Cautious Investors Not Rewarding PIERER Mobility AG's (VIE:PKTM) Performance Completely

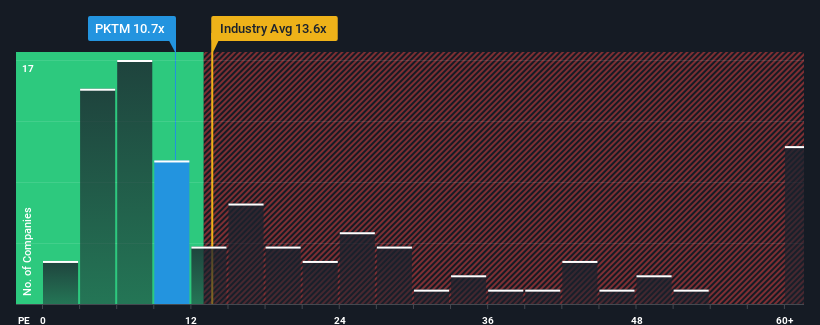

There wouldn't be many who think PIERER Mobility AG's (VIE:PKTM) price-to-earnings (or "P/E") ratio of 10.7x is worth a mention when the median P/E in Austria is similar at about 9x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

PIERER Mobility has been doing a good job lately as it's been growing earnings at a solid pace. One possibility is that the P/E is moderate because investors think this respectable earnings growth might not be enough to outperform the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Check out our latest analysis for PIERER Mobility

How Is PIERER Mobility's Growth Trending?

There's an inherent assumption that a company should be matching the market for P/E ratios like PIERER Mobility's to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 29% last year. The latest three year period has also seen an excellent 200% overall rise in EPS, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing earnings over that time.

Weighing the recent medium-term upward earnings trajectory against the broader market's one-year forecast for contraction of 0.7% shows it's a great look while it lasts.

With this information, we find it odd that PIERER Mobility is trading at a fairly similar P/E to the market. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

The Key Takeaway

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that PIERER Mobility currently trades on a lower than expected P/E since its recent three-year earnings growth is beating forecasts for a struggling market. There could be some unobserved threats to earnings preventing the P/E ratio from matching this positive performance. One major risk is whether its earnings trajectory can keep outperforming under these tough market conditions. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

There are also other vital risk factors to consider before investing and we've discovered 3 warning signs for PIERER Mobility that you should be aware of.

You might be able to find a better investment than PIERER Mobility. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WBAG:PKTM

PIERER Mobility

Operates as a motorcycle manufacturer in Europe, North America, Mexico, and internationally.

Low risk with imperfect balance sheet.

Market Insights

Community Narratives