- Australia

- /

- Construction

- /

- ASX:DUR

ASX Penny Stocks To Monitor In October 2024

Reviewed by Simply Wall St

In the last week, the Australian market has been flat, although it has seen a 20% rise over the past year with earnings forecasted to grow by 12% annually. Investing in penny stocks—once a buzzword but now more of a niche—can still open doors to growth opportunities, typically in smaller or newer companies. We'll spotlight several penny stocks that stand out for their financial strength, making them promising candidates for investors seeking under-the-radar companies poised for long-term success.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.80 | A$127.64M | ★★★★☆☆ |

| MaxiPARTS (ASX:MXI) | A$1.87 | A$99.57M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$1.845 | A$292.36M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.55 | A$334.88M | ★★★★★☆ |

| LaserBond (ASX:LBL) | A$0.61 | A$74.43M | ★★★★★★ |

| Navigator Global Investments (ASX:NGI) | A$1.72 | A$823.33M | ★★★★★☆ |

| Perenti (ASX:PRN) | A$1.19 | A$1.1B | ★★★★★★ |

| Atlas Pearls (ASX:ATP) | A$0.135 | A$59.91M | ★★★★★★ |

| GTN (ASX:GTN) | A$0.47 | A$93.09M | ★★★★★★ |

| Joyce (ASX:JYC) | A$3.915 | A$117.4M | ★★★★★★ |

Click here to see the full list of 1,031 stocks from our ASX Penny Stocks screener.

We'll examine a selection from our screener results.

Civmec (ASX:CVL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Civmec Limited is an investment holding company that offers construction and engineering services across the energy, resources, infrastructure, marine, and defense sectors in Australia with a market cap of A$474.60 million.

Operations: The company's revenue is derived from three primary segments: Energy (A$31.04 million), Resources (A$876.48 million), and Infrastructure, Marine & Defence (A$125.96 million).

Market Cap: A$474.6M

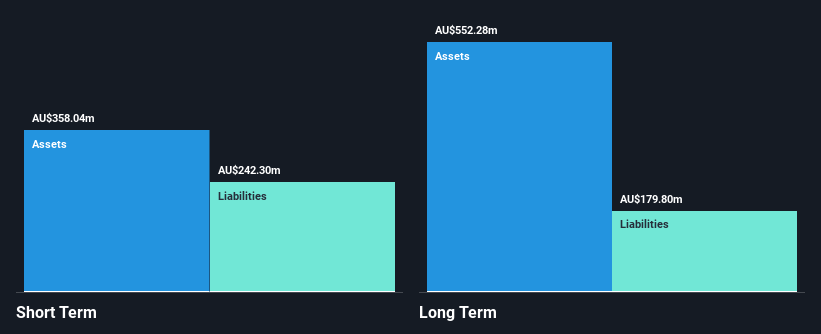

Civmec Limited, with a market cap of A$474.60 million, has demonstrated significant earnings growth over the past five years at 33.8% annually, although recent growth slowed to 11.7%. The company is trading at a good value, estimated to be 50% below its fair value. Civmec's financial health is supported by strong cash flow coverage of debt and well-covered interest payments. Recent board appointments bring seasoned expertise, potentially enhancing governance and strategic oversight. However, the management team lacks experience with an average tenure of just 0.1 years which may impact operational stability amidst ongoing executive changes.

- Unlock comprehensive insights into our analysis of Civmec stock in this financial health report.

- Learn about Civmec's future growth trajectory here.

Duratec (ASX:DUR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Duratec Limited, along with its subsidiaries, provides assessment, protection, remediation, and refurbishment services for steel and concrete infrastructure assets in Australia and has a market cap of A$414.61 million.

Operations: The company's revenue segments include Energy (A$46.64 million), Defence (A$220.16 million), Buildings & Facades (A$111.33 million), and Mining & Industrial (A$155.64 million).

Market Cap: A$414.61M

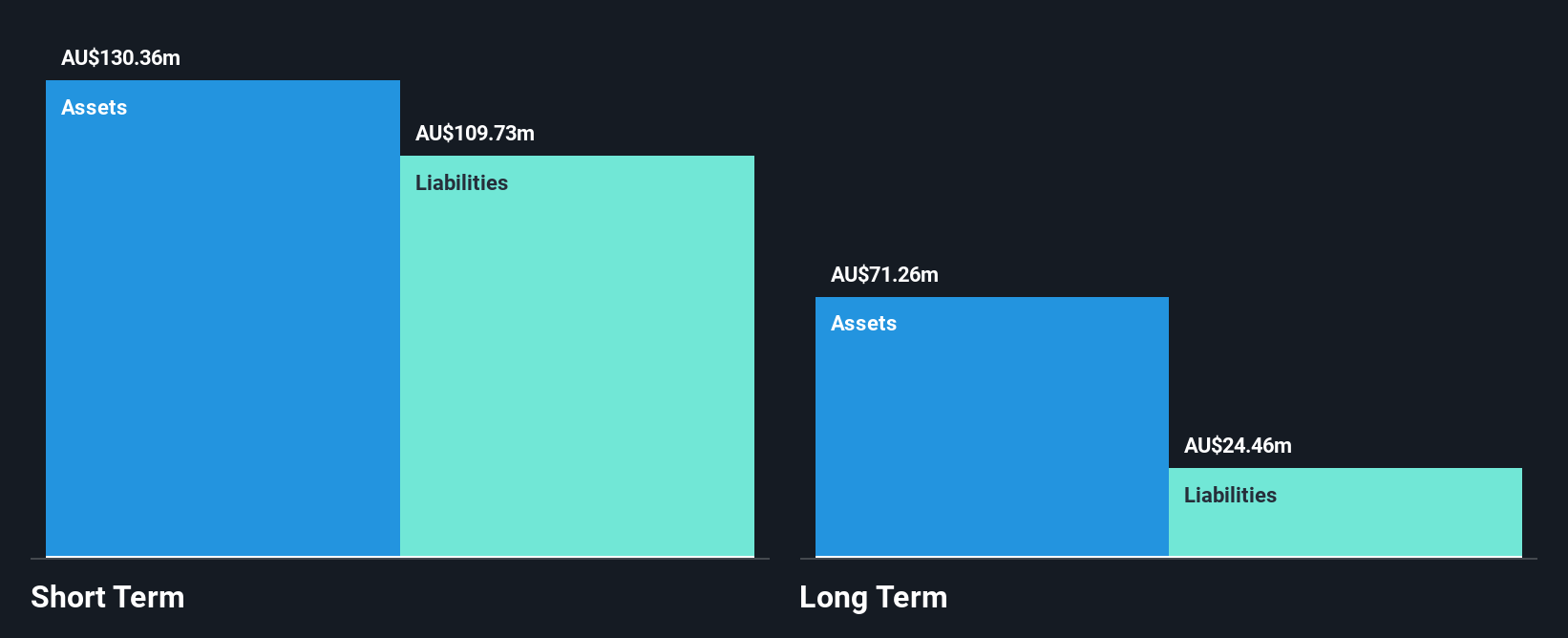

Duratec Limited, with a market cap of A$414.61 million, shows solid financial health as its short-term assets of A$161.3 million exceed both short and long-term liabilities. The company is debt-free, eliminating concerns over interest payments and cash flow coverage for debt. Despite a less experienced management team with an average tenure of 1.8 years, the board's seasoned leadership averages 14.2 years in tenure. Duratec's earnings have grown significantly by 24.8% annually over five years but slowed to 11.6% recently, underperforming the industry average growth rate of 16.2%. Recent inclusion in the S&P Global BMI Index highlights its growing market presence amidst stable weekly volatility at 7%.

- Get an in-depth perspective on Duratec's performance by reading our balance sheet health report here.

- Explore Duratec's analyst forecasts in our growth report.

ReadyTech Holdings (ASX:RDY)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: ReadyTech Holdings Limited offers technology-based solutions in Australia and has a market cap of A$360.62 million.

Operations: The company's revenue is derived from three main segments: Workforce Solutions (A$30.74 million), Government and Justice (A$42.51 million), and Education and Work Pathways (A$40.55 million).

Market Cap: A$360.62M

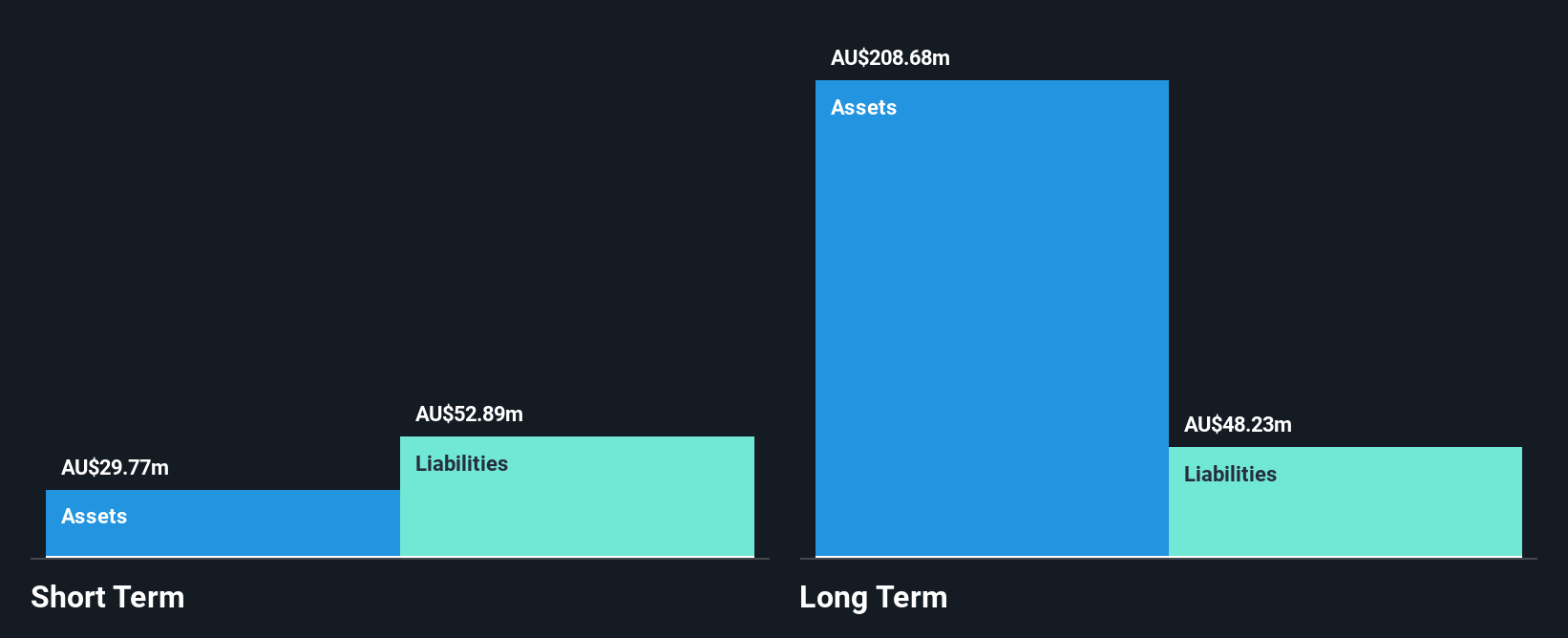

ReadyTech Holdings Limited, with a market cap of A$360.62 million, has shown revenue growth across its segments, totaling A$113.8 million for the year ending June 2024. Despite earnings growth of 9.8% surpassing the software industry average, net profit margins remain flat at 4.8%. The company faces challenges in covering short-term liabilities with assets and has seen shareholder dilution by 2.9%. However, debt is well-managed with operating cash flow coverage at 75.4%, and interest payments are adequately covered by EBIT (3.1x). Management and board experience averages four years and 5.6 years respectively, indicating seasoned leadership amidst recent board changes.

- Jump into the full analysis health report here for a deeper understanding of ReadyTech Holdings.

- Review our growth performance report to gain insights into ReadyTech Holdings' future.

Key Takeaways

- Dive into all 1,031 of the ASX Penny Stocks we have identified here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:DUR

Duratec

Engages in the provision of assessment, protection, remediation, and refurbishment services to a range of assets, primarily steel and concrete infrastructure in Australia.

Flawless balance sheet and good value.