- Australia

- /

- Construction

- /

- ASX:SXE

Southern Cross Electrical Engineering (ASX:SXE) Is Up 5.6% After Record Infrastructure-Driven Results and Upbeat Outlook

Reviewed by Sasha Jovanovic

- Southern Cross Electrical Engineering recently reported record revenue and profit for FY2025, driven by strong demand for data centre, battery energy storage, and airport infrastructure projects.

- While the Infrastructure segment showed impressive expansion, the Commercial and Resources segments declined, leading management to pursue further acquisitions and forecast significant EBITDA growth for FY2026.

- We'll explore how record infrastructure project demand, as highlighted in the recent results, may reshape Southern Cross Electrical Engineering's investment narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Southern Cross Electrical Engineering Investment Narrative Recap

To be a shareholder in Southern Cross Electrical Engineering, you’d need to believe in a continued boom in large-scale infrastructure, battery, and data centre projects across Australia, and that such growth can offset earnings volatility and margin pressure elsewhere in the business. The latest record FY2025 results have lifted near-term optimism about infrastructure demand, which is the most significant catalyst, but competition and order book declines remain live risks for both profitability and future growth; the news does not eliminate these short-term challenges.

Among recent announcements, the company’s stated intention to pursue further acquisitions stands out as directly related to its growth narrative and infrastructure-led expansion. With management highlighting M&A as a priority to target geographic and sector diversification, this aligns closely with ambitions to drive EBITDA higher into FY2026, though past acquisition costs and integration risks flagged in recent results will remain important to watch. The flip side to rapid expansion through infrastructure is…

Read the full narrative on Southern Cross Electrical Engineering (it's free!)

Southern Cross Electrical Engineering's narrative projects A$977.8 million revenue and A$43.7 million earnings by 2028. This requires 6.9% yearly revenue growth and a A$12 million earnings increase from A$31.7 million currently.

Uncover how Southern Cross Electrical Engineering's forecasts yield a A$2.44 fair value, in line with its current price.

Exploring Other Perspectives

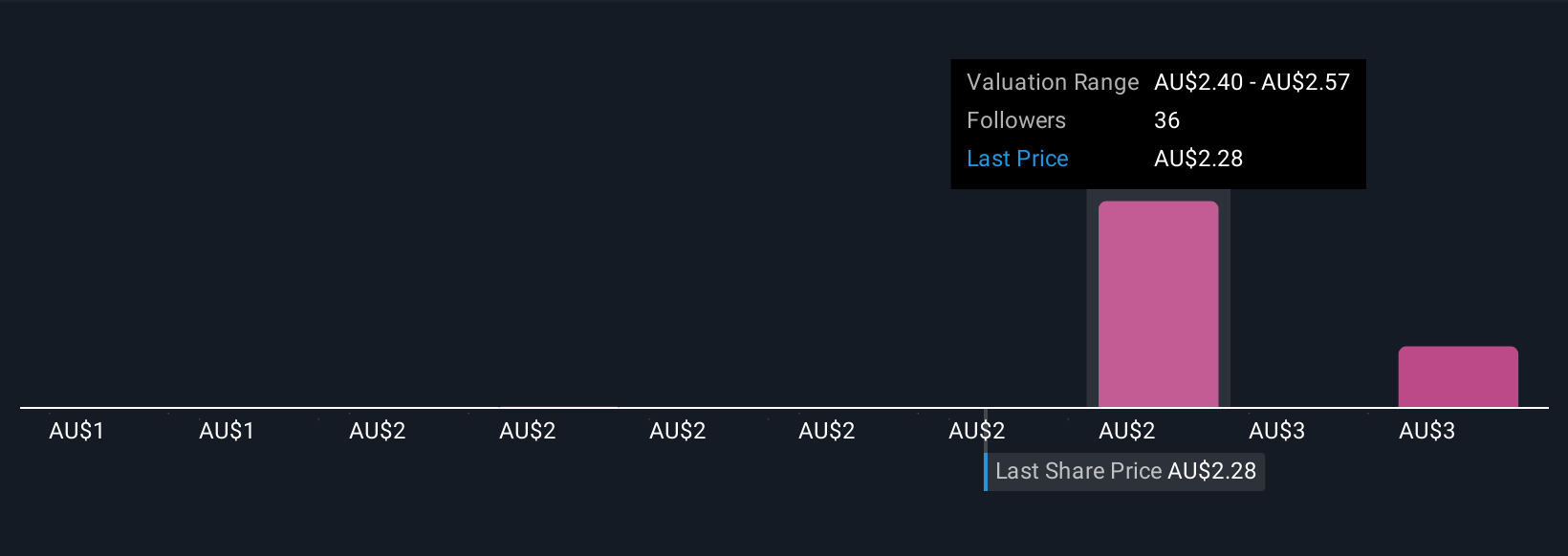

Nine Simply Wall St Community members put fair value for SXE anywhere from A$1.20 to A$2.90 per share, spanning cautious to optimistic outlooks. With management counting on acquisitions to fuel future earnings, this wide spread highlights how future growth and risk are being weighed differently, encouraging you to compare multiple views before taking any position.

Explore 9 other fair value estimates on Southern Cross Electrical Engineering - why the stock might be worth as much as 18% more than the current price!

Build Your Own Southern Cross Electrical Engineering Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Southern Cross Electrical Engineering research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Southern Cross Electrical Engineering research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Southern Cross Electrical Engineering's overall financial health at a glance.

Looking For Alternative Opportunities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SXE

Southern Cross Electrical Engineering

Provides electrical, instrumentation, communications, security, fire, and maintenance services and products in Australia.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives