- Australia

- /

- Hospitality

- /

- ASX:ALL

Aristocrat Leisure (ASX:ALL) Valuation in Focus After Strong Earnings and Higher Dividend Announcement

Reviewed by Simply Wall St

Aristocrat Leisure (ASX:ALL) just released its full-year results, revealing increased revenue and net income compared to last year. Investors also received news of a higher ordinary dividend, which provides another positive signal for shareholders.

See our latest analysis for Aristocrat Leisure.

Despite solid annual growth in revenue and net income, Aristocrat Leisure’s share price has struggled this year, with a year-to-date decline of 15.1%. Still, long-term investors have enjoyed a robust 71.96% total shareholder return over three years, highlighting the stock’s momentum through past cycles even as sentiment has recently cooled.

If today’s results have you weighing your next moves, now is a great chance to broaden your investing horizons and discover fast growing stocks with high insider ownership

With shares trading nearly 25% below analyst price targets and strong performance already reflected in recent results, the key question is whether Aristocrat Leisure is undervalued or if the market has priced in its future growth.

Most Popular Narrative: 20.4% Undervalued

According to the most widely followed narrative, Aristocrat Leisure’s fair value estimate stands well above the latest closing price, suggesting significant upside potential if the company delivers on future earnings projections and margin improvements. The narrative blends a detailed bottom-up forecast with a healthy dose of optimism about Aristocrat’s ability to capitalize on its strategic moves and new business segments.

The integration of NeoGames and the establishment of Aristocrat Interactive are expected to drive significant growth, with opportunities in iLottery and iGaming expanding market reach and potentially increasing revenue. The successful sale of Plarium and the strategic review of Big Fish Games may allow Aristocrat to focus more on its core gaming strengths, potentially enhancing future revenue growth and profit margins.

What powers this bullish outlook? A bold reset of profit margins and a structural expansion plan that could surprise even veteran investors. Do new business lines and squeezed costs really unlock value for Aristocrat? There is an intriguing financial blueprint lurking beneath the surface. Find out what makes this growth story tick.

Result: Fair Value of $73.12 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, challenges such as earnings dilution from recent divestitures and ongoing reliance on North American markets could cloud Aristocrat’s optimistic outlook.

Find out about the key risks to this Aristocrat Leisure narrative.

Another View: Valuation by Multiples

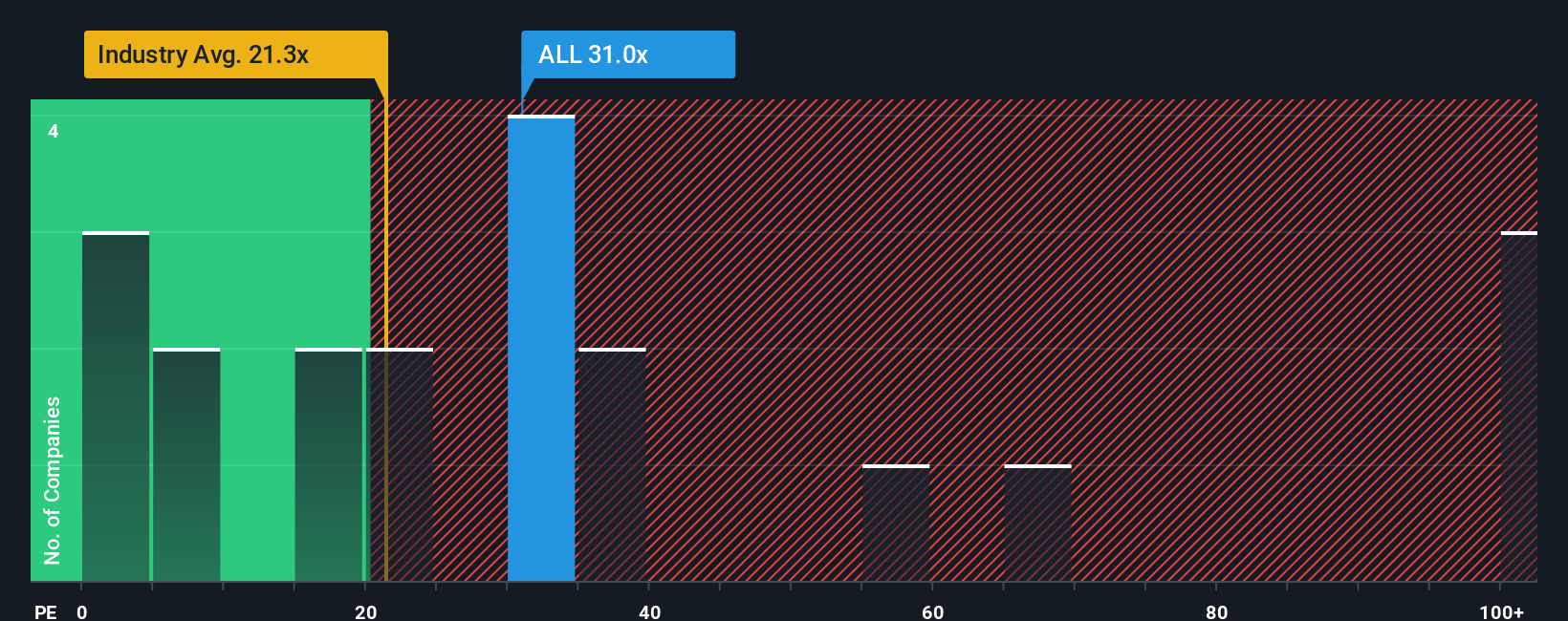

Looking through the classic lens of price-to-earnings ratios, Aristocrat Leisure appears expensive at 30.3 times earnings, higher than the global Hospitality sector's average of 20.9 times and about in line with peer businesses at 30.7. However, compared to its fair ratio of 35.3, there might still be room for upward movement if market sentiment shifts. Are investors overlooking hidden value, or is there good reason for this cautious pricing?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Aristocrat Leisure Narrative

If you have a different take or want to see what your own analysis reveals, you can easily craft your own narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Aristocrat Leisure.

Ready for More Opportunities?

Don’t limit your research to just one stock. Stretch your potential by uncovering new opportunities tailored to your investing goals with Simply Wall Street’s advanced screeners.

- Tap into breakthrough medical innovation by reviewing these 30 healthcare AI stocks, which are shaping the future of health with intelligent solutions.

- Unlock robust income streams by checking out these 16 dividend stocks with yields > 3%, offering yields greater than 3 percent for dependable returns.

- Catch the next big tech surge as you browse these 26 AI penny stocks, at the forefront of artificial intelligence and market disruption.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:ALL

Aristocrat Leisure

Operates as a gaming content and technology company in Australia and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives