- Australia

- /

- Trade Distributors

- /

- ASX:SGI

Investors Appear Satisfied With Stealth Group Holdings Ltd's (ASX:SGI) Prospects As Shares Rocket 30%

Stealth Group Holdings Ltd (ASX:SGI) shareholders would be excited to see that the share price has had a great month, posting a 30% gain and recovering from prior weakness. The last month tops off a massive increase of 117% in the last year.

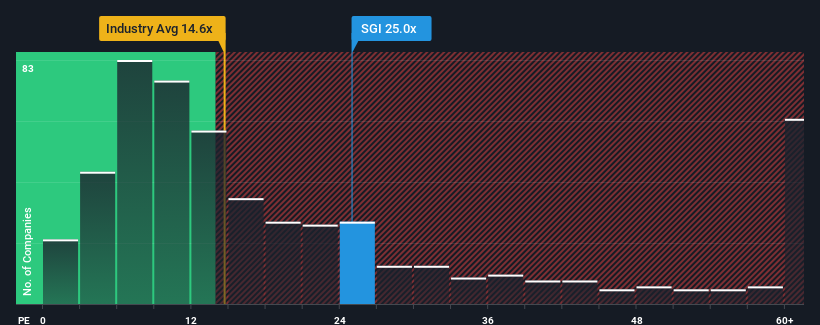

Since its price has surged higher, Stealth Group Holdings' price-to-earnings (or "P/E") ratio of 25x might make it look like a sell right now compared to the market in Australia, where around half of the companies have P/E ratios below 19x and even P/E's below 10x are quite common. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

As an illustration, earnings have deteriorated at Stealth Group Holdings over the last year, which is not ideal at all. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/E from collapsing. If not, then existing shareholders may be quite nervous about the viability of the share price.

See our latest analysis for Stealth Group Holdings

Is There Enough Growth For Stealth Group Holdings?

The only time you'd be truly comfortable seeing a P/E as high as Stealth Group Holdings' is when the company's growth is on track to outshine the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 17%. However, a few very strong years before that means that it was still able to grow EPS by an impressive 755% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

This is in contrast to the rest of the market, which is expected to grow by 29% over the next year, materially lower than the company's recent medium-term annualised growth rates.

In light of this, it's understandable that Stealth Group Holdings' P/E sits above the majority of other companies. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

The Final Word

The large bounce in Stealth Group Holdings' shares has lifted the company's P/E to a fairly high level. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

As we suspected, our examination of Stealth Group Holdings revealed its three-year earnings trends are contributing to its high P/E, given they look better than current market expectations. Right now shareholders are comfortable with the P/E as they are quite confident earnings aren't under threat. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Stealth Group Holdings that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:SGI

Stealth Group Holdings

Operates as an industrial distribution company in Australia and internationally.

Exceptional growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives