- Austria

- /

- Oil and Gas

- /

- WBAG:OMV

OMV (WBAG:OMV) Valuation in Focus After Recent Share Price Gains

Reviewed by Simply Wall St

OMV (WBAG:OMV) has seen its stock catch some investor attention recently, thanks to a run of gains over the past month. Shares are up 8% in that period, adding to a steady longer-term performance.

See our latest analysis for OMV.

Momentum seems to be building for OMV, with the stock notching an impressive 8% share price return over the past month and a robust 24% gain year-to-date. Looking at the bigger picture, investors holding on through the ups and downs have enjoyed a total shareholder return of nearly 40% over the past year, and more than tripling over five years. These are clear signs that OMV's long-term performance has been rewarding for patient investors.

If recent strength in energy stocks has you thinking about what else could benefit from market momentum, it could be the perfect time to broaden your search and discover fast growing stocks with high insider ownership

The recent surge in OMV's share price raises a crucial question: is there still value to be found, or has the market already factored in the company's future growth prospects?

Most Popular Narrative: 4% Undervalued

OMV's fair value, based on the most widely followed narrative, stands at €49.95, slightly above the last close of €47.76. Recent momentum has put the stock within striking distance of consensus valuations, setting the stage for a closer look at the assumptions supporting this outlook.

OMV's diversified expansion in gas, petrochemicals, and specialty products strengthens revenue stability and cushions earnings from energy market volatility. Investments in renewables, recycling, and international partnerships support long-term profitability and reduce exposure to regulatory and market risks.

Want to know what makes this estimate tick? The secret sauce involves shifting margins, a structural overhaul, and one forward-looking profit projection that might surprise you. The tension between stagnating sales and robust margin optimism is just one twist. Dive into the full narrative for the crucial quantitative leap behind OMV's valuation.

Result: Fair Value of €49.95 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent cost pressures and falling oil and gas output could quickly challenge OMV’s bullish outlook if those trends accelerate from this point.

Find out about the key risks to this OMV narrative.

Another View: What Do Valuation Ratios Say?

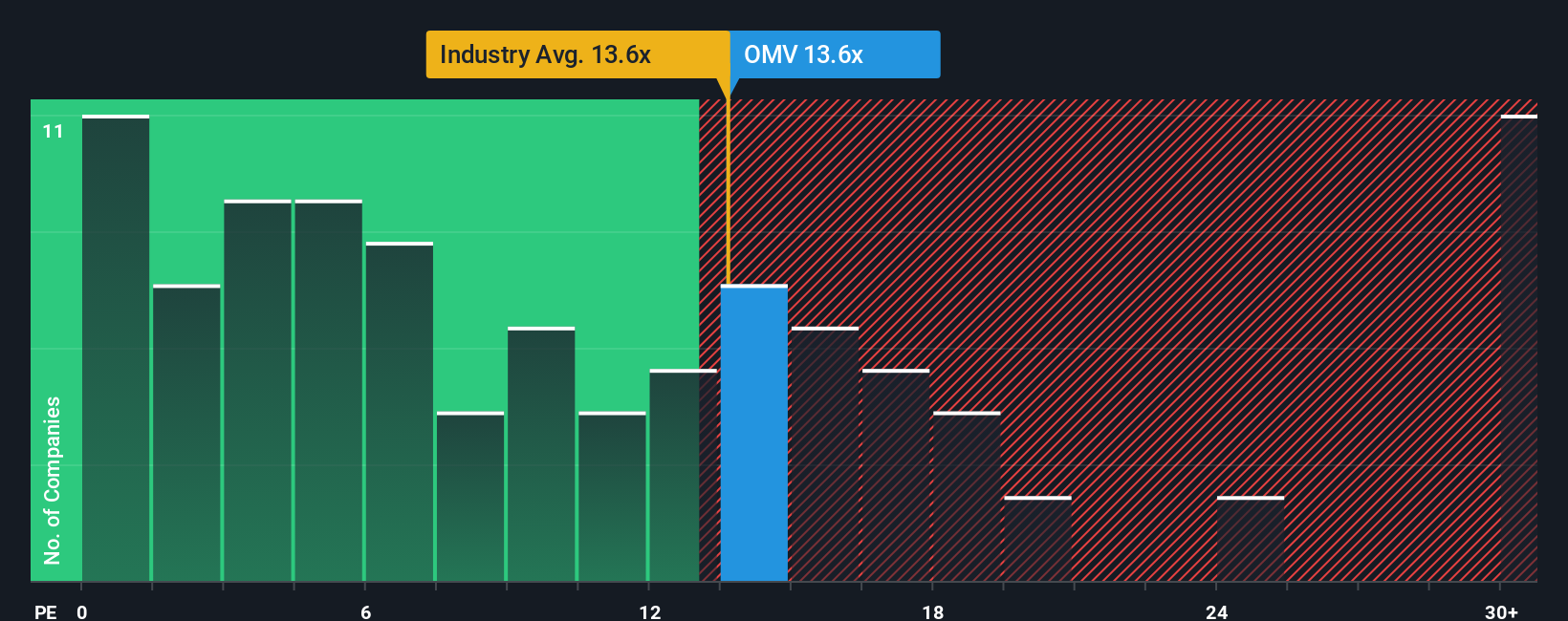

While narrative-based fair value points to OMV as slightly undervalued, the market’s price-to-earnings ratio tells a different story. OMV trades on a ratio of 13.8x, just above both its peer average (12.9x) and the broader industry (13.3x). This signals that, relative to other energy companies, OMV is priced on the higher side. Is this a sign of future confidence, or an indicator that most of the upside has already been captured?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own OMV Narrative

Prefer a different perspective or want to see how your own analysis stacks up? Take just a few minutes to build your own narrative and discover fresh insights. Do it your way

A great starting point for your OMV research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Invest with confidence and ensure you're ahead of the market by zeroing in on stock opportunities others might miss. The right screener could be your edge; do not let tomorrow's winners pass you by.

- Tap into strong, reliable cash flows plus attractive yields. Start your hunt with these 16 dividend stocks with yields > 3% and spot companies rewarding investors with more than just share price gains.

- Uncover unique growth prospects in the healthcare sector by targeting AI-driven medical innovators using these 32 healthcare AI stocks, and see first-hand how AI is transforming patient care.

- Ride the wave of digital financial evolution by jumping into these 82 cryptocurrency and blockchain stocks, where you can pinpoint companies building the next generation of cryptocurrency and blockchain solutions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WBAG:OMV

OMV

Operates as an oil, gas, and chemicals company in Austria, Belgium, Germany, New Zealand, Norway, Romania, the United Arab Emirates, the rest of Central and Eastern Europe, the rest of Europe, and internationally.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives