- Australia

- /

- Aerospace & Defense

- /

- ASX:DRO

DroneShield (ASX:DRO) Valuation: Assessing Options Vesting and Major Latin American Contract Impact

Reviewed by Simply Wall St

DroneShield (ASX:DRO) shares have faced recent volatility as investors reacted to two major developments: the vesting of over 44 million performance options tied to a $200 million cash milestone, and a landmark Latin American contract win.

See our latest analysis for DroneShield.

Over the past month, DroneShield’s share price return dropped 50.7% following some fast-paced news, including that milestone contract in Latin America and the vesting of performance options. Even so, long-term momentum is still impressive. The total shareholder return stands at 278.8% over the past year and a staggering 1,331% over three years, underscoring the company’s growth narrative and shifting investor expectations.

If contract wins like DroneShield’s have you searching for other defence innovators, it’s worth exploring opportunities through our aerospace and defence stock screener: See the full list for free.

With such strong recent contracts and a steep share price pullback, investors may be wondering, is DroneShield trading at a discount to its potential, or has the market already priced in the next wave of growth?

Most Popular Narrative: 37.5% Undervalued

DroneShield's narrative fair value stands well above the latest closing price, suggesting that the market may be missing a key aspect of the company's future story. The current assessment points to substantial upside if analysts’ quantitative projections play out.

Surging demand for counter-drone technologies is being driven by ongoing geopolitical instability and heightened security threats, as evidenced by record global and NATO-aligned defense spending and an escalating number of large procurement contracts in DroneShield's pipeline. This positions the company for robust, sustained revenue growth.

Curious what assumptions could justify such a bullish outlook? The analysts behind this narrative are betting on a dramatic ramp in core financial metrics and a future profit multiple as ambitious as those reserved for the fastest-growing industry disruptors. Want to see what specific scenario drives this striking valuation? Read on for all the details powering this premium fair value call.

Result: Fair Value of $5.15 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, unpredictable government contract timing and rising R&D spending could present challenges to DroneShield’s rapid expansion narrative and put pressure on future profit margins.

Find out about the key risks to this DroneShield narrative.

Another View: Market Ratios Paint a Different Picture

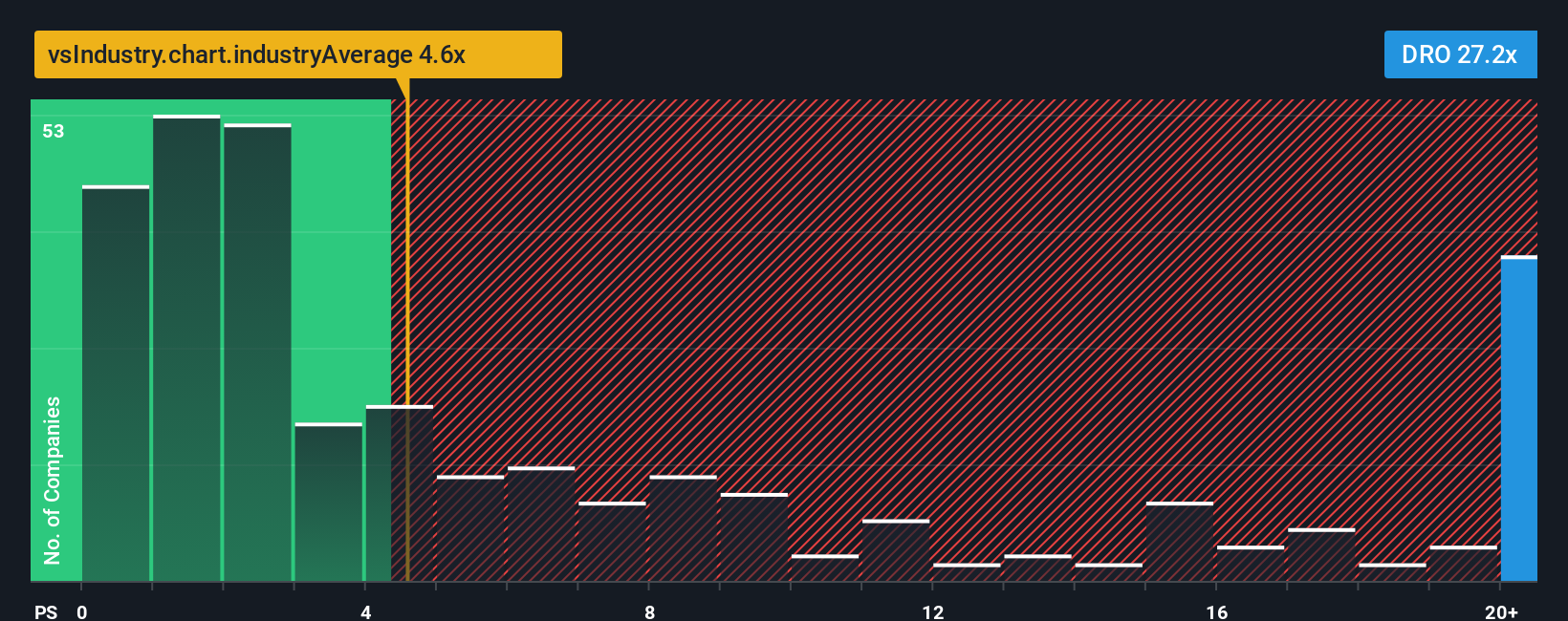

While the narrative-based valuation suggests DroneShield is undervalued, a look at key market ratios tells another story. Compared to the global industry, DroneShield’s price-to-sales multiple of 27.2x is much higher than both the industry average of 4.6x and a peer average of 3.2x. The fair ratio estimate is 19.3x, signaling that the stock trades at a significant premium.

What does such a wide gap between price and fundamentals mean for future returns? Could the market be overestimating growth, or is there still hidden value yet to emerge?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own DroneShield Narrative

Keep in mind, if you see things differently or want to dig deeper into the numbers yourself, you can easily build your own perspective from the ground up in just a few minutes. Do it your way

A great starting point for your DroneShield research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let great opportunities pass you by. Expand your watchlist with companies that match your goals. With just a few minutes, you could uncover winners before the crowd.

- Grow your portfolio with potential by uncovering these 861 undervalued stocks based on cash flows that stand out for their attractive valuations and future upside.

- Jump ahead of market trends by identifying these 25 AI penny stocks driving innovation at the frontier of artificial intelligence and automation.

- Secure reliable income with these 17 dividend stocks with yields > 3% offering solid yields for investors seeking steady returns and defensive gains.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:DRO

DroneShield

Engages in the development, commercialization, and sale of hardware and software technology for drone detection and security in Australia and the United States.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives