Global Investments (ASX:NGI) | A$1.575 | A$771.88M | ✅ 5 ⚠️ 3 View Analysis > |

| Lindsay Australia (ASX:LAU) | A$0.695 | A$220.43M | ✅ 4 ⚠️ 2 View Analysis > |

| Bisalloy Steel Group (ASX:BIS) | A$3.30 | A$156.59M | ✅ 4 ⚠️ 1 View Analysis > |

| CTI Logistics (ASX:CLX) | A$1.84 | A$148.2M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 1,006 stocks from our ASX Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Cue Energy Resources (ASX:CUE)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Cue Energy Resources Limited is an oil and gas company focused on the exploration, development, and production of petroleum products with a market capitalization of A$87.39 million.

Operations: The company's revenue is derived entirely from its production and exploration activities for hydrocarbons, amounting to A$47.48 million.

Market Cap: A$87.39M

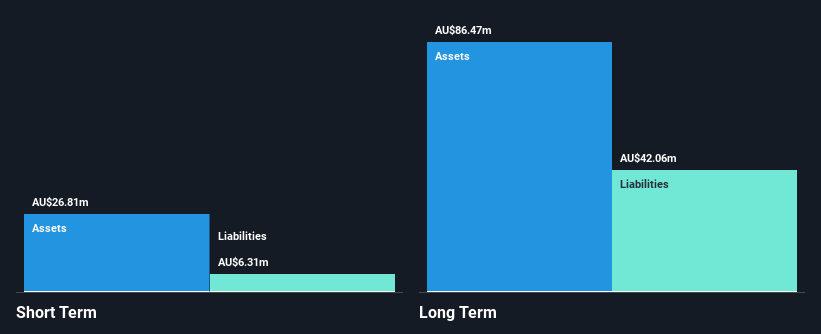

Cue Energy Resources, with a market capitalization of A$87.39 million, has seen consistent profitability growth over the past five years. Despite recent negative earnings growth of -46%, its short-term assets comfortably cover short-term liabilities but fall short against long-term obligations. The company remains debt-free, eliminating concerns about debt coverage and interest payments. However, its dividend yield of 8% is not well-supported by earnings. While the board boasts experience with an average tenure of 7.3 years, management's experience level is unclear. Trading significantly below estimated fair value may present potential opportunities for investors considering penny stocks in this sector.

- Click to explore a detailed breakdown of our findings in Cue Energy Resources' financial health report.

- Review our historical performance report to gain insights into Cue Energy Resources' track record.

HighCom (ASX:HCL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: HighCom Limited offers specialized products and tailored solutions to military, law enforcement, government agencies, space, and commercial sectors with a market cap of A$30.80 million.

Operations: HighCom generates its revenue across several regions, with A$26.37 million from North America, A$22.12 million from Australia and Asia Pacific, and A$7.47 million from Europe.

Market Cap: A$30.8M

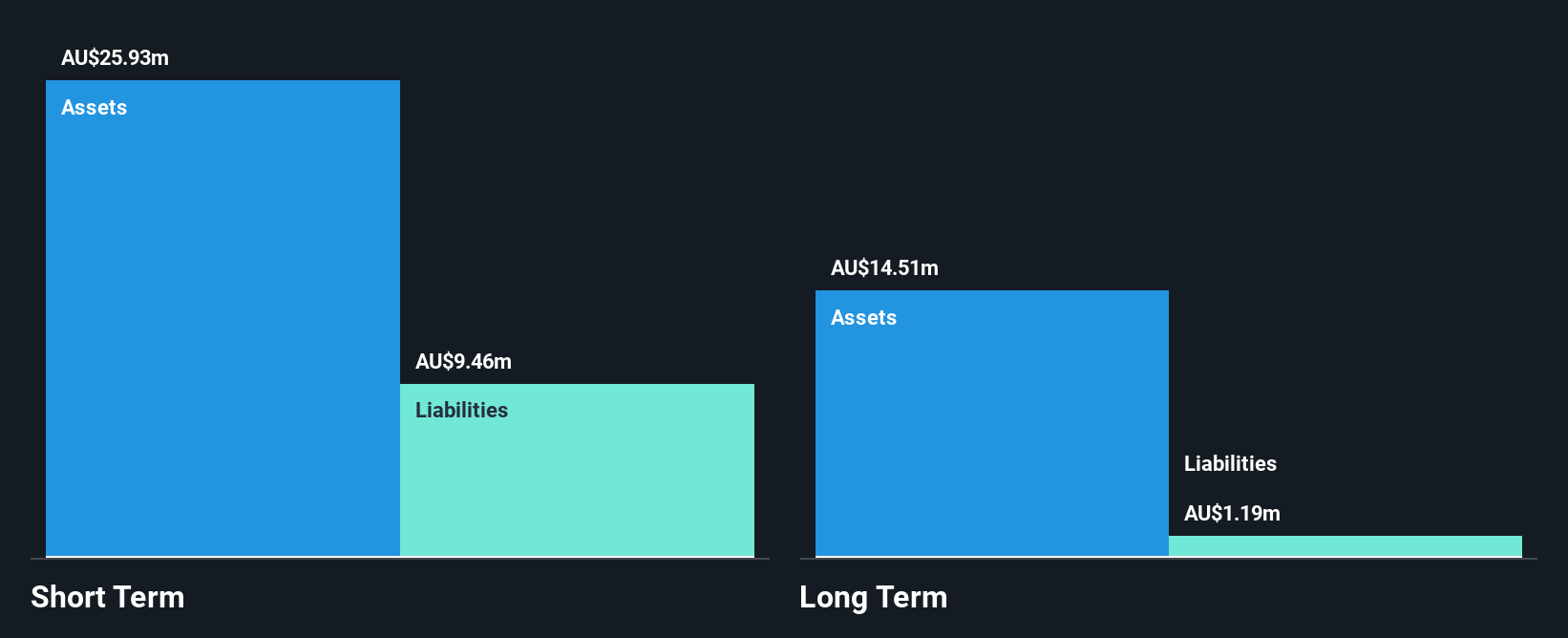

HighCom Limited, with a market cap of A$30.80 million, has recently achieved profitability, marking a significant milestone in its financial trajectory. The company operates debt-free and maintains high-quality earnings while trading at 91% below estimated fair value, suggesting potential undervaluation. Its short-term assets of A$29.8 million comfortably cover both short-term and long-term liabilities. However, the management team is relatively inexperienced with an average tenure of 1.2 years, which may impact strategic continuity. Recent executive changes include the appointment of Mr. Martyn Dominy as CFO to strengthen financial leadership following his successful role at Quickstep Holdings Limited.

- Get an in-depth perspective on HighCom's performance by reading our balance sheet health report here.

- Gain insights into HighCom's future direction by reviewing our growth report.

Hearts and Minds Investments (ASX:HM1)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Hearts and Minds Investments (ASX:HM1) is an investment company that leverages the expertise of leading fund managers to invest in high-conviction ideas, with a market cap of A$686.95 million.

Operations: The company generates revenue of A$191.25 million from its investment activities.

Market Cap: A$686.95M

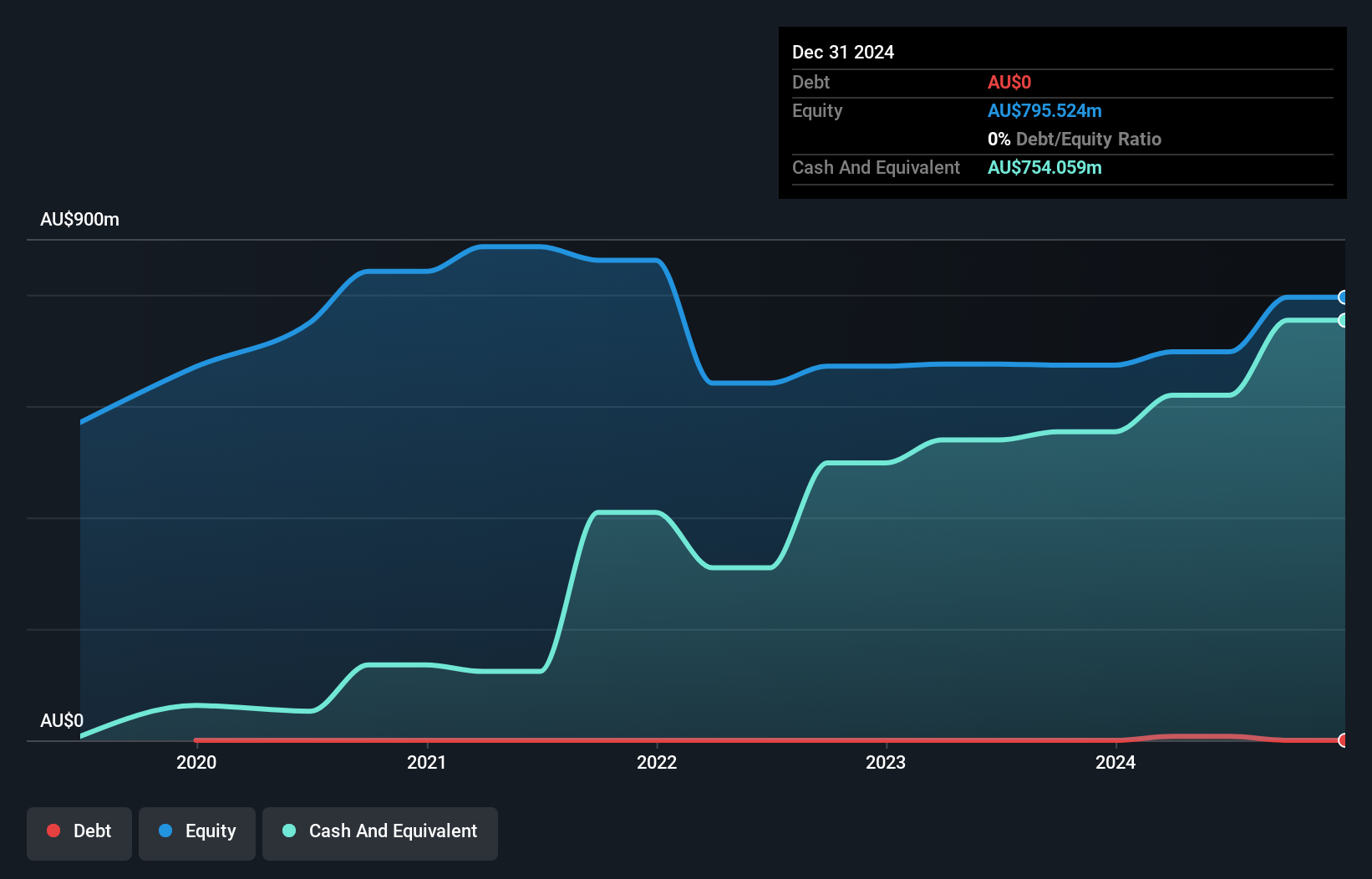

Hearts and Minds Investments, with a market cap of A$686.95 million, operates debt-free and has demonstrated impressive earnings growth of 466.4% over the past year, outpacing the industry average. The company maintains strong financial health with short-term assets of A$754.4 million exceeding liabilities significantly. Despite its high non-cash earnings and stable weekly volatility, its dividend yield is not well supported by free cash flows, raising sustainability concerns. The management team is relatively new with an average tenure of 1.3 years, which might affect strategic consistency despite having an experienced board to guide them through transitions.

- Click here and access our complete financial health analysis report to understand the dynamics of Hearts and Minds Investments.

- Evaluate Hearts and Minds Investments' historical performance by accessing our past performance report.

Where To Now?

- Reveal the 1,006 hidden gems among our ASX Penny Stocks screener with a single click here.

- Ready To Venture Into Other Investment Styles? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hearts and Minds Investments might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:HM1

Hearts and Minds Investments

Flawless balance sheet with solid track record.

Market Insights

Community Narratives