- Australia

- /

- Construction

- /

- ASX:DUR

3 ASX Stocks That Could Be Trading Below Their Estimated Value In November 2025

Reviewed by Simply Wall St

As the Australian market experiences a mixed performance with commodities like lithium gaining traction and technology stocks facing headwinds, investors are keenly observing potential opportunities amidst these fluctuations. In such an environment, identifying undervalued stocks becomes crucial, as they offer the possibility of growth when market conditions stabilize or improve.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Symal Group (ASX:SYL) | A$2.42 | A$4.57 | 47% |

| Superloop (ASX:SLC) | A$3.09 | A$5.62 | 45.1% |

| NRW Holdings (ASX:NWH) | A$5.07 | A$8.98 | 43.5% |

| Immutep (ASX:IMM) | A$0.27 | A$0.49 | 44.5% |

| Flight Centre Travel Group (ASX:FLT) | A$12.23 | A$23.38 | 47.7% |

| Cynata Therapeutics (ASX:CYP) | A$0.25 | A$0.43 | 42.4% |

| CleanSpace Holdings (ASX:CSX) | A$0.69 | A$1.34 | 48.7% |

| Betmakers Technology Group (ASX:BET) | A$0.175 | A$0.35 | 49.7% |

| Airtasker (ASX:ART) | A$0.345 | A$0.68 | 49.2% |

| Advanced Braking Technology (ASX:ABV) | A$0.12 | A$0.24 | 49.4% |

Let's explore several standout options from the results in the screener.

Duratec (ASX:DUR)

Overview: Duratec Limited, with a market cap of A$473.15 million, provides assessment, protection, remediation, and refurbishment services for steel and concrete infrastructure assets in Australia.

Operations: The company's revenue is derived from several segments, including Energy (A$82.51 million), Defence (A$181.36 million), Buildings & Facades (A$111.87 million), and Mining & Industrial (A$136.65 million).

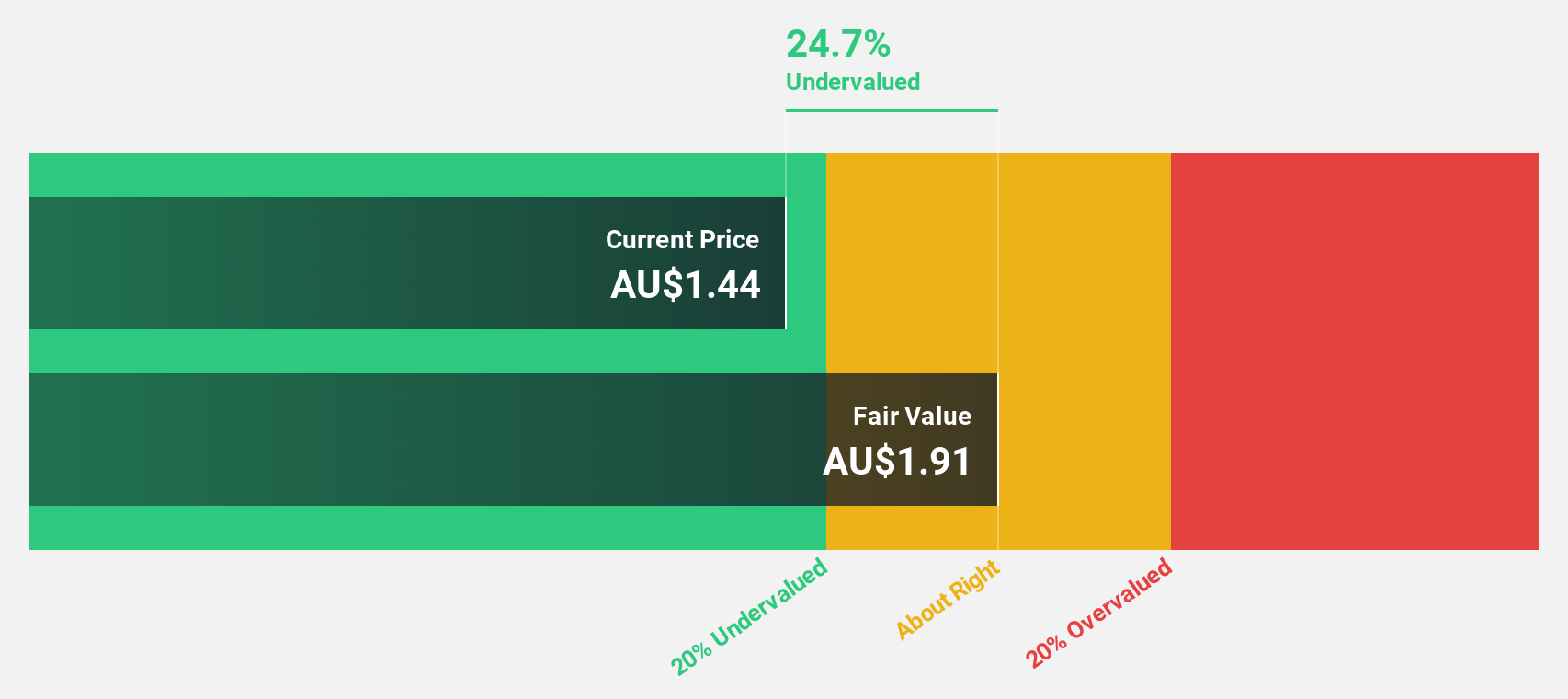

Estimated Discount To Fair Value: 23%

Duratec, trading at A$1.84, is undervalued compared to its estimated fair value of A$2.38 and is expected to grow earnings by 13.8% annually, outpacing the Australian market's 12%. Despite recent insider selling, revenue growth forecasts exceed the market average at 8.1% per year. Recent financials show a modest increase in sales and net income for the year ending June 2025, supporting its potential as an undervalued stock based on cash flows in Australia.

- Our comprehensive growth report raises the possibility that Duratec is poised for substantial financial growth.

- Click to explore a detailed breakdown of our findings in Duratec's balance sheet health report.

Flight Centre Travel Group (ASX:FLT)

Overview: Flight Centre Travel Group Limited offers travel retailing services for both leisure and corporate clients across various regions including Australia, New Zealand, the Americas, Europe, the Middle East, Africa, Asia, and beyond with a market cap of A$2.60 billion.

Operations: The company's revenue is derived from its leisure segment, generating A$1.41 billion, and its corporate segment, contributing A$1.14 billion.

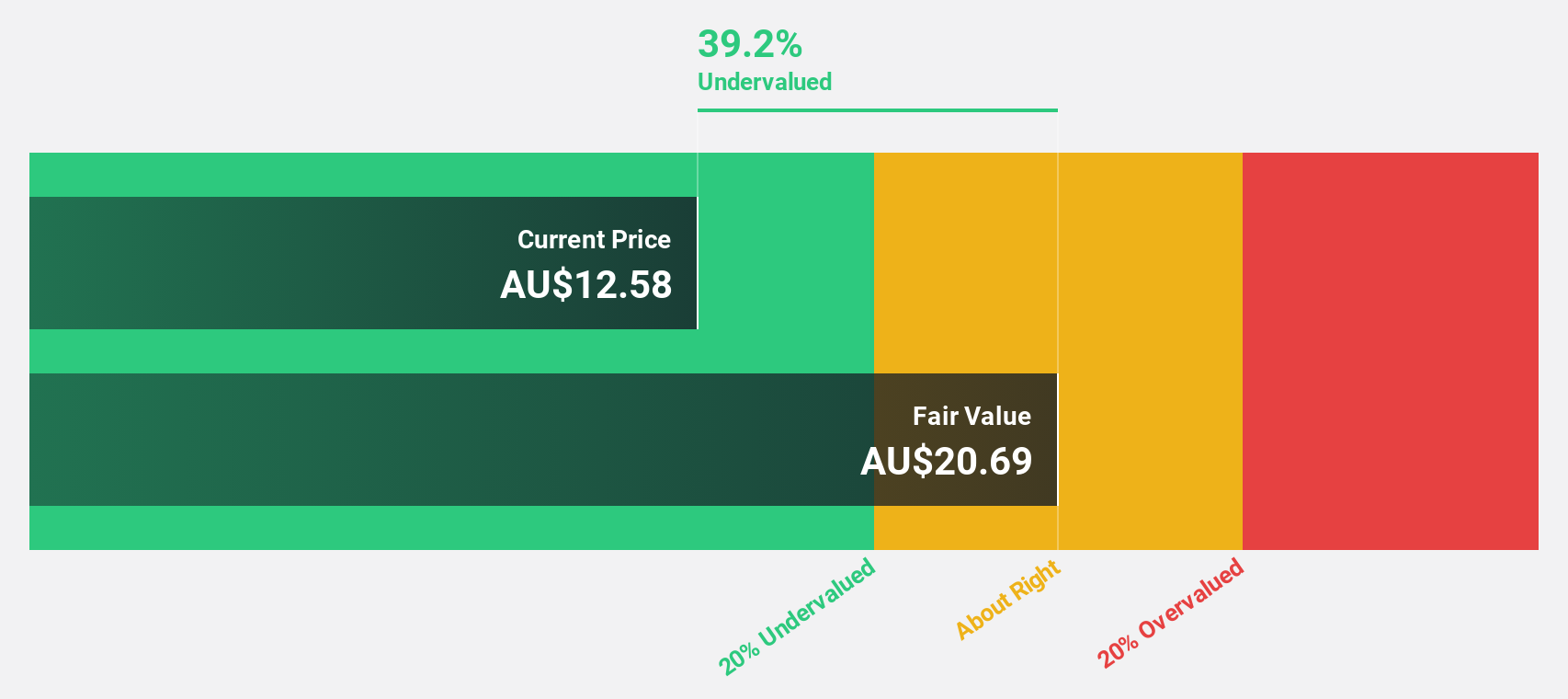

Estimated Discount To Fair Value: 47.7%

Flight Centre Travel Group, with its stock at A$12.23, is undervalued relative to a fair value estimate of A$23.38. Earnings are projected to grow significantly at 20.7% annually, surpassing the Australian market's average growth rate. Despite a dividend not fully covered by free cash flows and recent index exclusion from the S&P/ASX 100, strategic M&A considerations and completed share buybacks underscore potential for enhanced shareholder value through cash flow utilization.

- Our growth report here indicates Flight Centre Travel Group may be poised for an improving outlook.

- Click here to discover the nuances of Flight Centre Travel Group with our detailed financial health report.

SHAPE Australia (ASX:SHA)

Overview: SHAPE Australia Corporation Limited, listed as ASX:SHA, operates in the construction, fitout, and refurbishment of commercial properties in Australia with a market cap of A$495.72 million.

Operations: The company's revenue primarily comes from its heavy construction segment, which generated A$956.87 million.

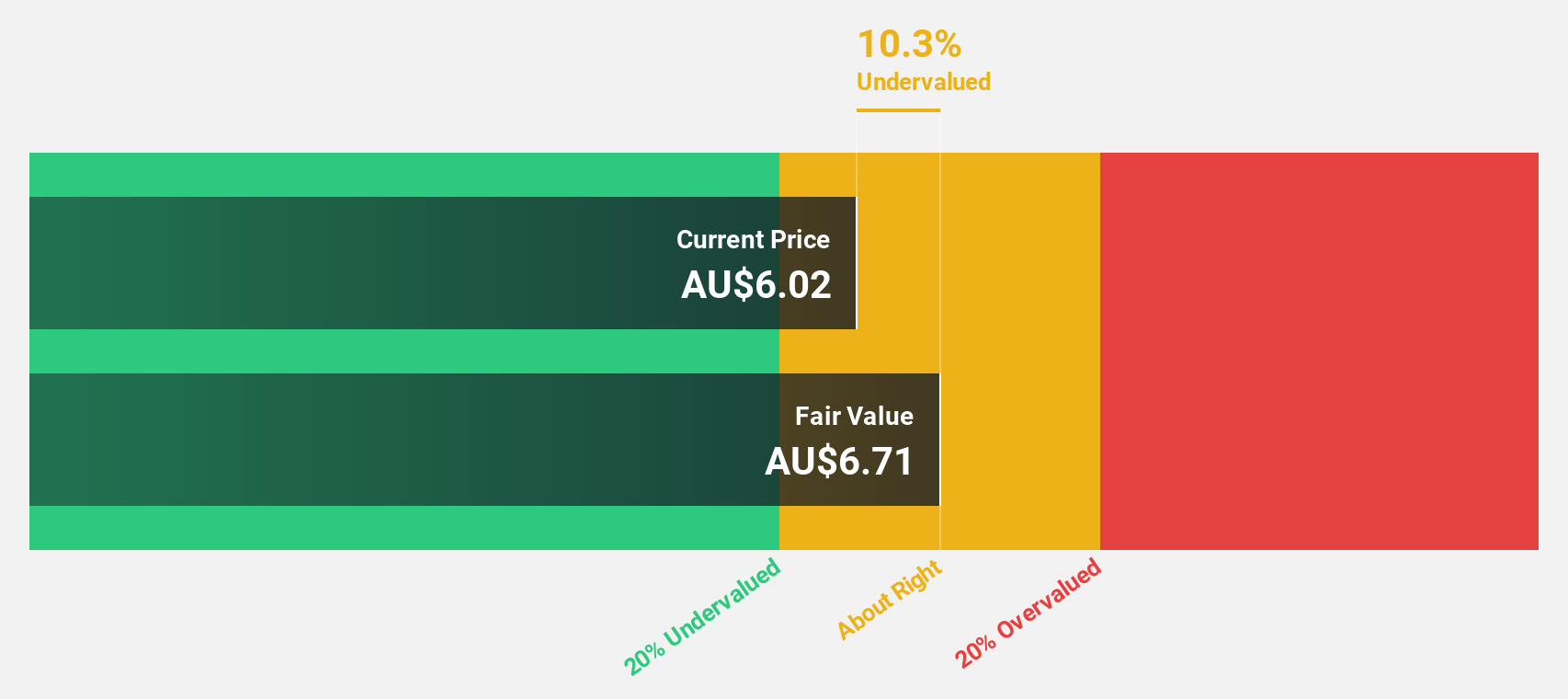

Estimated Discount To Fair Value: 10.3%

SHAPE Australia, trading at A$6.02, is undervalued compared to a fair value estimate of A$6.71, with earnings growing 31.9% over the past year and forecasted to grow 13.8% annually, outpacing the Australian market's average growth rate. Despite insider selling and an unstable dividend history, SHAPE's focus on M&A activities could enhance cash flow utilization and shareholder value as evidenced by recent board changes emphasizing strategic growth through acquisitions.

- Our expertly prepared growth report on SHAPE Australia implies its future financial outlook may be stronger than recent results.

- Get an in-depth perspective on SHAPE Australia's balance sheet by reading our health report here.

Taking Advantage

- Embark on your investment journey to our 33 Undervalued ASX Stocks Based On Cash Flows selection here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:DUR

Duratec

Engages in the provision of assessment, protection, remediation, and refurbishment services to a range of assets primarily for steel and concrete infrastructure in Australia.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives