- Australia

- /

- Metals and Mining

- /

- ASX:CYL

ASX Penny Stocks To Watch In October 2024

Reviewed by Simply Wall St

The Australian market remained flat over the last week but has seen a 20% increase over the past year, with earnings expected to grow by 12% annually. In this context, identifying stocks that combine value and growth potential is crucial for investors looking to capitalize on market opportunities. Although the term "penny stocks" might seem outdated, these smaller or newer companies can still offer significant promise when supported by strong financials, and we'll explore several that stand out for their potential.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| LaserBond (ASX:LBL) | A$0.555 | A$63.88M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.805 | A$127.64M | ★★★★☆☆ |

| MaxiPARTS (ASX:MXI) | A$1.895 | A$104.82M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.50 | A$303.87M | ★★★★★☆ |

| Helloworld Travel (ASX:HLO) | A$1.865 | A$298M | ★★★★★★ |

| Navigator Global Investments (ASX:NGI) | A$1.72 | A$838.04M | ★★★★★☆ |

| West African Resources (ASX:WAF) | A$1.71 | A$1.82B | ★★★★★★ |

| Atlas Pearls (ASX:ATP) | A$0.13 | A$56.64M | ★★★★★★ |

| GTN (ASX:GTN) | A$0.47 | A$93.09M | ★★★★★★ |

| Joyce (ASX:JYC) | A$3.93 | A$114.45M | ★★★★★★ |

Click here to see the full list of 1,026 stocks from our ASX Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Catalyst Metals (ASX:CYL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Catalyst Metals Limited is an Australian company focused on exploring and evaluating mineral properties, with a market cap of A$759.30 million.

Operations: The company's revenue is primarily derived from its operations in Western Australia, contributing A$243.77 million, and Tasmania, contributing A$75.08 million.

Market Cap: A$759.3M

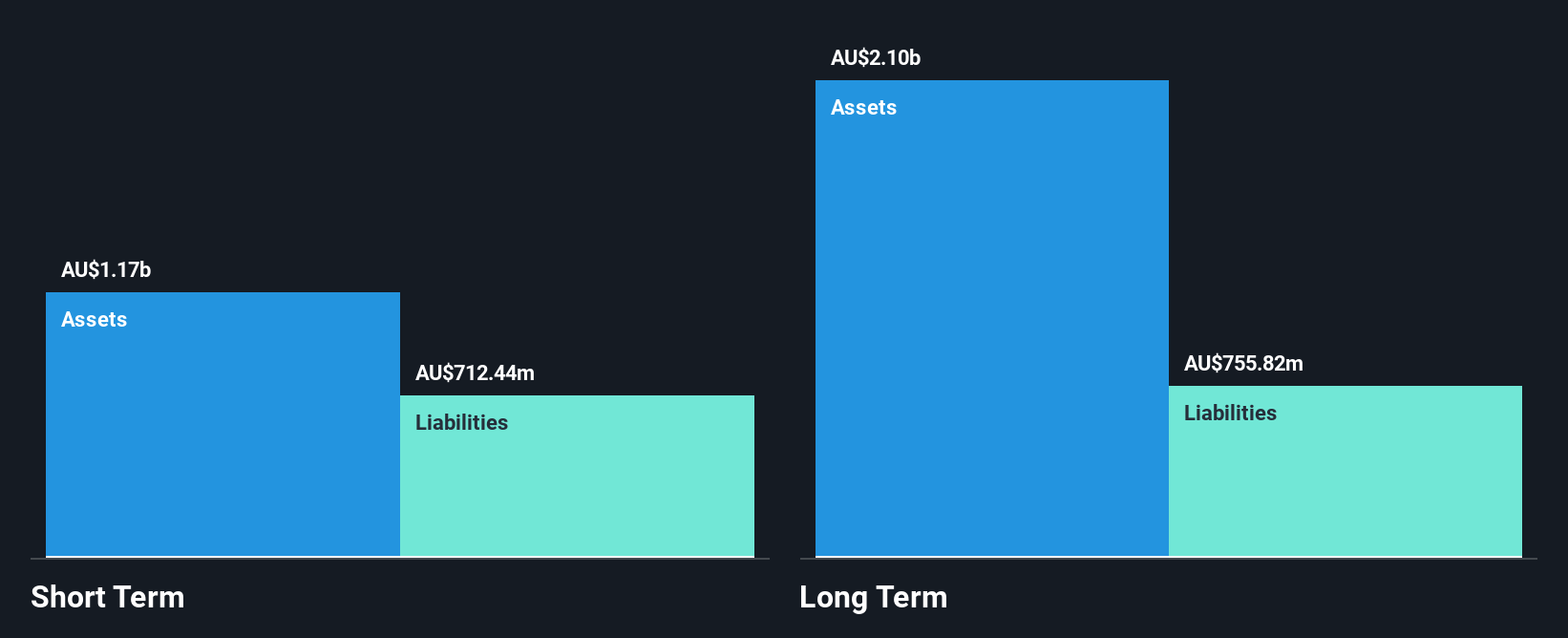

Catalyst Metals has recently been added to the S&P/ASX Emerging Companies Index, reflecting its growing presence in the market. The company reported A$317.01 million in sales for the year ending June 2024, a significant increase from A$63.94 million the previous year, and achieved profitability with a net income of A$23.56 million. Despite having more cash than total debt and well-covered interest payments, Catalyst's short-term assets do not cover its short-term liabilities fully. The company has experienced shareholder dilution over the past year but maintains high-quality earnings with an experienced management team leading its operations.

- Get an in-depth perspective on Catalyst Metals' performance by reading our balance sheet health report here.

- Learn about Catalyst Metals' future growth trajectory here.

Perenti (ASX:PRN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Perenti Limited is a global mining services company with a market capitalization of A$1.05 billion.

Operations: The company's revenue is primarily derived from its Contract Mining Services segment, which generated A$2.54 billion, followed by Drilling Services with A$598.10 million, and Mining Services and Idoba contributing A$239.06 million.

Market Cap: A$1.05B

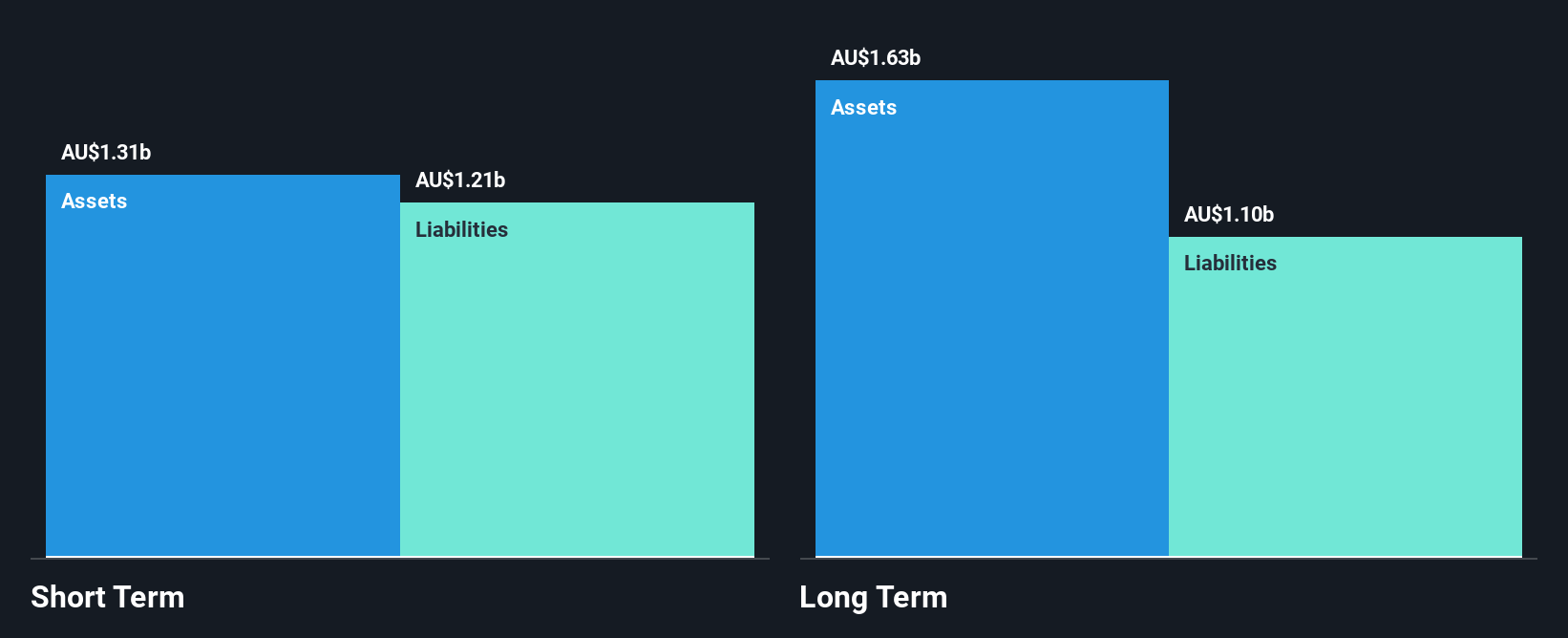

Perenti Limited has announced a share buyback program, aiming to repurchase up to 93.4 million shares, which is nearly 10% of its issued capital. The company's financials show a revenue increase to A$3.34 billion for the year ending June 2024, though net income remained relatively flat at A$95.48 million compared to the previous year. Perenti's debt management appears robust with satisfactory net debt levels and well-covered interest payments by EBIT. However, recent executive changes highlight potential transitional challenges within its management team, as new leaders take on key roles in its operations and strategic initiatives.

- Click to explore a detailed breakdown of our findings in Perenti's financial health report.

- Gain insights into Perenti's outlook and expected performance with our report on the company's earnings estimates.

Ventia Services Group (ASX:VNT)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Ventia Services Group Limited offers infrastructure services across Australia and New Zealand, with a market cap of A$3.96 billion.

Operations: The company's revenue is derived from four primary segments: Transport (A$657.6 million), Telecommunications (A$1.50 billion), Infrastructure Services (A$1.30 billion), and Defence and Social Infrastructure (A$2.51 billion).

Market Cap: A$3.96B

Ventia Services Group has secured significant contracts, including a new A$150 million deal with NBN Co and a four-year A$220 million contract with Seqwater, enhancing its revenue prospects. Despite high debt levels, Ventia's operating cash flow adequately covers its liabilities. The company reported earnings growth of 16.3% over the past year, though this is below its five-year average of 45% per annum. Ventia's short-term assets exceed both short- and long-term liabilities, suggesting solid financial footing despite an inexperienced management team and unstable dividend history. Its shares trade below estimated fair value, indicating potential market undervaluation.

- Jump into the full analysis health report here for a deeper understanding of Ventia Services Group.

- Examine Ventia Services Group's earnings growth report to understand how analysts expect it to perform.

Next Steps

- Embark on your investment journey to our 1,026 ASX Penny Stocks selection here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CYL

Exceptional growth potential and undervalued.