- Austria

- /

- Metals and Mining

- /

- WBAG:AMAG

AMAG Austria Metall (WBAG:AMAG) Margin Decline Challenges Case for Premium Valuation

Reviewed by Simply Wall St

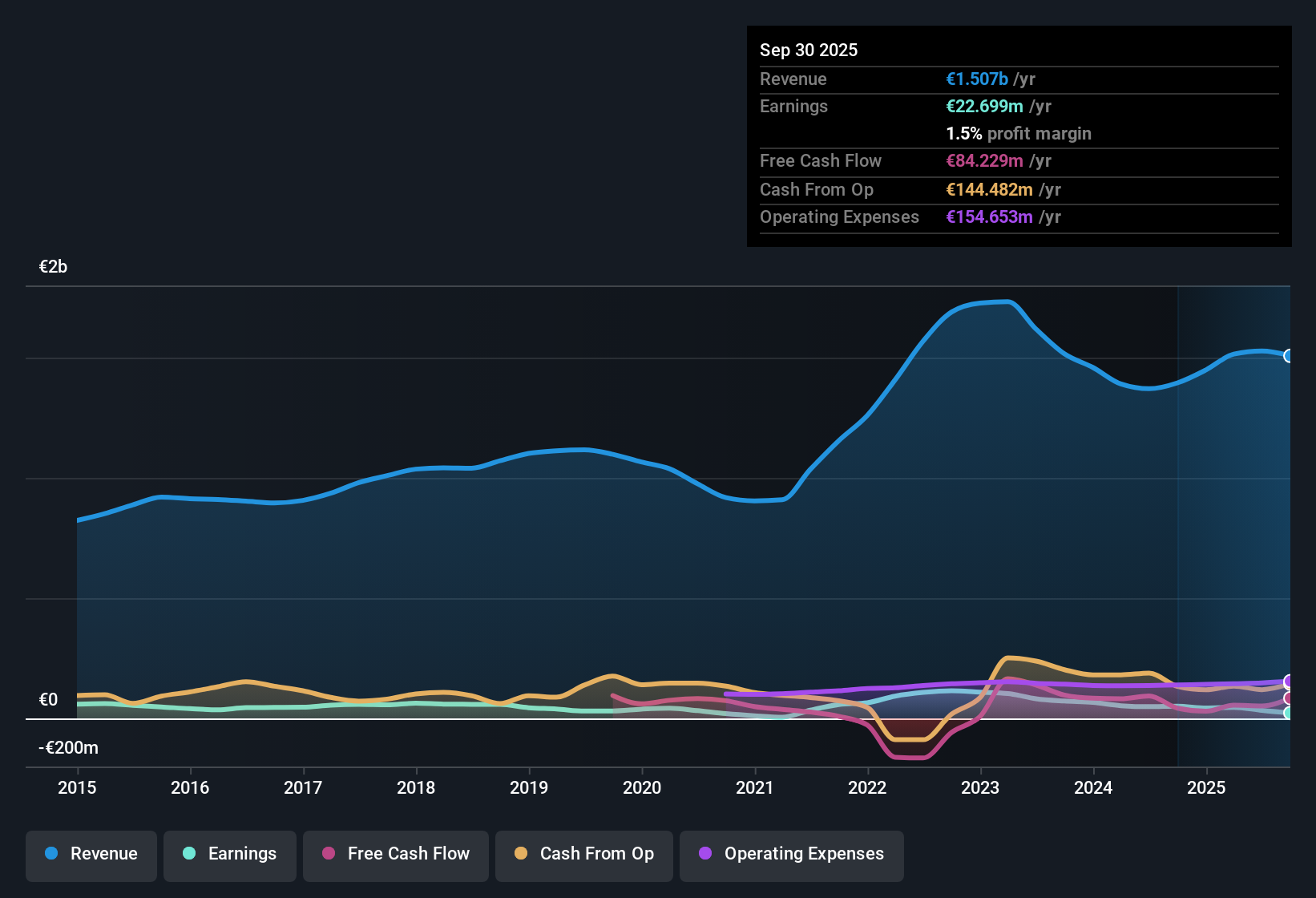

AMAG Austria Metall (WBAG:AMAG) is set to deliver earnings forecast growth of 58% per year, a pace that far exceeds the Austrian market's expected annual growth of 8.8%. Over the past five years, the company’s earnings have grown at a rate of 4.8% per year, though recent results show a net profit margin of 2.2%, down from last year's 3.6%, alongside a Price-to-Earnings Ratio of 25.9x that remains above both peer and industry averages. Investors tracking AMAG this earnings season will be weighing the company’s strong forward growth potential against weaker margins and higher valuation, especially as operational and financial risks remain on the radar.

See our full analysis for AMAG Austria Metall.Next, we will see how the new numbers measure up against the current narratives around AMAG. Some common expectations may be confirmed, while others could be in for a surprise.

See what the community is saying about AMAG Austria Metall

Profit Margin Projected to Nearly Double by 2028

- Analysts expect AMAG’s net profit margin to rise from 2.2% today to 4.2% in three years, indicating a significant recovery ahead despite near-term margin pressure.

- According to the analysts' consensus view, this margin rebound is set against a backdrop of revenue forecasts declining by 1.0% per year:

- This confident outlook hinges on stable long-term power contracts and AMAG’s operational flexibility, which analysts say should support margin improvement even as topline growth remains under strain.

- Consensus also highlights increasing investments in recycling and green technologies, which are expected to strengthen both net margins and ESG-linked capital access, providing a buffer against margin volatility.

Consensus sees margin expansion as a key driver behind the moderate upside in the stock's fair value. Find out why analysts believe AMAG is set up for a turnaround in their full narrative. 📊 Read the full AMAG Austria Metall Consensus Narrative.

PE Ratio Must Fall 32% to Align With Forecasts

- To justify analyst price targets, AMAG would have to trade at a forward PE ratio of 17.7x on the 2028 profit estimate, down from today’s 25.9x. This would represent a significant de-rating compared to both the current peer average (22x) and European metals industry (15.7x).

- Analysts' consensus view notes that while future earnings growth looks strong, the stock’s premium valuation leaves little room for error:

- Any slip in the projected jump in profit margins could make the high multiple harder to sustain, especially with headwinds from tariffs and input costs.

- Consensus narrative also flags that, despite AMAG trading below DCF fair value (€24.4 vs €37.94), analyst price targets remain conservative at €25.6. This suggests the market is unconvinced of imminent multiple expansion.

Tariff and Cost Risks Shadow North America Exposure

- Management confirms that U.S. aluminum tariffs, now at 50%, are having a major negative impact on profitability and revenues, with no clear sign of when these headwinds will ease.

- Analysts' consensus view highlights this risk as a top concern for AMAG:

- Even with the company ramping up its recycling capabilities and securing long-term energy contracts, persistent tariff and cost pressures could restrict both margin and earnings upside over the next several years.

- Consensus also points to the ongoing weakness in core automotive and aerospace sectors as a drag on higher-margin business, challenging AMAG’s ability to offset these headwinds by pivoting to alternative segments.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for AMAG Austria Metall on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have your own interpretation of the figures? Put your perspective into action and create a narrative in just a few minutes. Do it your way

A great starting point for your AMAG Austria Metall research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

AMAG’s premium valuation and reliance on a profit margin turnaround make it vulnerable if projected growth or margin expansion falls short.

If you want more confidence in pricing, use these 832 undervalued stocks based on cash flows to target companies trading at a discount to their expected cash flows right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WBAG:AMAG

AMAG Austria Metall

Engages in the production, processing, and sale of aluminum, aluminum semi-finished, and cast products in Austria, Europe, North America, and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives