- Australia

- /

- Metals and Mining

- /

- ASX:SGM

Undervalued Small Caps In Australia With Insider Buying For September 2024

Reviewed by Simply Wall St

The Australian market has shown robust performance, climbing 1.2% in the last 7 days and up 11% over the past year, with earnings forecast to grow by 12% annually. In this favorable environment, identifying undervalued small-cap stocks with insider buying can present attractive opportunities for investors seeking potential growth.

Top 10 Undervalued Small Caps With Insider Buying In Australia

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Magellan Financial Group | 7.1x | 4.5x | 41.79% | ★★★★★☆ |

| Corporate Travel Management | 19.6x | 2.3x | 8.00% | ★★★★★☆ |

| GWA Group | 15.7x | 1.5x | 44.06% | ★★★★★☆ |

| Eagers Automotive | 10.1x | 0.2x | 40.60% | ★★★★★☆ |

| Credit Corp Group | 20.0x | 2.7x | 42.71% | ★★★★☆☆ |

| Coventry Group | 221.5x | 0.4x | -10.37% | ★★★☆☆☆ |

| Dicker Data | 20.4x | 0.7x | -67.16% | ★★★☆☆☆ |

| Megaport | 123.2x | 6.1x | 45.66% | ★★★☆☆☆ |

| BSP Financial Group | 7.8x | 2.8x | 2.28% | ★★★☆☆☆ |

| Abacus Group | NA | 6.1x | 23.55% | ★★★☆☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

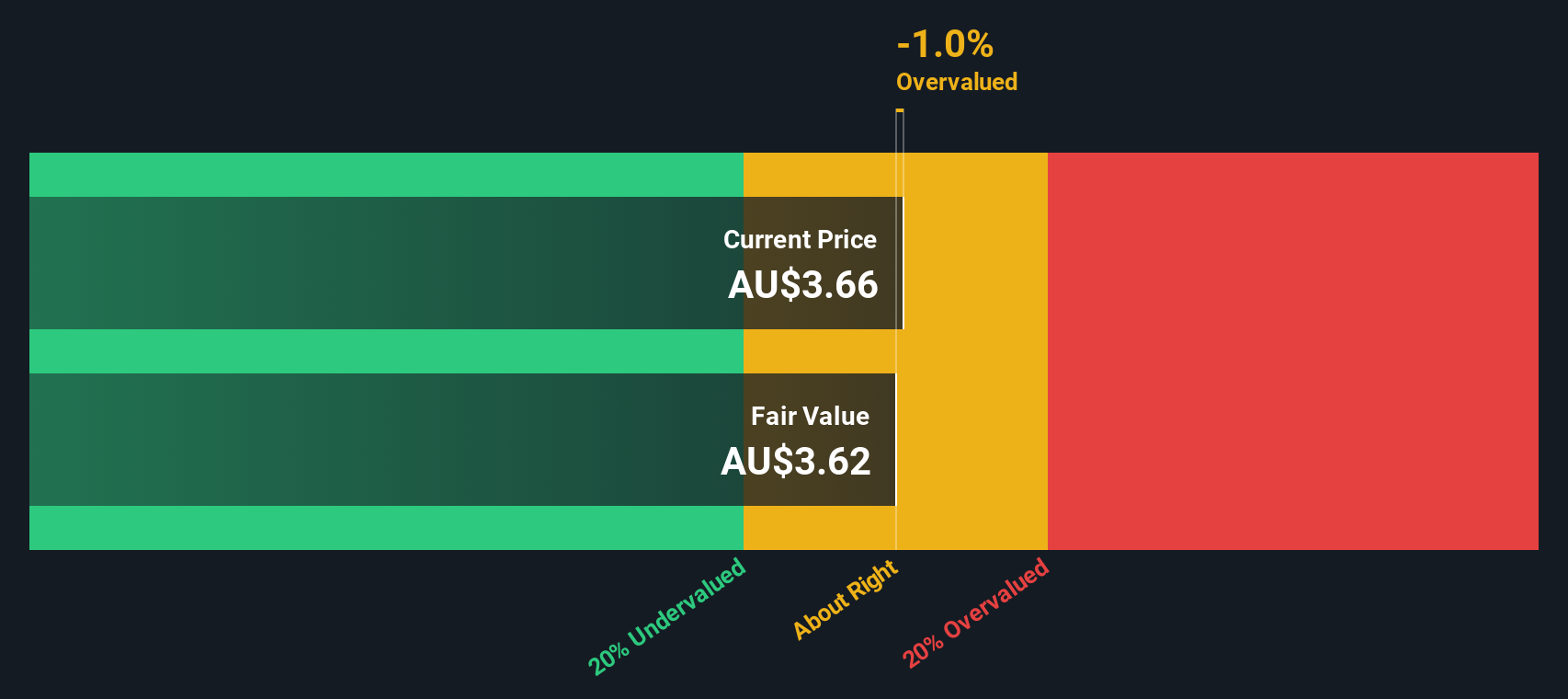

Deterra Royalties (ASX:DRR)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Deterra Royalties focuses on managing royalty arrangements and has a market cap of approximately A$2.12 billion.

Operations: Deterra Royalties derives its revenue primarily from royalty arrangements, with a notable gross profit margin of 96.22% as of September 2024. The company incurs costs including COGS and non-operating expenses, impacting net income, which stood at A$154.89 million for the same period.

PE: 12.6x

Deterra Royalties, a small cap in Australia, reported net income of A$154.89 million for the year ending June 30, 2024, a slight increase from A$152.46 million the previous year. Basic earnings per share rose to A$0.293 from A$0.2885. Despite earnings forecasted to decline by an average of 6.6% annually over the next three years and reliance on external borrowing for funding, insider confidence is evident with recent share purchases in August 2024 signaling potential undervaluation opportunities ahead.

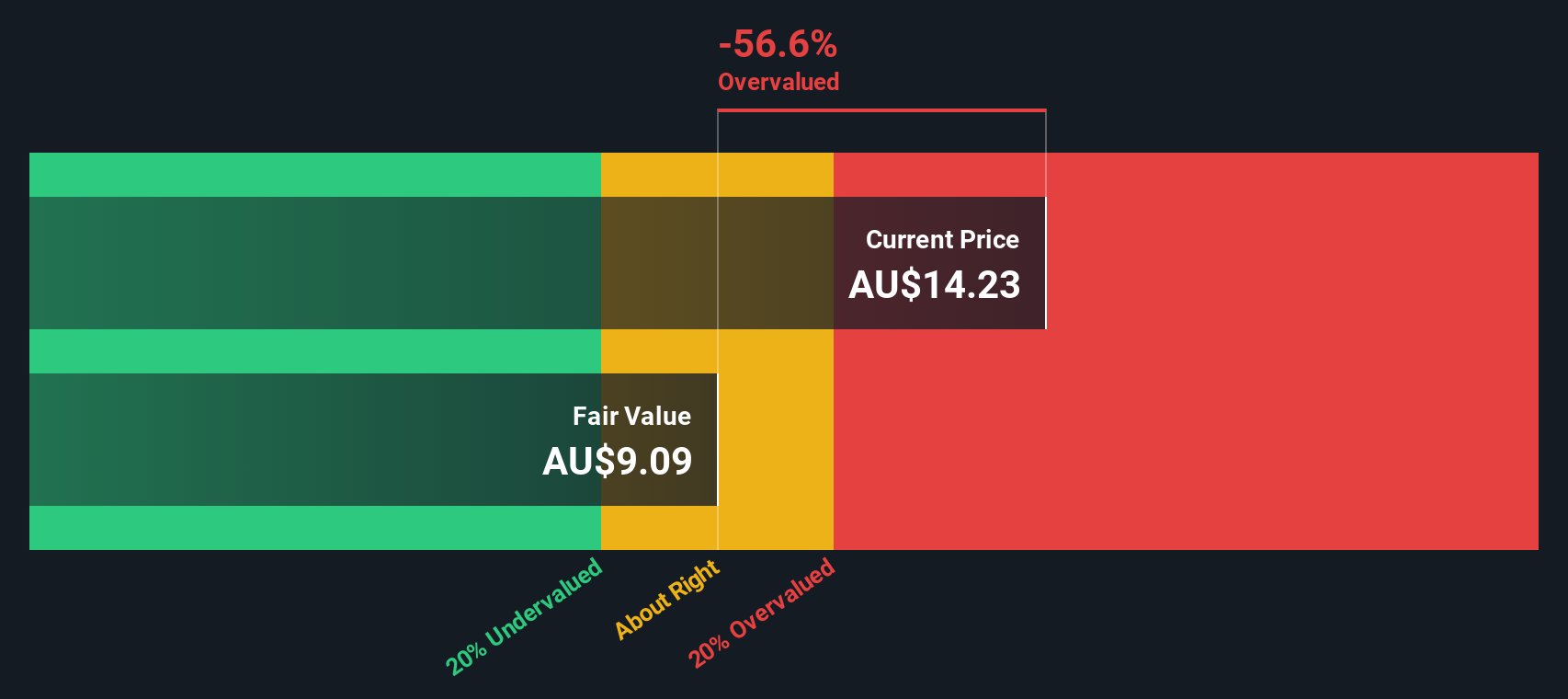

Sims (ASX:SGM)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Sims is a global leader in metal and electronics recycling, with operations spanning North America, Australia/New Zealand, and other regions; the company has a market cap of A$2.51 billion.

Operations: The company's revenue streams are primarily derived from North America Metals (A$4.49 billion), Australia/New Zealand Metals (A$1.60 billion), Global Trading (A$771.20 million), and Sims Lifecycle Services (A$350 million). Its cost of goods sold significantly impacts gross profit, with the most recent gross profit margin at 9.41%. Operating expenses and non-operating expenses further affect net income, resulting in a net income margin of 1.74% for the latest period ending December 31, 2023.

PE: 1191.0x

Sims Limited, a small cap Australian company, reported A$7.22 billion in sales for the year ending June 30, 2024, up from A$6.66 billion the previous year. Despite this revenue growth, they faced a net loss of A$57.8 million compared to a net income of A$181.1 million last year due to significant one-off items impacting financial results and lower profit margins (0.02% vs 3%). Insider confidence is evident with recent share purchases by executives over the past six months, indicating potential future value despite current challenges.

- Get an in-depth perspective on Sims' performance by reading our valuation report here.

Examine Sims' past performance report to understand how it has performed in the past.

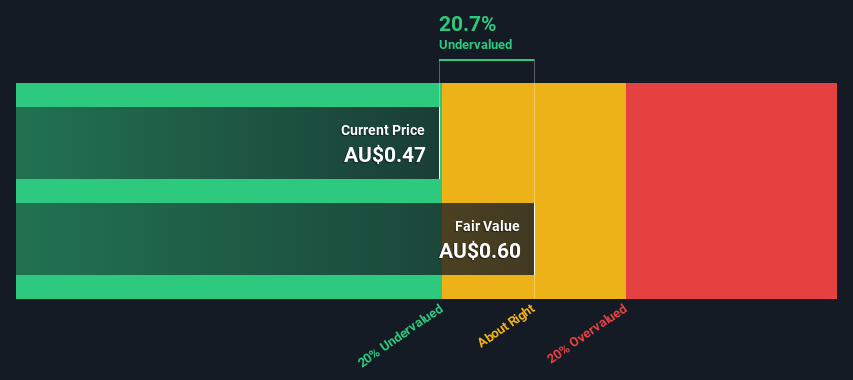

Tabcorp Holdings (ASX:TAH)

Simply Wall St Value Rating: ★★★★★☆

Overview: Tabcorp Holdings operates in the gaming services and wagering and media sectors, with a market cap of A$5.30 billion.

Operations: Tabcorp Holdings generates revenue primarily from its Wagering and Media segment, contributing A$2162.8 million, and Gaming Services, which adds A$176.1 million. The company consistently reports a gross profit margin of 100%, with significant operating expenses impacting net income margins that have fluctuated over the periods reviewed.

PE: -0.7x

Tabcorp Holdings, a small cap in Australia, has recently seen insider confidence with purchases made by executives over the past quarter. Despite reporting a net loss of A$1.36 billion for the year ending June 30, 2024, compared to net income of A$66.5 million last year, the company remains focused on growth with earnings forecasted to increase by 117.91% annually. The dividend decreased to A$0.003 per share and will be paid on September 20, 2024.

- Dive into the specifics of Tabcorp Holdings here with our thorough valuation report.

Assess Tabcorp Holdings' past performance with our detailed historical performance reports.

Seize The Opportunity

- Access the full spectrum of 22 Undervalued ASX Small Caps With Insider Buying by clicking on this link.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SGM

Sims

Engages in buying, processing, and selling of ferrous and non-ferrous recycled metals in Australia, Bangladesh, China, India, Turkey, the United States, and internationally.

Good value with adequate balance sheet.