- Australia

- /

- Electrical

- /

- ASX:SKS

SKS Technologies Group (ASX:SKS) Is Up 9.2% After Doubling Profit and Lifting Dividend Tenfold – What’s Changed

Reviewed by Simply Wall St

- SKS Technologies Group Limited recently reported significant financial growth for the fiscal year ending June 2025, including a very large 92% increase in revenue and a 111.8% rise in net profit, alongside the declaration of a fully franked dividend of 6.0 cents per share.

- This marks a substantial increase in shareholder returns compared to the previous year's 1.0 cent dividend and highlights the impact of robust demand in digital infrastructure and smart technology solutions.

- We'll look at how the much higher dividend and strong profit growth influence SKS Technologies Group's investment narrative and future prospects.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

SKS Technologies Group Investment Narrative Recap

To be a shareholder in SKS Technologies Group today, you'd need to believe in the ongoing surge of digital infrastructure and data center projects driving meaningful and sustained growth in both revenue and earnings. The company's rapid top and bottom line expansion, showcased by its recent results and a sharply higher dividend, is encouraging, but does not substantively lessen the most immediate risk, SKS's exposure to a handful of large data center contracts, which could still lead to volatile earnings if any single project is lost or delayed.

Among recent announcements, SKS Technologies' application for the quotation of new shares under its employee incentive scheme stands out. Issuing additional shares to staff not only aligns employee interests with company success, but it also hints at a need to attract and retain specialized talent, particularly relevant given the ongoing sector-wide skilled labor shortages and rising employee costs, both of which remain central to the company's ability to maintain its growth trajectory.

However, investors should be aware that despite this financial momentum, the potential for revenue shocks still exists if a major contract is lost or delayed...

Read the full narrative on SKS Technologies Group (it's free!)

SKS Technologies Group's outlook projects A$368.1 million in revenue and A$22.2 million in earnings by 2028. This assumes a 12.1% annual revenue growth rate and a A$8.2 million increase in earnings from the current A$14.0 million.

Uncover how SKS Technologies Group's forecasts yield a A$3.10 fair value, a 10% downside to its current price.

Exploring Other Perspectives

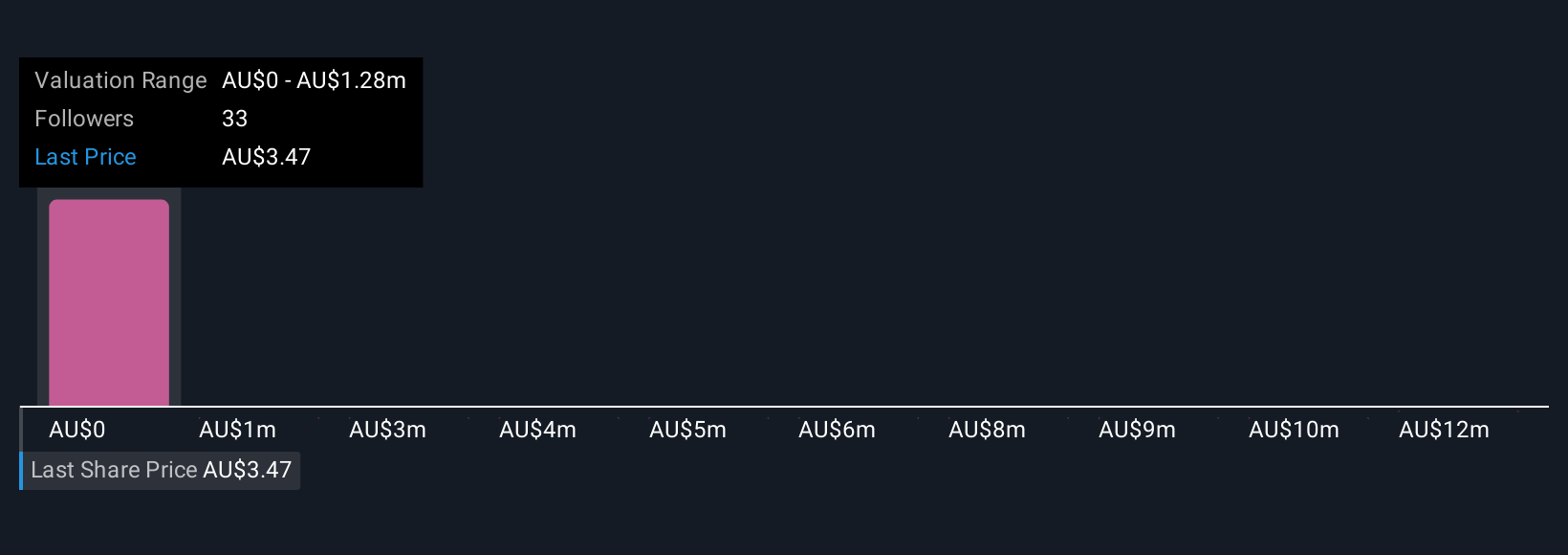

Eleven fair value estimates from the Simply Wall St Community range widely from A$1,281,910 to A$12,819,105 per share. While many see significant growth potential in SKS's digital infrastructure pipeline, projections rely on whether large project wins materialize as expected.

Explore 11 other fair value estimates on SKS Technologies Group - why the stock might be worth just A$1281911!

Build Your Own SKS Technologies Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your SKS Technologies Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free SKS Technologies Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate SKS Technologies Group's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SKS

SKS Technologies Group

Engages in the design, supply, and installation of audio visual, electrical, and communication products and services in Australia.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives