- France

- /

- Electric Utilities

- /

- ENXTPA:ELEC

European Dividend Stocks To Consider For Your Portfolio

Reviewed by Simply Wall St

As the European market experiences a mix of relief from the reopening of the U.S. federal government and tempered enthusiasm due to cooling sentiment on artificial intelligence, investors are carefully evaluating their options. In such an environment, dividend stocks can offer a blend of stability and income potential, making them an attractive consideration for those looking to navigate current economic uncertainties.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.46% | ★★★★★★ |

| Telekom Austria (WBAG:TKA) | 4.57% | ★★★★★★ |

| Swiss Re (SWX:SREN) | 4.29% | ★★★★★☆ |

| Sulzer (SWX:SUN) | 3.26% | ★★★★★☆ |

| Holcim (SWX:HOLN) | 4.35% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 5.11% | ★★★★★★ |

| Evolution (OM:EVO) | 4.90% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.32% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.76% | ★★★★★★ |

| Bravida Holding (OM:BRAV) | 4.72% | ★★★★★★ |

Click here to see the full list of 225 stocks from our Top European Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

Aeroporto Guglielmo Marconi di Bologna (BIT:ADB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Aeroporto Guglielmo Marconi di Bologna S.p.A., along with its subsidiaries, is involved in the development, management, and maintenance of an airport in Italy and internationally, with a market cap of €331.63 million.

Operations: Aeroporto Guglielmo Marconi di Bologna S.p.A. generates revenue through its operations in developing, managing, and maintaining an airport both domestically in Italy and on an international scale.

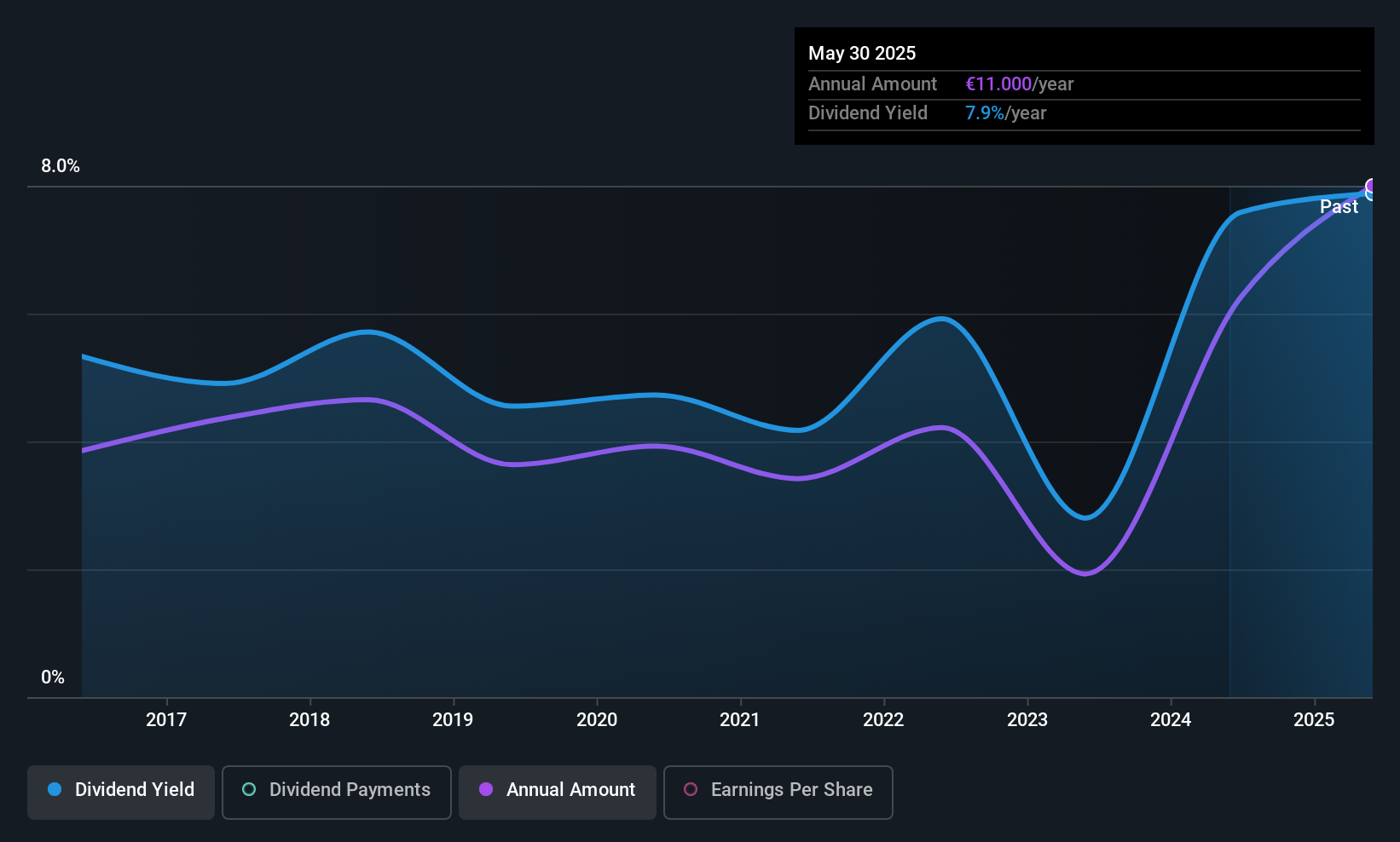

Dividend Yield: 5.1%

Aeroporto Guglielmo Marconi di Bologna offers a 5.13% dividend yield, ranking in the top 25% of Italian dividend payers. However, this yield is not well-supported by free cash flows and has been volatile over the past decade, with significant annual drops. Despite a reasonable payout ratio of 68.7%, earnings are expected to decline by an average of 2.2% annually over the next three years, raising concerns about future dividend sustainability.

- Unlock comprehensive insights into our analysis of Aeroporto Guglielmo Marconi di Bologna stock in this dividend report.

- Our expertly prepared valuation report Aeroporto Guglielmo Marconi di Bologna implies its share price may be too high.

Électricite de Strasbourg Société Anonyme (ENXTPA:ELEC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Électricite de Strasbourg Société Anonyme supplies electricity and natural gas to individuals, businesses, and local authorities in France, with a market cap of €1.24 billion.

Operations: Électricite de Strasbourg Société Anonyme's revenue segments include €329.54 million from electricity and gas distribution and €1.02 billion from the production and marketing of electricity and gas.

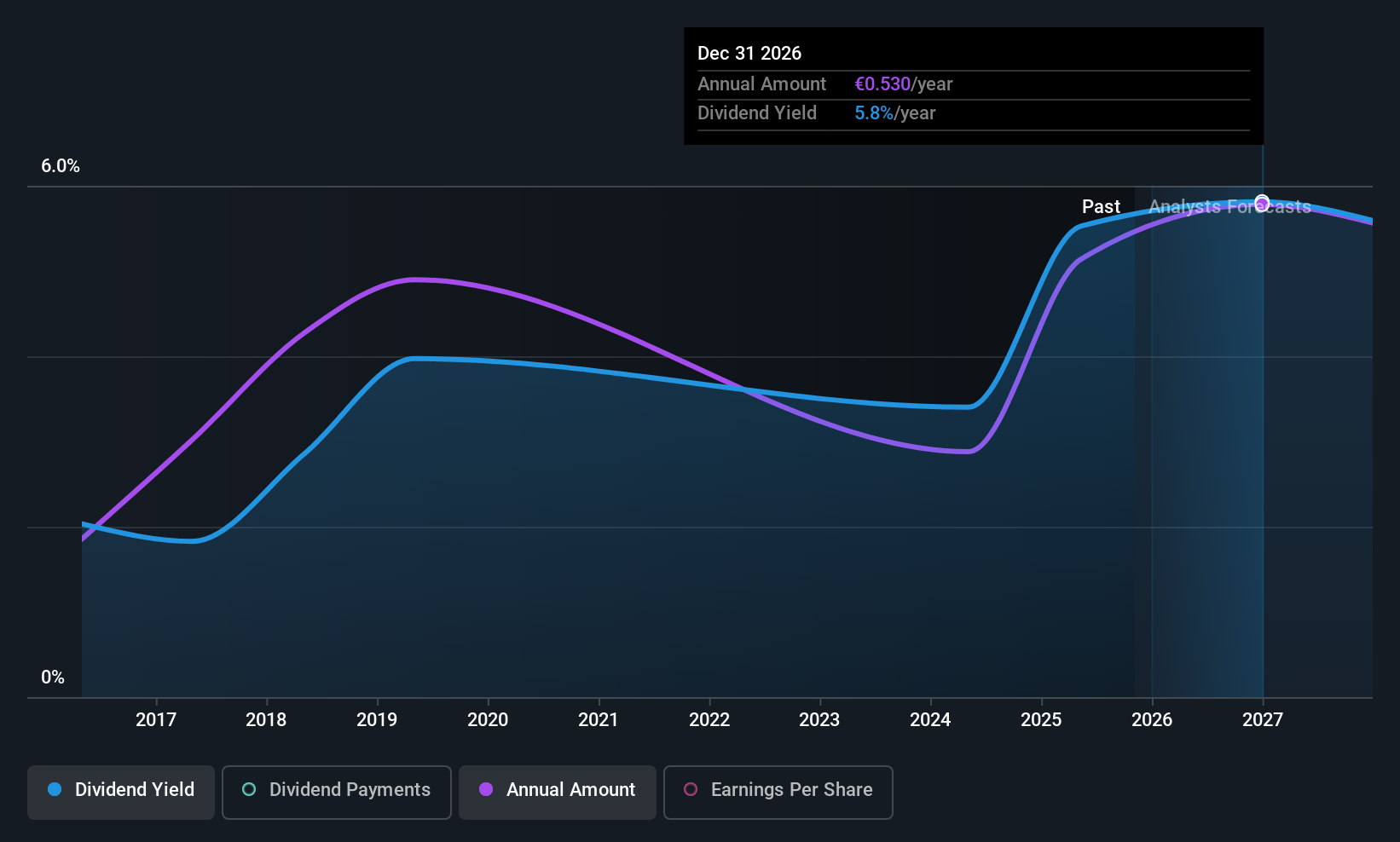

Dividend Yield: 6.4%

Électricité de Strasbourg Société Anonyme offers a dividend yield of 6.38%, placing it in the top quartile of French dividend payers. Despite this attractive yield, the company's dividend history has been volatile over the past decade. However, with a payout ratio of 50.7% and a cash payout ratio of 61.7%, dividends are currently covered by both earnings and cash flows. Recent financials show net income growth to €84.29 million, despite declining sales and revenue figures year-over-year.

- Click here to discover the nuances of Électricite de Strasbourg Société Anonyme with our detailed analytical dividend report.

- The valuation report we've compiled suggests that Électricite de Strasbourg Société Anonyme's current price could be quite moderate.

Vienna Insurance Group (WBAG:VIG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Vienna Insurance Group AG, with a market cap of €5.91 billion, operates through its subsidiaries to offer insurance products and services in Austria and internationally.

Operations: Vienna Insurance Group AG generates revenue through its insurance products and services offered both in Austria and internationally.

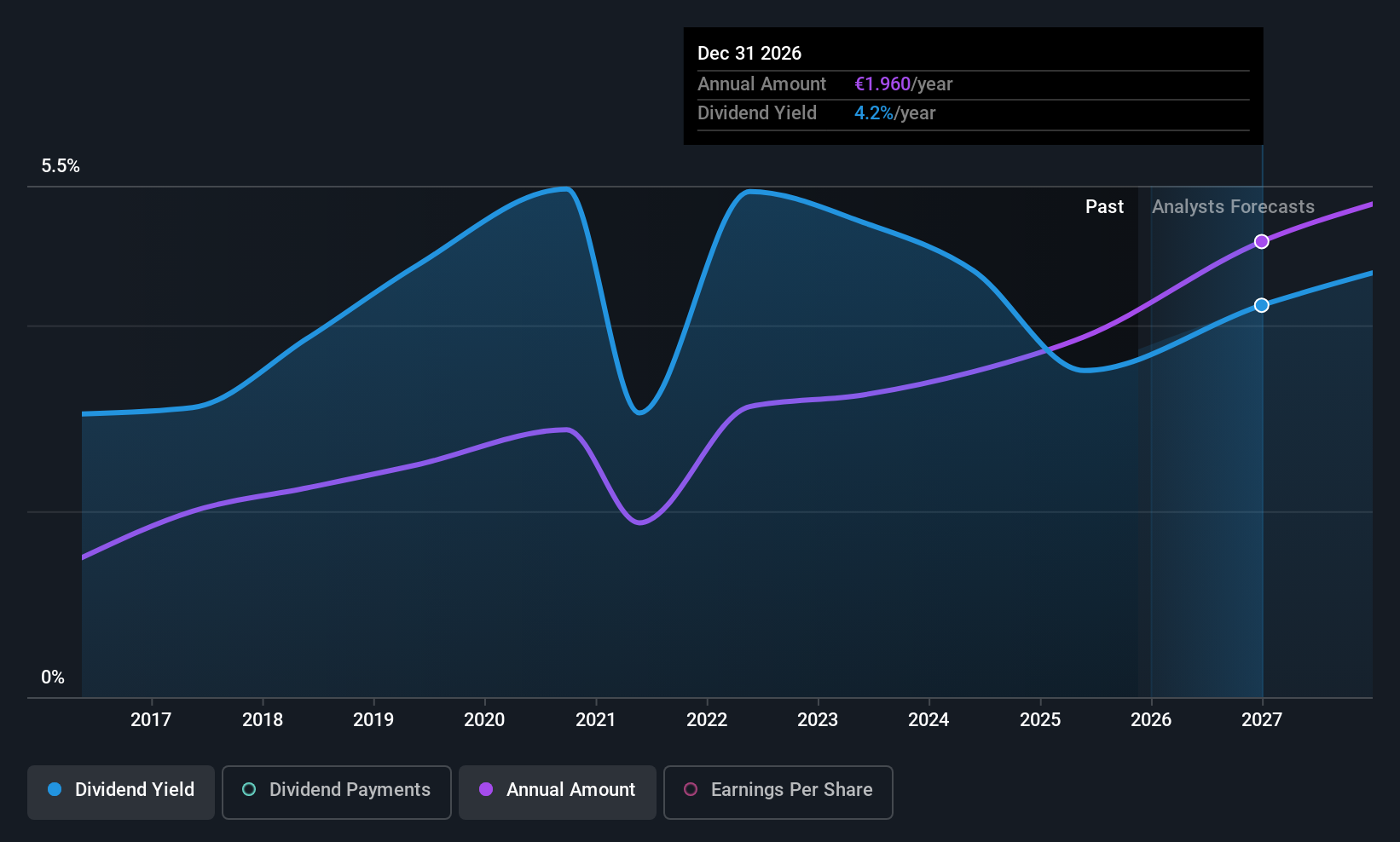

Dividend Yield: 3.4%

Vienna Insurance Group's dividend is covered by earnings and cash flows, with payout ratios of 29.5% and 49.3%, respectively, suggesting sustainability despite a historically volatile dividend track record. Recent earnings growth to €386.74 million for the first half of 2025 highlights profitability, yet its yield of 3.36% falls short compared to top Austrian payers at 4.56%. The stock trades significantly below estimated fair value, indicating potential undervaluation relative to peers and industry standards.

- Navigate through the intricacies of Vienna Insurance Group with our comprehensive dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of Vienna Insurance Group shares in the market.

Seize The Opportunity

- Gain an insight into the universe of 225 Top European Dividend Stocks by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Électricite de Strasbourg Société Anonyme might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ELEC

Électricite de Strasbourg Société Anonyme

Engages in the supply of electricity and natural gas to individuals, businesses, and local authorities in France.

Solid track record with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives