- Australia

- /

- Professional Services

- /

- ASX:IPH

Did CEO Succession Plans Just Shift IPH's (ASX:IPH) Investment Narrative?

Reviewed by Sasha Jovanovic

- IPH Limited recently announced that CEO Dr. Andrew Blattman will retire in the second half of 2026, prompting the company to begin a formal search for a new leader from both internal and external candidates.

- Dr. Blattman’s lengthy tenure saw IPH expand its footprint in Asia and enter the Canadian market, which has helped shape the group’s international presence and long-term direction.

- We'll examine how the planned CEO transition and leadership search may impact IPH's investment outlook and ongoing strategic initiatives.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

IPH Investment Narrative Recap

Investors in IPH Limited need to believe in the long-term growth of intellectual property services, particularly in the Asia-Pacific region, and the company’s ability to capture demand as patent filings expand. The recent CEO retirement news is unlikely to materially disrupt the most important short-term catalyst, continued expansion into Asia and Canada, but it raises some uncertainty around integration execution, already the biggest risk due to the company’s ongoing acquisition strategy and reliance on smooth post-deal transitions.

Among recent announcements, the appointment of Brendan York as Chief Financial Officer just months before the CEO transition is particularly relevant. As CFOs play a central role during leadership changes and business integrations, his experience may help maintain financial discipline and stability through this period, supporting confidence in the company's strategy as it seeks to leverage growth opportunities in new markets. Still, it’s important for investors to remember that integration risk can quickly become more significant when compounded by…

Read the full narrative on IPH (it's free!)

IPH's outlook sees revenue reaching A$768.8 million and earnings rising to A$107.5 million by 2028. This scenario is based on analysts assuming annual revenue growth of 2.9% and a A$38.7 million increase in earnings from the current A$68.8 million.

Uncover how IPH's forecasts yield a A$5.86 fair value, a 63% upside to its current price.

Exploring Other Perspectives

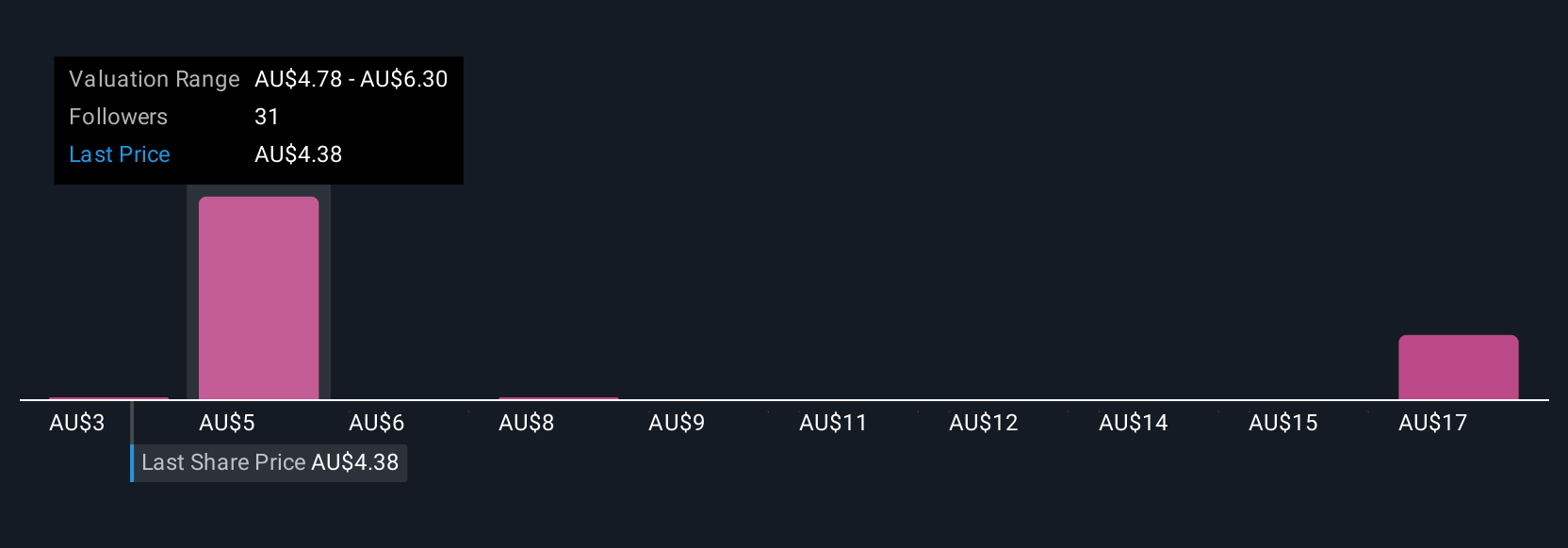

Ten fair value estimates from the Simply Wall St Community range widely, from A$3.27 to A$17.70 per share. With recent management changes and integration risk on the table, diverse investor views highlight the importance of comparing several perspectives before making a decision.

Explore 10 other fair value estimates on IPH - why the stock might be worth 9% less than the current price!

Build Your Own IPH Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your IPH research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

- Our free IPH research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate IPH's overall financial health at a glance.

Interested In Other Possibilities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:IPH

Very undervalued established dividend payer.

Market Insights

Community Narratives