Andritz (WBAG:ANDR) Valuation Discount Reinforces Bullish Narrative Ahead of Earnings Season

Reviewed by Simply Wall St

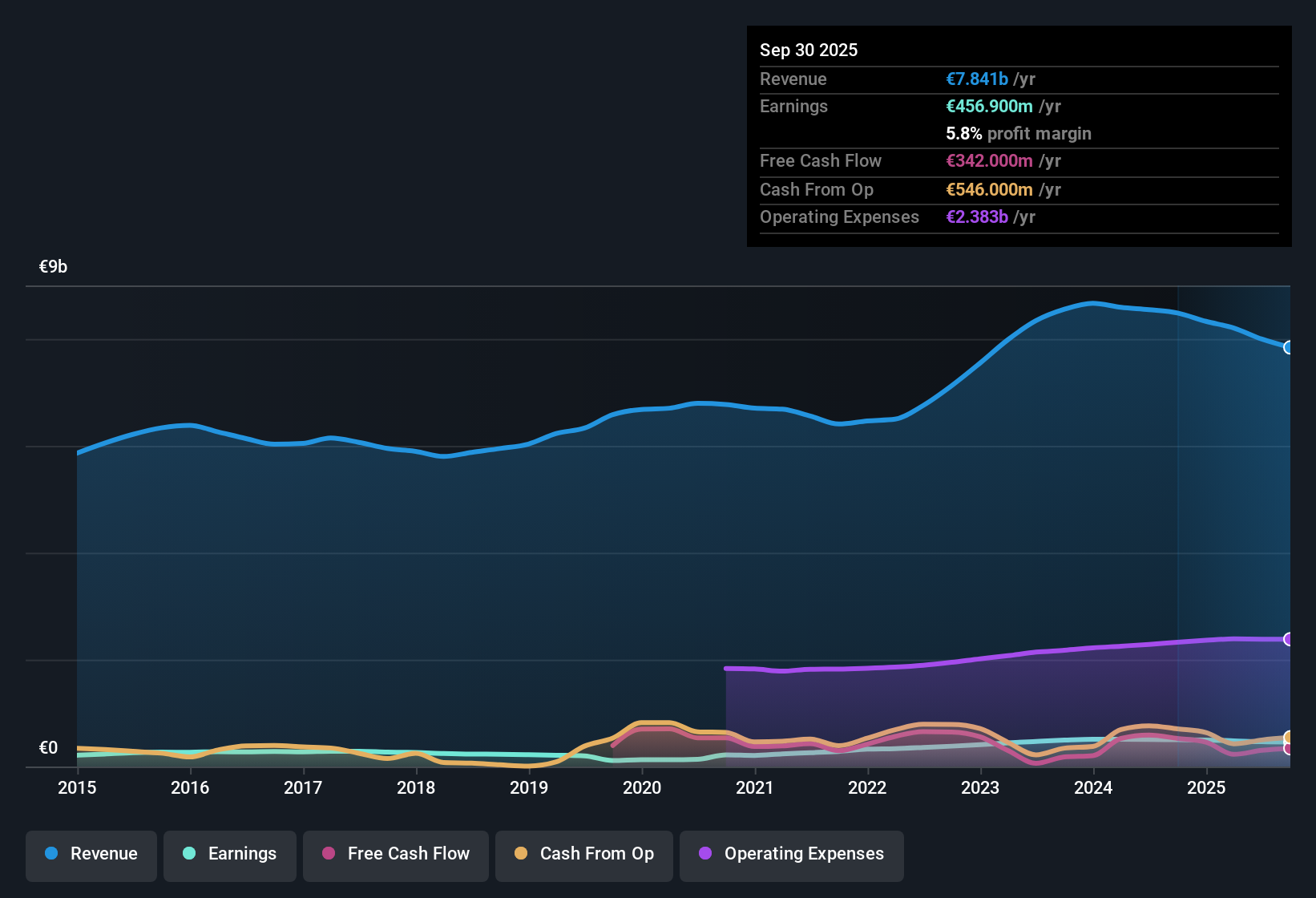

Andritz (WBAG:ANDR) delivered 17.3% annual earnings growth over the past five years, and future forecasts call for a continued pace of 13% per year. This outpaces the Austrian market's 8.8% growth. Revenue is also set to grow at 7% annually compared to the local benchmark of 3.2%. Current net profit margins stand at 5.8%, a touch below last year's 5.9%. With shares trading at €65.6, below an estimated fair value of €126.66, investors may see the company's attractive valuation and sustained profit and revenue growth as key positives despite minor concerns around dividend sustainability.

See our full analysis for Andritz.The next step is to see how these results measure up to the widely held narratives. Some expectations may be confirmed, while others could be up for debate.

See what the community is saying about Andritz

Order Backlog Hits €10.4 Billion Milestone

- Andritz’s order backlog reached a record €10.4 billion, bolstered by strong intake in Hydropower (up 26% in Q2), Metals, and a rebounding Pulp & Paper segment.

- According to the analysts' consensus view, this surge in orders directly supports confidence in future revenue and margin growth, especially as macro trends like decarbonization and infrastructure renewal continue to drive demand.

- The backlog provides greater revenue visibility and should help mitigate short-term dips in cyclical markets by spreading execution across business lines.

- A larger share of recurring service revenue, now at 44%, is expected to increase resilience and help sustain profitability even when project-based revenues fluctuate.

Margins Face Headwinds from Restructuring and FX

- Current net profit margins stand at 5.8%, just below last year’s 5.9%, as recent restructuring in Pulp & Paper and Metals and unfavorable FX movements weighed on reported performance.

- The consensus narrative flags that despite cost controls, margin recovery could be delayed by operational inefficiencies and currency swings.

- Execution risk remains in these divisions, as additional restructuring charges and market uncertainty could limit near-term gains until end-market demand firmly returns.

- Margin improvement assumptions rely on normalization post-restructuring and a more stable euro, neither of which are guaranteed given current trends.

Valuation Still Attractive vs. Peers

- Andritz trades at a Price-To-Earnings ratio of 13.8x, well below the European Machinery industry average of 20.1x and peer average of 20.6x, with its €65.60 share price still a steep discount to the DCF fair value of €126.66.

- The analysts' consensus view anchors its optimistic price target (71.11, or 8.4% above today’s close) in forecasts for profit margins rising to 7.1% by 2028 and ongoing revenue growth outpacing the broader market.

- This valuation gap supports the idea that the market may be underappreciating the company's capacity for future earnings expansion, even as some analyst forecasts remain cautious.

- With a forward PE projection of 11.9x for 2028, still below industry norms, there is room for multiple expansion if execution aligns with consensus expectations.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Andritz on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Think you interpret the figures another way? Share your take in just a few minutes and make your personal mark on the story. Do it your way

A great starting point for your Andritz research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Andritz’s near-term outlook is clouded by margin pressures from restructuring and currency swings, which raises questions about the consistency of its earnings growth.

If choppy results concern you, use our stable growth stocks screener (2103 results) to zero in on companies delivering steady performance and resilience no matter the cycle.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WBAG:ANDR

Andritz

Engages in the provision of industrial machinery, equipment, and services in Europe, North America, South America, China, Asia, Africa, Australia, and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives