- Australia

- /

- Aerospace & Defense

- /

- ASX:EOS

The 12% return this week takes Electro Optic Systems Holdings' (ASX:EOS) shareholders one-year gains to 362%

While some are satisfied with an index fund, active investors aim to find truly magnificent investments on the stock market. When you buy and hold the right company, the returns can make a huge difference to both you and your family. For example, the Electro Optic Systems Holdings Limited (ASX:EOS) share price rocketed moonwards 362% in just one year. Also pleasing for shareholders was the 118% gain in the last three months. This could be related to the recent financial results, released recently - you can catch up on the most recent data by reading our company report. Zooming out, the stock is actually down 60% in the last three years.

After a strong gain in the past week, it's worth seeing if longer term returns have been driven by improving fundamentals.

Check out our latest analysis for Electro Optic Systems Holdings

Because Electro Optic Systems Holdings made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Electro Optic Systems Holdings grew its revenue by 59% last year. That's stonking growth even when compared to other loss-making stocks. But the share price seems headed to the moon, up 362% as previously highlighted. Even the most bullish shareholders might be thinking that the share price might drop back a bit, after a gain like that. But if the share price does moderate a bit, there might be an opportunity for high growth investors.

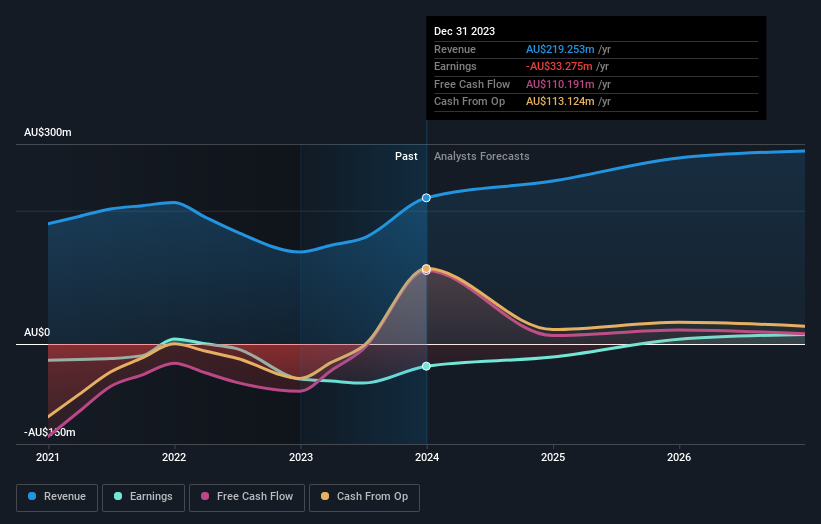

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Take a more thorough look at Electro Optic Systems Holdings' financial health with this free report on its balance sheet.

A Different Perspective

It's nice to see that Electro Optic Systems Holdings shareholders have received a total shareholder return of 362% over the last year. There's no doubt those recent returns are much better than the TSR loss of 5% per year over five years. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. Before spending more time on Electro Optic Systems Holdings it might be wise to click here to see if insiders have been buying or selling shares.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Australian exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Electro Optic Systems Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:EOS

Electro Optic Systems Holdings

Engages in the development, manufacture, and sale of telescopes and dome enclosures, laser satellite tracking systems, electro-optic fire control systems, and microwave satellite dishes and receivers.

Undervalued with excellent balance sheet.