As the Australian market navigates a period of volatility, with the S&P/ASX 200 index retracting from its recent peak amid fluctuations in commodity prices and cautious sentiment ahead of the Reserve Bank's interest rate decision, investors are closely monitoring opportunities for stability and growth. In this environment, dividend stocks stand out as they can offer regular income streams and potential defensive qualities against market uncertainties.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Computershare (ASX:CPU) | 3.06% | ★★★★★☆ |

| Nick Scali (ASX:NCK) | 4.88% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 4.40% | ★★★★★☆ |

| Joyce (ASX:JYC) | 7.12% | ★★★★★☆ |

| Korvest (ASX:KOV) | 6.79% | ★★★★★☆ |

| Bendigo and Adelaide Bank (ASX:BEN) | 6.38% | ★★★★★☆ |

| Fortescue (ASX:FMG) | 7.86% | ★★★★★☆ |

| Vita Life Sciences (ASX:VLS) | 4.00% | ★★★★☆☆ |

| Atlas Arteria (ASX:ALX) | 7.37% | ★★★★☆☆ |

| Centrepoint Alliance (ASX:CAF) | 7.94% | ★★★★☆☆ |

Click here to see the full list of 32 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Bendigo and Adelaide Bank (ASX:BEN)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Bendigo and Adelaide Bank Limited is an Australian financial institution offering banking products and services to retail clients and SMEs, with a market capitalization of approximately A$5.68 billion.

Operations: Bendigo and Adelaide Bank Limited's revenue is primarily derived from its consumer segment, which generated A$1.44 billion, and its business and agribusiness segment with revenues of A$582.8 million.

Dividend Yield: 6.4%

Bendigo and Adelaide Bank's dividend yield stands at a competitive A$6.38%, ranking in the top quartile of Australian payers. Despite a 27.5% earnings growth last year, dividends have been inconsistent over the past decade, raising questions about reliability. The bank trades at 20.7% below estimated fair value, with recent fixed-income offerings potentially bolstering capital structure but also introducing elements of risk through convertible securities.

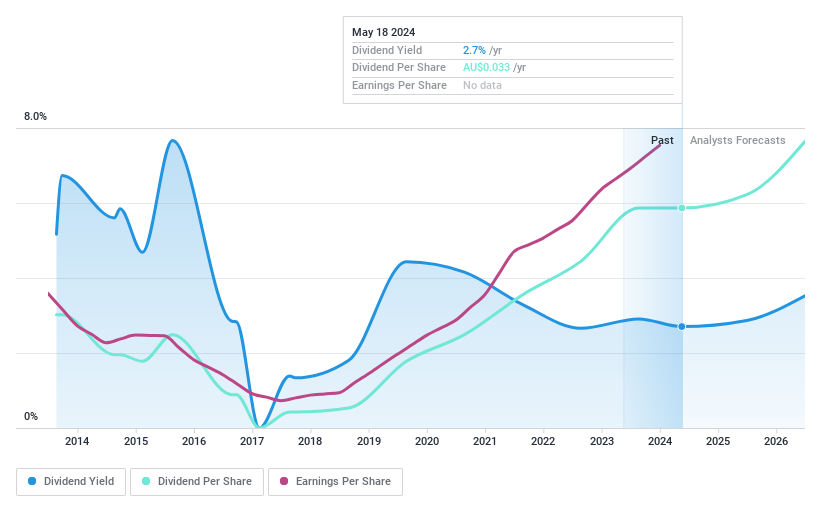

XRF Scientific (ASX:XRF)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: XRF Scientific Limited is an Australian company engaged in the manufacturing and marketing of precious metal products, specialized chemicals, and instrumentation for various industries including scientific analysis, construction materials, and mining with a market capitalization of approximately A$165.65 million.

Operations: XRF Scientific Limited's revenue is derived from three primary segments: Consumables generating A$18.78 million, Precious Metals at A$20.68 million, and Capital Equipment contributing A$19.28 million.

Dividend Yield: 2.8%

XRF Scientific, with a dividend yield of 2.75%, falls short of the Australian market's top dividend payers. However, its dividends are well-supported by both earnings and cash flows, with payout ratios of 53.9% and 68.3% respectively, indicating sustainability. Recent performance shows promise; sales rose to A$28.62 million from A$27.09 million year-over-year, alongside net income growth to A$4.48 million from A$3.74 million—pointing to solid financial health despite a history of dividend volatility and below-market yield levels.

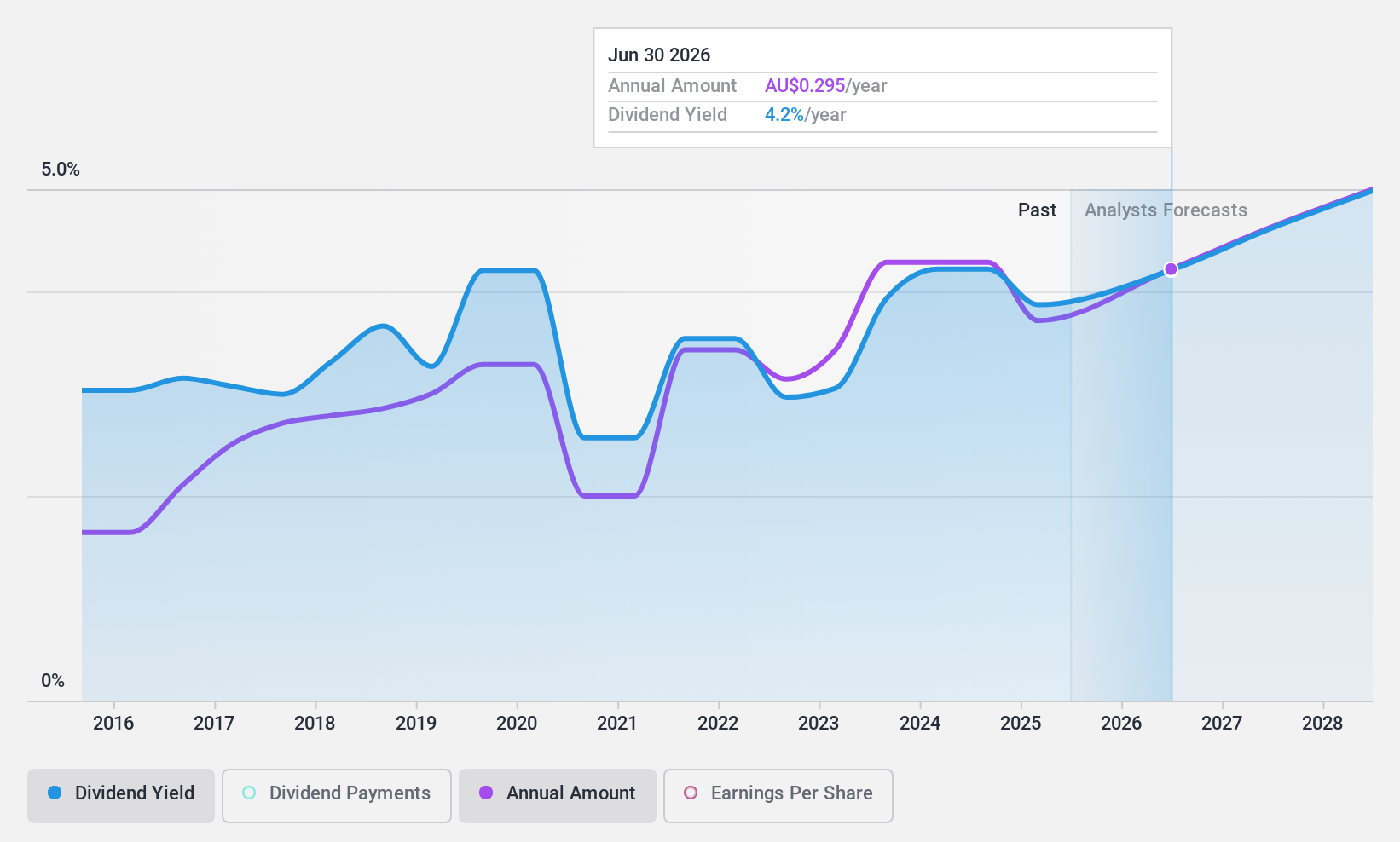

nib holdings (ASX:NHF)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Nib Holdings Limited is a company that specializes in underwriting and distributing private health insurance to residents, international students, and visitors in Australia and New Zealand, with a market capitalization of approximately A$3.87 billion.

Operations: Nib Holdings Limited generates its revenue primarily from Australian Residents Health Insurance at A$2.55 billion, followed by New Zealand Insurance at A$351.9 million, with additional contributions from NIB Travel at A$109.1 million and International (Inbound) Health Insurance at A$173.2 million.

Dividend Yield: 3.8%

nib holdings' dividends, while not top-tier in yield at 3.75%, demonstrate a commitment to growth, evidenced by a decade of increases. The company's recent earnings report showed a rise in net income to A$106.4 million, supporting its dividend sustainability with both earnings and cash flow coverage ratios below 70%. Despite this positive trend, investors should note NHF's past dividend volatility and current trading at 34.5% under its fair value estimate.

Make It Happen

- Unlock our comprehensive list of 32 Top Dividend Stocks by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore small companies with big growth potential before they take off.

- Fuel your portfolio with fast-growing stocks poised for rapid expansion .

- Play it safe and steady with these reliable blue chips that offer both stability and growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether nib holdings is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:NHF

nib holdings

nib holdings limited, together with its subsidiaries, underwrites and distributes private health insurance to residents, international students, and visitors in Australia and New Zealand.

Flawless balance sheet with solid track record and pays a dividend.