- Australia

- /

- Medical Equipment

- /

- ASX:NAN

GWA Group And 2 Other ASX Penny Stocks Worth Watching

Reviewed by Simply Wall St

As the Australian market kicked off the week on a positive note, with most sectors in the green and Information Technology leading with a 2.5% intraday rise, investors are keeping an eye on potential catalysts like European Union investments in critical minerals. In such an optimistic atmosphere, penny stocks continue to capture attention for their unique blend of affordability and growth potential. Despite being considered somewhat outdated, these smaller or newer companies can offer compelling opportunities when backed by strong financials.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.425 | A$121.8M | ✅ 4 ⚠️ 3 View Analysis > |

| Dusk Group (ASX:DSK) | A$0.83 | A$51.68M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.99 | A$459.53M | ✅ 4 ⚠️ 3 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$3.62 | A$267.38M | ✅ 4 ⚠️ 2 View Analysis > |

| Veris (ASX:VRS) | A$0.066 | A$34.76M | ✅ 4 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$3.04 | A$3.47B | ✅ 4 ⚠️ 2 View Analysis > |

| Service Stream (ASX:SSM) | A$2.19 | A$1.34B | ✅ 3 ⚠️ 2 View Analysis > |

| Fleetwood (ASX:FWD) | A$2.73 | A$252.75M | ✅ 3 ⚠️ 2 View Analysis > |

| MaxiPARTS (ASX:MXI) | A$2.365 | A$131.36M | ✅ 3 ⚠️ 2 View Analysis > |

| GWA Group (ASX:GWA) | A$2.46 | A$645.5M | ✅ 5 ⚠️ 1 View Analysis > |

Click here to see the full list of 412 stocks from our ASX Penny Stocks screener.

Let's dive into some prime choices out of the screener.

GWA Group (ASX:GWA)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: GWA Group Limited is involved in the research, design, manufacture, importation, and marketing of building fixtures and fittings for residential and commercial properties across Australia, New Zealand, the United Kingdom, and other international markets with a market cap of A$645.50 million.

Operations: The company's revenue is primarily generated from its Water Solutions segment, which contributed A$418.48 million.

Market Cap: A$645.5M

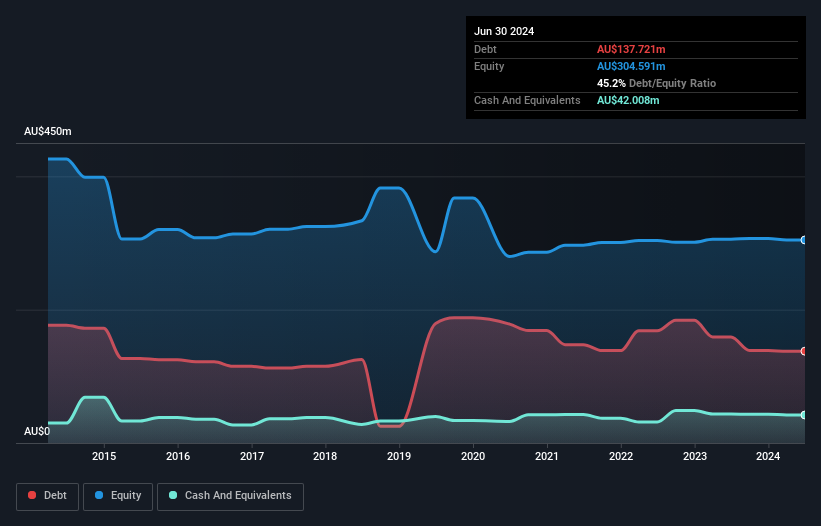

GWA Group Limited, with a market cap of A$645.50 million, has shown promising growth in its earnings over the past year at 12.3%, surpassing the building industry's decline. The company's debt management has improved, with a reduction in its debt-to-equity ratio from 63.8% to 43.9% over five years and interest payments well covered by EBIT at 9.7 times. Despite trading below analyst price targets and offering high-quality earnings, GWA’s dividend sustainability is questionable as it's not well covered by earnings. Recent board changes include Nicola Page's appointment as an Independent Non-Executive Director, enhancing governance expertise.

- Dive into the specifics of GWA Group here with our thorough balance sheet health report.

- Explore GWA Group's analyst forecasts in our growth report.

IPD Group (ASX:IPG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: IPD Group Limited is an Australian company that distributes electrical infrastructure, with a market cap of A$355.17 million.

Operations: The company generates revenue through its Products Division, which accounts for A$334.53 million, and its Services Division, contributing A$20.16 million.

Market Cap: A$355.17M

IPD Group, with a market cap of A$355.17 million, has demonstrated strong financial health and stability in the penny stock domain. The company boasts significant revenue streams from its Products and Services Divisions, totaling A$354.68 million for the year ending June 2025. Its debt is well covered by operating cash flow, and interest payments are comfortably managed by EBIT at 19.6 times coverage. Although earnings growth slowed to 17.1% last year compared to its five-year average of 31.9%, it remains above industry standards. Recent executive changes include Mohamed Yoosuff stepping down from his role but continuing as a Non-Executive Director.

- Take a closer look at IPD Group's potential here in our financial health report.

- Understand IPD Group's earnings outlook by examining our growth report.

Nanosonics (ASX:NAN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Nanosonics Limited is an infection prevention company operating across various regions including Australia, North America, Europe, the United Kingdom, the Middle East, and Asia Pacific with a market cap of A$1.24 billion.

Operations: The company's revenue is derived from its Healthcare Equipment segment, totaling A$198.63 million.

Market Cap: A$1.24B

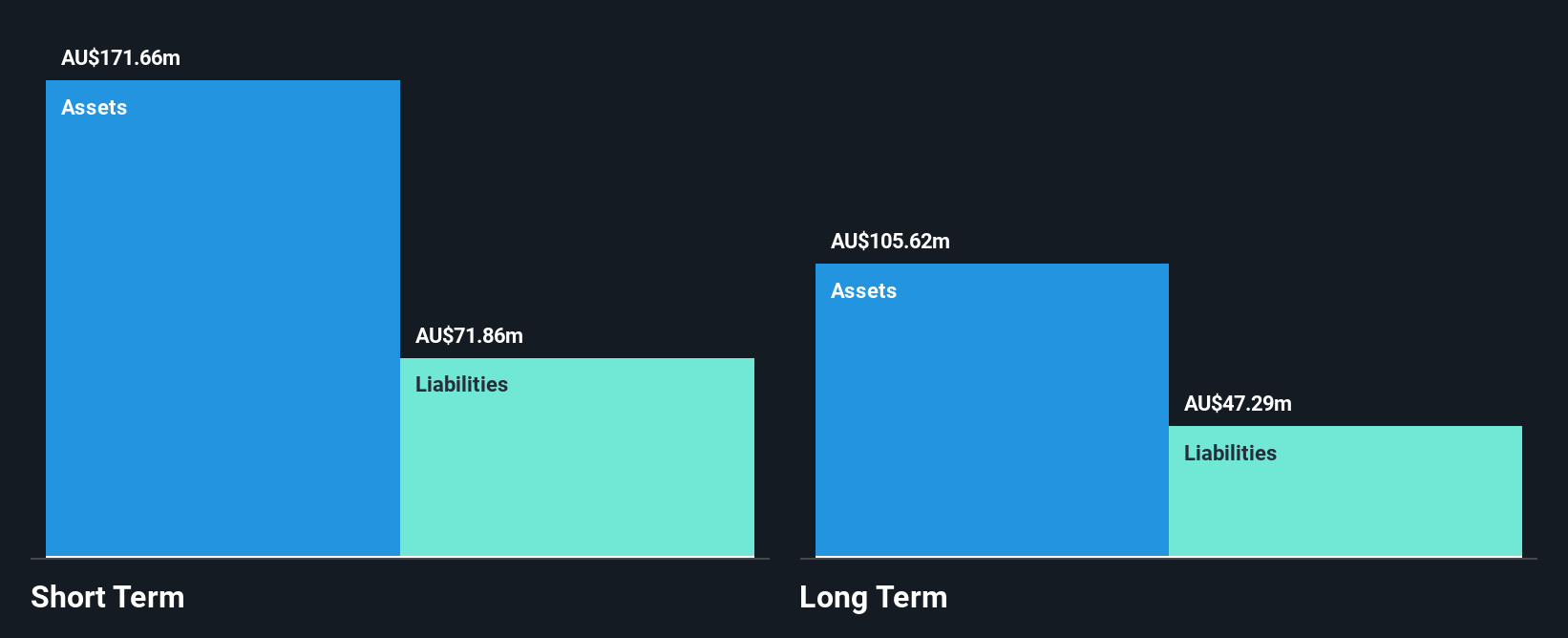

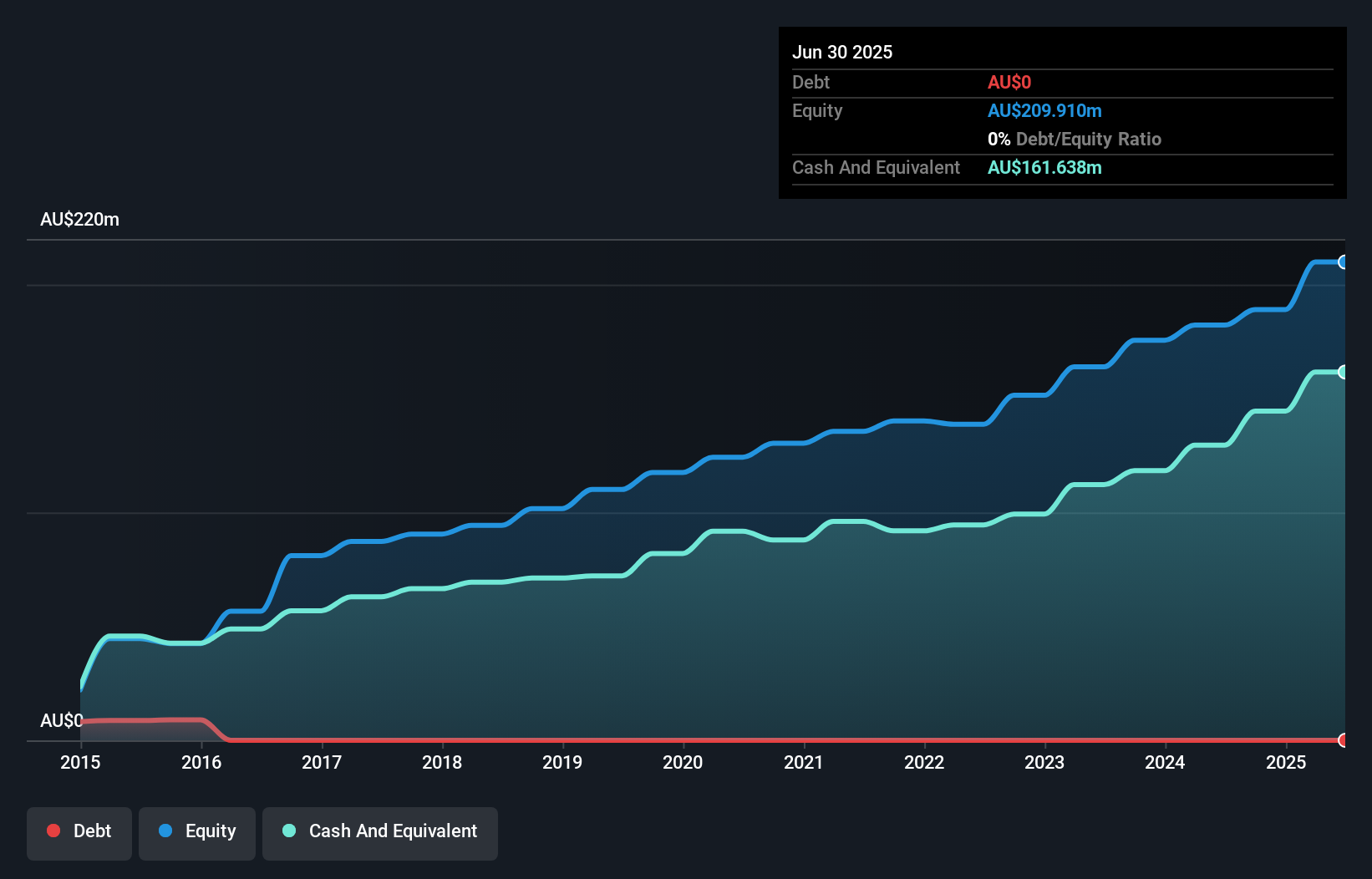

Nanosonics Limited, with a market cap of A$1.24 billion, stands out for its debt-free balance sheet and strong financial position, as evidenced by short-term assets of A$225.3 million surpassing liabilities. The company reported revenue of A$198.63 million and net income growth from A$12.97 million to A$20.68 million year-over-year, reflecting robust earnings quality and improved profit margins at 10.4%. Recent strategic moves include a share buyback program up to $20 million and the appointment of William Haydon as Regional President for North America, aiming to bolster its innovative CORIS® platform's launch in endoscope reprocessing.

- Get an in-depth perspective on Nanosonics' performance by reading our balance sheet health report here.

- Gain insights into Nanosonics' outlook and expected performance with our report on the company's earnings estimates.

Seize The Opportunity

- Dive into all 412 of the ASX Penny Stocks we have identified here.

- Ready To Venture Into Other Investment Styles? We've found 15 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nanosonics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:NAN

Nanosonics

Operates as an infection prevention company in Australia, North America, Europe, the United Kingdom, the Middle East, and Asia Pacific.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives