David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. As with many other companies Strabag SE (VIE:STR) makes use of debt. But the more important question is: how much risk is that debt creating?

When Is Debt Dangerous?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for Strabag

How Much Debt Does Strabag Carry?

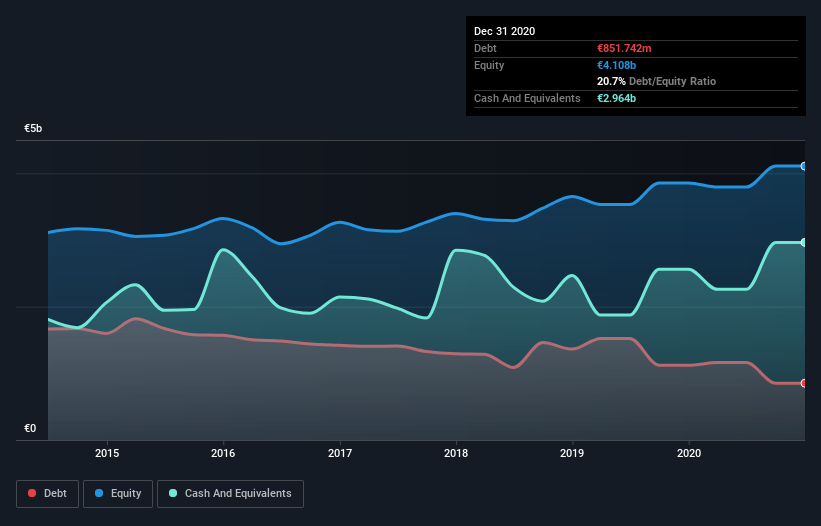

You can click the graphic below for the historical numbers, but it shows that Strabag had €851.7m of debt in December 2020, down from €1.12b, one year before. However, its balance sheet shows it holds €2.96b in cash, so it actually has €2.11b net cash.

How Strong Is Strabag's Balance Sheet?

We can see from the most recent balance sheet that Strabag had liabilities of €5.64b falling due within a year, and liabilities of €2.38b due beyond that. Offsetting this, it had €2.96b in cash and €2.83b in receivables that were due within 12 months. So it has liabilities totalling €2.23b more than its cash and near-term receivables, combined.

This deficit is considerable relative to its market capitalization of €3.49b, so it does suggest shareholders should keep an eye on Strabag's use of debt. This suggests shareholders would be heavily diluted if the company needed to shore up its balance sheet in a hurry. While it does have liabilities worth noting, Strabag also has more cash than debt, so we're pretty confident it can manage its debt safely.

On the other hand, Strabag saw its EBIT drop by 2.9% in the last twelve months. That sort of decline, if sustained, will obviously make debt harder to handle. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Strabag's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. While Strabag has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. Over the last three years, Strabag actually produced more free cash flow than EBIT. That sort of strong cash conversion gets us as excited as the crowd when the beat drops at a Daft Punk concert.

Summing up

Although Strabag's balance sheet isn't particularly strong, due to the total liabilities, it is clearly positive to see that it has net cash of €2.11b. The cherry on top was that in converted 115% of that EBIT to free cash flow, bringing in €829m. So we are not troubled with Strabag's debt use. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. Be aware that Strabag is showing 2 warning signs in our investment analysis , and 1 of those doesn't sit too well with us...

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About WBAG:STR

Flawless balance sheet, undervalued and pays a dividend.