- Australia

- /

- Capital Markets

- /

- ASX:AFI

Does Australian Foundation Investment (ASX:AFI) Deserve A Spot On Your Watchlist?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Australian Foundation Investment (ASX:AFI). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Australian Foundation Investment with the means to add long-term value to shareholders.

View our latest analysis for Australian Foundation Investment

How Fast Is Australian Foundation Investment Growing?

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. That makes EPS growth an attractive quality for any company. Over the last three years, Australian Foundation Investment has grown EPS by 5.6% per year. That might not be particularly high growth, but it does show that per-share earnings are moving steadily in the right direction.

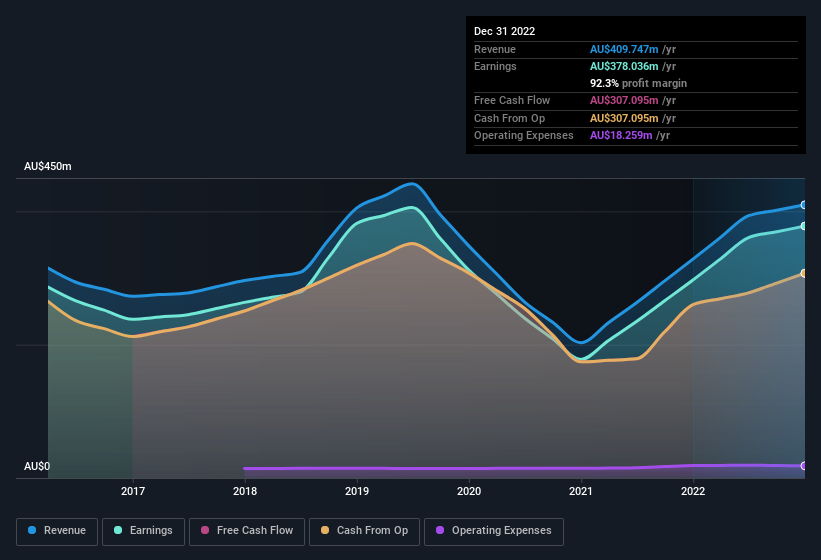

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Not all of Australian Foundation Investment's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers used in this article might not be the best representation of the underlying business. While we note Australian Foundation Investment achieved similar EBIT margins to last year, revenue grew by a solid 25% to AU$410m. That's a real positive.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check Australian Foundation Investment's balance sheet strength, before getting too excited.

Are Australian Foundation Investment Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

In the last twelve months Australian Foundation Investment insiders spent AU$22k on stock; good news for shareholders. This might not be a huge sum, but it's well worth noting anyway, given the complete lack of selling.

Recent insider purchases of Australian Foundation Investment stock is not the only way management has kept the interests of the general public shareholders in mind. Namely, Australian Foundation Investment has a very reasonable level of CEO pay. Our analysis has discovered that the median total compensation for the CEOs of companies like Australian Foundation Investment with market caps between AU$5.6b and AU$17b is about AU$3.7m.

The Australian Foundation Investment CEO received total compensation of just AU$1.6m in the year to June 2022. That looks like a modest pay packet, and may hint at a certain respect for the interests of shareholders. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of a culture of integrity, in a broader sense.

Does Australian Foundation Investment Deserve A Spot On Your Watchlist?

One positive for Australian Foundation Investment is that it is growing EPS. That's nice to see. And that's not all. We've also seen insiders buying stock, and noted modest executive pay. The sum of all that, points to a quality business, and a genuine prospect for further research. What about risks? Every company has them, and we've spotted 1 warning sign for Australian Foundation Investment you should know about.

The good news is that Australian Foundation Investment is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:AFI

Adequate balance sheet second-rate dividend payer.