- Austria

- /

- Commercial Services

- /

- WBAG:DOC

DO & CO (WBAG:DOC): Assessing Valuation After Strong Q2 Earnings and Revenue Growth

Reviewed by Simply Wall St

DO & CO (WBAG:DOC) released earnings showing higher sales and net income for the second quarter and six months ended September 30, 2025, compared with the previous year. This drew attention from investors and the market.

See our latest analysis for DO & CO.

While investors cheered DO & CO’s strong quarterly results, the share price has been on a volatile ride lately, surging 5.5% in a single day but still down 16.4% over the past month. Despite these swings, shareholders have seen a 12.1% total return over the past year and an impressive 257% total return over five years. This underscores both enduring growth and some short-term uncertainty.

If you’re interested in discovering what else is capturing the market’s attention, now’s a great time to broaden your search and discover fast growing stocks with high insider ownership

With shares still down over the past month despite strong long-term gains and robust recent earnings, the big question for investors is whether DO & CO is trading at an attractive discount or if future growth is already reflected in the price.

Price-to-Earnings of 19.5x: Is it justified?

DO & CO is currently trading at a price-to-earnings (P/E) ratio of 19.5x, which stands out against both industry and peer averages. Based on this figure, the company's shares appear relatively expensive in comparison to the wider European Commercial Services space.

The price-to-earnings ratio measures how much investors are paying for each euro of earnings. It is a common tool for valuing service-oriented businesses like DO & CO, as earnings power is central to the business model and long-term performance prospects.

With a P/E of 19.5x, DO & CO’s shares cost substantially more per euro of earnings than the European Commercial Services industry average of 13.2x. This signals a market expectation for stronger growth or higher profitability. However, compared to its own peer group, where the average is 30.5x, DO & CO actually appears more reasonably valued, suggesting that its valuation premium may be well-earned given past profitability and earnings momentum.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 19.5x (ABOUT RIGHT)

However, macroeconomic uncertainties and potential shifts in demand could impact DO & CO’s growth outlook. This may challenge current market optimism.

Find out about the key risks to this DO & CO narrative.

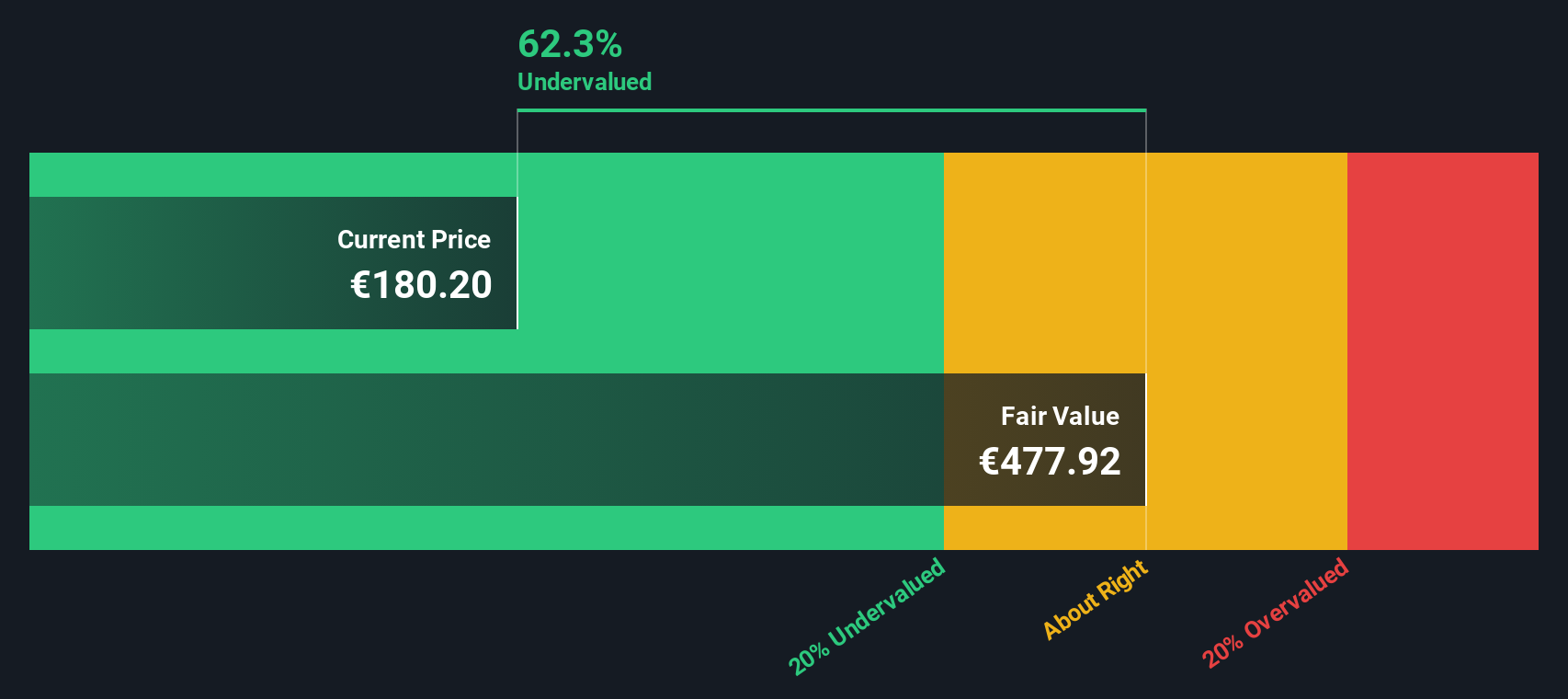

Another View: SWS DCF Model Points to Deep Discount

Looking at valuation from a different angle, our DCF model suggests DO & CO’s shares are trading well below intrinsic value. The current price is €180.20, while our fair value estimate is €477.64, indicating the stock could be undervalued by a significant margin. Could the market be missing something?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out DO & CO for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 898 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own DO & CO Narrative

If you see things differently or want to dive deeper, it’s easy to analyze the data and shape your own narrative with just a few clicks. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding DO & CO.

Looking for more investment ideas?

Don’t watch opportunity pass you by. The Simply Wall Street Screener lets you spot powerful trends and promising stocks before everyone else.

- Unlock hidden value by reviewing these 898 undervalued stocks based on cash flows for companies whose strong cash flows could mean big upside potential.

- Benefit from stable income streams as you browse these 15 dividend stocks with yields > 3%, featuring stocks with attractive yields above 3%.

- Capitalize on new tech frontiers with these 26 quantum computing stocks and see which players are shaping tomorrow’s computing landscape.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WBAG:DOC

DO & CO

Provides catering services in Austria, Turkey, Great Britain, the United States, Spain, Germany, and internationally.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives