What trends should we look for it we want to identify stocks that can multiply in value over the long term? Amongst other things, we'll want to see two things; firstly, a growing return on capital employed (ROCE) and secondly, an expansion in the company's amount of capital employed. Basically this means that a company has profitable initiatives that it can continue to reinvest in, which is a trait of a compounding machine. However, after investigating GLG (ASX:GLE), we don't think it's current trends fit the mold of a multi-bagger.

What Is Return On Capital Employed (ROCE)?

For those who don't know, ROCE is a measure of a company's yearly pre-tax profit (its return), relative to the capital employed in the business. The formula for this calculation on GLG is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.11 = US$7.9m ÷ (US$111m - US$42m) (Based on the trailing twelve months to December 2022).

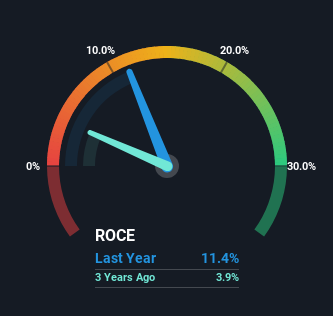

So, GLG has an ROCE of 11%. That's a relatively normal return on capital, and it's around the 9.6% generated by the Luxury industry.

View our latest analysis for GLG

Historical performance is a great place to start when researching a stock so above you can see the gauge for GLG's ROCE against it's prior returns. If you want to delve into the historical earnings, revenue and cash flow of GLG, check out these free graphs here.

What The Trend Of ROCE Can Tell Us

Over the past five years, GLG's ROCE and capital employed have both remained mostly flat. It's not uncommon to see this when looking at a mature and stable business that isn't re-investing its earnings because it has likely passed that phase of the business cycle. With that in mind, unless investment picks up again in the future, we wouldn't expect GLG to be a multi-bagger going forward.

On a side note, GLG has done well to reduce current liabilities to 38% of total assets over the last five years. This can eliminate some of the risks inherent in the operations because the business has less outstanding obligations to their suppliers and or short-term creditors than they did previously.

The Key Takeaway

In summary, GLG isn't compounding its earnings but is generating stable returns on the same amount of capital employed. And investors may be recognizing these trends since the stock has only returned a total of 9.5% to shareholders over the last five years. So if you're looking for a multi-bagger, the underlying trends indicate you may have better chances elsewhere.

GLG does come with some risks though, we found 5 warning signs in our investment analysis, and 2 of those are concerning...

While GLG may not currently earn the highest returns, we've compiled a list of companies that currently earn more than 25% return on equity. Check out this free list here.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:GLE

GLG

Engages in the manufacture, supply, and wholesale of knitwear, apparel, garments, and accessories in India, Hong Kong, Malaysia, Canada, Europe, Japan, Singapore, the United States, Cambodia, Malaysia, and internationally.

Adequate balance sheet with low risk.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success