- Australia

- /

- Construction

- /

- ASX:SXE

How Does Southern Cross Electrical Engineering's (ASX:SXE) CEO Pay Compare With Company Performance?

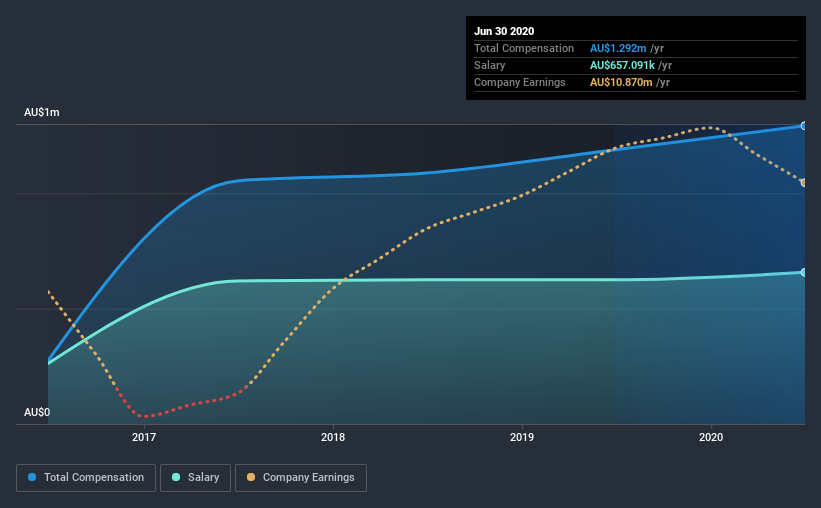

Graeme Dunn has been the CEO of Southern Cross Electrical Engineering Limited (ASX:SXE) since 2016, and this article will examine the executive's compensation with respect to the overall performance of the company. This analysis will also evaluate the appropriateness of CEO compensation when taking into account the earnings and shareholder returns of the company.

See our latest analysis for Southern Cross Electrical Engineering

Comparing Southern Cross Electrical Engineering Limited's CEO Compensation With the industry

According to our data, Southern Cross Electrical Engineering Limited has a market capitalization of AU$149m, and paid its CEO total annual compensation worth AU$1.3m over the year to June 2020. That's a notable increase of 8.8% on last year. Notably, the salary which is AU$657.1k, represents most of the total compensation being paid.

For comparison, other companies in the industry with market capitalizations below AU$261m, reported a median total CEO compensation of AU$672k. This suggests that Graeme Dunn is paid more than the median for the industry. Furthermore, Graeme Dunn directly owns AU$898k worth of shares in the company.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | AU$657k | AU$625k | 51% |

| Other | AU$635k | AU$563k | 49% |

| Total Compensation | AU$1.3m | AU$1.2m | 100% |

On an industry level, around 69% of total compensation represents salary and 31% is other remuneration. Southern Cross Electrical Engineering sets aside a smaller share of compensation for salary, in comparison to the overall industry. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

A Look at Southern Cross Electrical Engineering Limited's Growth Numbers

Southern Cross Electrical Engineering Limited's earnings per share (EPS) grew 37% per year over the last three years. It achieved revenue growth of 7.5% over the last year.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. It's nice to see revenue heading northwards, as this is consistent with healthy business conditions. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Southern Cross Electrical Engineering Limited Been A Good Investment?

Since shareholders would have lost about 13% over three years, some Southern Cross Electrical Engineering Limited investors would surely be feeling negative emotions. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

In Summary...

As we noted earlier, Southern Cross Electrical Engineering pays its CEO higher than the norm for similar-sized companies belonging to the same industry. But the company has impressed with its EPS growth, but shareholder returns — over the same period — have been disappointing. Although we'd stop short of calling it inappropriate, we think Graeme is earning a very handsome sum.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. That's why we did some digging and identified 3 warning signs for Southern Cross Electrical Engineering that investors should think about before committing capital to this stock.

Important note: Southern Cross Electrical Engineering is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

When trading Southern Cross Electrical Engineering or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:SXE

Southern Cross Electrical Engineering

Provides electrical, instrumentation, communications, security, fire, and maintenance services and products in Australia.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

The AI Infrastructure Giant Grows Into Its Valuation

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success