Subdued Growth No Barrier To VEEM Ltd (ASX:VEE) With Shares Advancing 30%

VEEM Ltd (ASX:VEE) shares have continued their recent momentum with a 30% gain in the last month alone. The annual gain comes to 212% following the latest surge, making investors sit up and take notice.

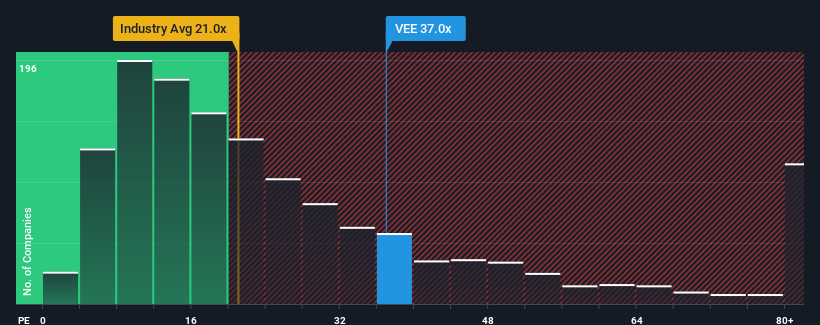

Following the firm bounce in price, given close to half the companies in Australia have price-to-earnings ratios (or "P/E's") below 19x, you may consider VEEM as a stock to avoid entirely with its 37x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

With earnings growth that's superior to most other companies of late, VEEM has been doing relatively well. It seems that many are expecting the strong earnings performance to persist, which has raised the P/E. If not, then existing shareholders might be a little nervous about the viability of the share price.

View our latest analysis for VEEM

Does Growth Match The High P/E?

There's an inherent assumption that a company should far outperform the market for P/E ratios like VEEM's to be considered reasonable.

If we review the last year of earnings growth, the company posted a terrific increase of 107%. EPS has also lifted 22% in aggregate from three years ago, mostly thanks to the last 12 months of growth. Therefore, it's fair to say the earnings growth recently has been respectable for the company.

Shifting to the future, estimates from the sole analyst covering the company suggest earnings should grow by 14% per year over the next three years. With the market predicted to deliver 16% growth per year, the company is positioned for a weaker earnings result.

In light of this, it's alarming that VEEM's P/E sits above the majority of other companies. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as this level of earnings growth is likely to weigh heavily on the share price eventually.

The Final Word

Shares in VEEM have built up some good momentum lately, which has really inflated its P/E. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that VEEM currently trades on a much higher than expected P/E since its forecast growth is lower than the wider market. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the high P/E lower. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

The company's balance sheet is another key area for risk analysis. Take a look at our free balance sheet analysis for VEEM with six simple checks on some of these key factors.

If you're unsure about the strength of VEEM's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:VEE

VEEM

Engages in designing, manufacturing, and selling of marine propulsion and stabilization systems in Australia.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives