- Australia

- /

- Consumer Services

- /

- ASX:EDU

Market Still Lacking Some Conviction On EDU Holdings Limited (ASX:EDU)

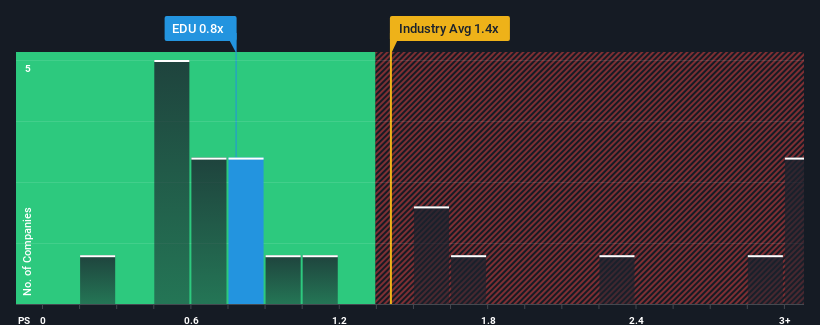

There wouldn't be many who think EDU Holdings Limited's (ASX:EDU) price-to-sales (or "P/S") ratio of 0.8x is worth a mention when the median P/S for the Consumer Services industry in Australia is very similar. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for EDU Holdings

How EDU Holdings Has Been Performing

EDU Holdings' revenue growth of late has been pretty similar to most other companies. The P/S ratio is probably moderate because investors think this modest revenue performance will continue. Those who are bullish on EDU Holdings will be hoping that revenue performance can pick up, so that they can pick up the stock at a slightly lower valuation.

Want the full picture on analyst estimates for the company? Then our free report on EDU Holdings will help you uncover what's on the horizon.Do Revenue Forecasts Match The P/S Ratio?

EDU Holdings' P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Taking a look back first, we see that the company grew revenue by an impressive 17% last year. Despite this strong recent growth, it's still struggling to catch up as its three-year revenue frustratingly shrank by 13% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 18% each year during the coming three years according to the only analyst following the company. Meanwhile, the rest of the industry is forecast to only expand by 11% per annum, which is noticeably less attractive.

With this information, we find it interesting that EDU Holdings is trading at a fairly similar P/S compared to the industry. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Key Takeaway

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that EDU Holdings currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

Before you settle on your opinion, we've discovered 2 warning signs for EDU Holdings (1 is concerning!) that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if EDU Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:EDU

EDU Holdings

Through its subsidiaries, provides tertiary education services in Australia.

Excellent balance sheet and good value.

Market Insights

Community Narratives