- Australia

- /

- Capital Markets

- /

- ASX:COG

We Take A Look At Why COG Financial Services Limited's (ASX:COG) CEO Compensation Is Well Earned

The performance at COG Financial Services Limited (ASX:COG) has been quite strong recently and CEO Andrew Bennett has played a role in it. Coming up to the next AGM on 25 November 2022, shareholders would be keeping this in mind. It is likely that the focus will be on company strategy going forward as shareholders hear from the board and cast their votes on resolutions such as executive remuneration and other matters. In light of the great performance, we discuss the case why we think CEO compensation is not excessive.

Check out the opportunities and risks within the AU Capital Markets industry.

Comparing COG Financial Services Limited's CEO Compensation With The Industry

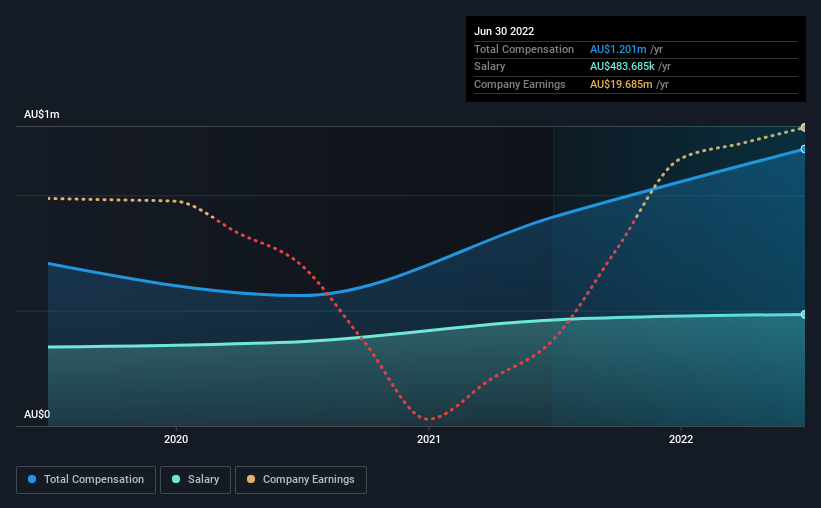

At the time of writing, our data shows that COG Financial Services Limited has a market capitalization of AU$280m, and reported total annual CEO compensation of AU$1.2m for the year to June 2022. We note that's an increase of 33% above last year. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at AU$484k.

For comparison, other companies in the same industry with market capitalizations ranging between AU$150m and AU$601m had a median total CEO compensation of AU$1.1m. From this we gather that Andrew Bennett is paid around the median for CEOs in the industry. What's more, Andrew Bennett holds AU$111k worth of shares in the company in their own name.

| Component | 2022 | 2021 | Proportion (2022) |

| Salary | AU$484k | AU$460k | 40% |

| Other | AU$717k | AU$445k | 60% |

| Total Compensation | AU$1.2m | AU$905k | 100% |

Speaking on an industry level, nearly 59% of total compensation represents salary, while the remainder of 41% is other remuneration. COG Financial Services sets aside a smaller share of compensation for salary, in comparison to the overall industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

COG Financial Services Limited's Growth

Over the past three years, COG Financial Services Limited has seen its earnings per share (EPS) grow by 48% per year. It achieved revenue growth of 18% over the last year.

This demonstrates that the company has been improving recently and is good news for the shareholders. It's also good to see decent revenue growth in the last year, suggesting the business is healthy and growing. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has COG Financial Services Limited Been A Good Investment?

Boasting a total shareholder return of 83% over three years, COG Financial Services Limited has done well by shareholders. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

To Conclude...

Seeing that company performance has been quite good recently, some shareholders may feel that CEO compensation may not be the biggest focus in the upcoming AGM. Seeing that earnings growth and share price performance seems to be on the right path, the more pressing focus for shareholders at the AGM may be how the board and management plans to turn the company into a sustainably profitable one.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. We've identified 3 warning signs for COG Financial Services that investors should be aware of in a dynamic business environment.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:COG

COG Financial Services

Engages in equipment financing and broking, aggregation, insurance broking, and novated leasing activities for in Australia.

Proven track record with moderate growth potential.

Market Insights

Community Narratives