- Austria

- /

- Electronic Equipment and Components

- /

- WBAG:KTCG

Kapsch TrafficCom (VIE:KTCG shareholders incur further losses as stock declines 12% this week, taking five-year losses to 69%

Statistically speaking, long term investing is a profitable endeavour. But unfortunately, some companies simply don't succeed. For example, after five long years the Kapsch TrafficCom AG (VIE:KTCG) share price is a whole 72% lower. That's not a lot of fun for true believers. Shareholders have had an even rougher run lately, with the share price down 22% in the last 90 days. However, one could argue that the price has been influenced by the general market, which is down 9.2% in the same timeframe.

With the stock having lost 12% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

View our latest analysis for Kapsch TrafficCom

Kapsch TrafficCom wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over half a decade Kapsch TrafficCom reduced its trailing twelve month revenue by 8.0% for each year. While far from catastrophic that is not good. The share price fall of 11% (per year, over five years) is a stern reminder that money-losing companies are expected to grow revenue. We're generally averse to companies with declining revenues, but we're not alone in that. That is not really what the successful investors we know aim for.

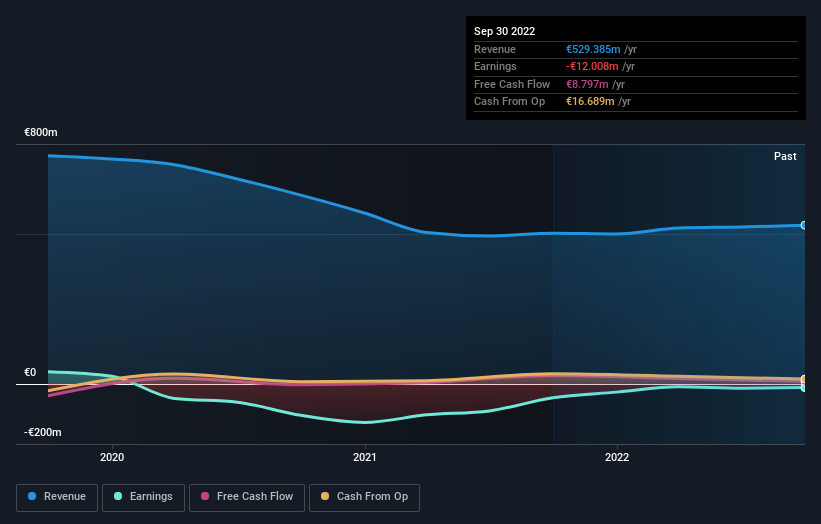

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Take a more thorough look at Kapsch TrafficCom's financial health with this free report on its balance sheet.

What About The Total Shareholder Return (TSR)?

Investors should note that there's a difference between Kapsch TrafficCom's total shareholder return (TSR) and its share price change, which we've covered above. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Dividends have been really beneficial for Kapsch TrafficCom shareholders, and that cash payout explains why its total shareholder loss of 69%, over the last 5 years, isn't as bad as the share price return.

A Different Perspective

We regret to report that Kapsch TrafficCom shareholders are down 19% for the year. Unfortunately, that's worse than the broader market decline of 4.8%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. However, the loss over the last year isn't as bad as the 11% per annum loss investors have suffered over the last half decade. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Even so, be aware that Kapsch TrafficCom is showing 4 warning signs in our investment analysis , and 2 of those don't sit too well with us...

Of course Kapsch TrafficCom may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Austrian exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Kapsch TrafficCom might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WBAG:KTCG

Kapsch TrafficCom

Provides intelligent transportation systems technologies, solutions, and services in Austria, Europe, the Middle East, Africa, the Asia-Pacific, and the Americas.

Undervalued with slight risk.

Similar Companies

Market Insights

Community Narratives