Positive Sentiment Still Eludes AT & S Austria Technologie & Systemtechnik Aktiengesellschaft (VIE:ATS) Following 27% Share Price Slump

AT & S Austria Technologie & Systemtechnik Aktiengesellschaft (VIE:ATS) shareholders that were waiting for something to happen have been dealt a blow with a 27% share price drop in the last month. For any long-term shareholders, the last month ends a year to forget by locking in a 52% share price decline.

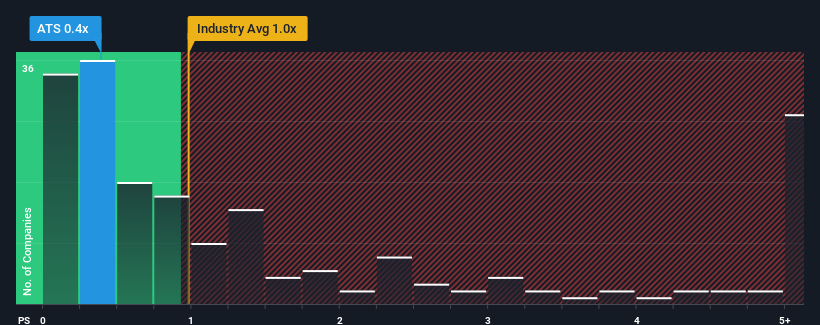

Since its price has dipped substantially, AT & S Austria Technologie & Systemtechnik may be sending buy signals at present with its price-to-sales (or "P/S") ratio of 0.4x, considering almost half of all companies in the Electronic industry in Austria have P/S ratios greater than 1x and even P/S higher than 3x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for AT & S Austria Technologie & Systemtechnik

How AT & S Austria Technologie & Systemtechnik Has Been Performing

AT & S Austria Technologie & Systemtechnik could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on AT & S Austria Technologie & Systemtechnik.How Is AT & S Austria Technologie & Systemtechnik's Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like AT & S Austria Technologie & Systemtechnik's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 6.8% decrease to the company's top line. Regardless, revenue has managed to lift by a handy 22% in aggregate from three years ago, thanks to the earlier period of growth. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Looking ahead now, revenue is anticipated to climb by 26% per year during the coming three years according to the seven analysts following the company. With the industry only predicted to deliver 11% per year, the company is positioned for a stronger revenue result.

In light of this, it's peculiar that AT & S Austria Technologie & Systemtechnik's P/S sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Key Takeaway

AT & S Austria Technologie & Systemtechnik's recently weak share price has pulled its P/S back below other Electronic companies. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

A look at AT & S Austria Technologie & Systemtechnik's revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. There could be some major risk factors that are placing downward pressure on the P/S ratio. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

You need to take note of risks, for example - AT & S Austria Technologie & Systemtechnik has 2 warning signs (and 1 which is a bit unpleasant) we think you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WBAG:ATS

AT & S Austria Technologie & Systemtechnik

Manufactures, distributes, and sells printed circuit boards in Austria, Germany, rest of Europe, China, rest of Asia, and the Americas.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success