- Turkey

- /

- Transportation

- /

- IBSE:METRO

Middle Eastern Penny Stocks: 3 Picks With Market Caps Larger Than US$100M

Reviewed by Simply Wall St

The Middle Eastern stock markets have recently faced challenges, with UAE shares experiencing declines due to weaker oil prices and uncertainties surrounding interest rate cuts. Despite these headwinds, the region continues to offer intriguing investment opportunities, particularly in the realm of penny stocks. While the term 'penny stocks' might seem outdated, these smaller or newer companies can still provide significant growth potential when backed by solid financials and strong fundamentals.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Thob Al Aseel (SASE:4012) | SAR3.38 | SAR1.35B | ✅ 2 ⚠️ 1 View Analysis > |

| Alarum Technologies (TASE:ALAR) | ₪3.707 | ₪265.77M | ✅ 4 ⚠️ 2 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.01 | AED2.04B | ✅ 3 ⚠️ 3 View Analysis > |

| Sharjah Insurance Company P.S.C (ADX:SICO) | AED1.49 | AED225M | ✅ 2 ⚠️ 2 View Analysis > |

| Al Wathba National Insurance Company PJSC (ADX:AWNIC) | AED3.50 | AED724.5M | ✅ 2 ⚠️ 3 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED2.95 | AED340.73M | ✅ 2 ⚠️ 5 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED3.24 | AED13.73B | ✅ 3 ⚠️ 3 View Analysis > |

| Union Properties (DFM:UPP) | AED0.797 | AED2.29B | ✅ 2 ⚠️ 2 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.81 | AED492.69M | ✅ 2 ⚠️ 1 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.70 | ₪211.95M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 78 stocks from our Middle Eastern Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Sharjah Cement and Industrial Development (PJSC) operates in the cement and industrial sector, with a market capitalization of AED492.69 million.

Operations: The company's revenue segment is derived entirely from its manufacturing operations, totaling AED735.05 million.

Market Cap: AED492.69M

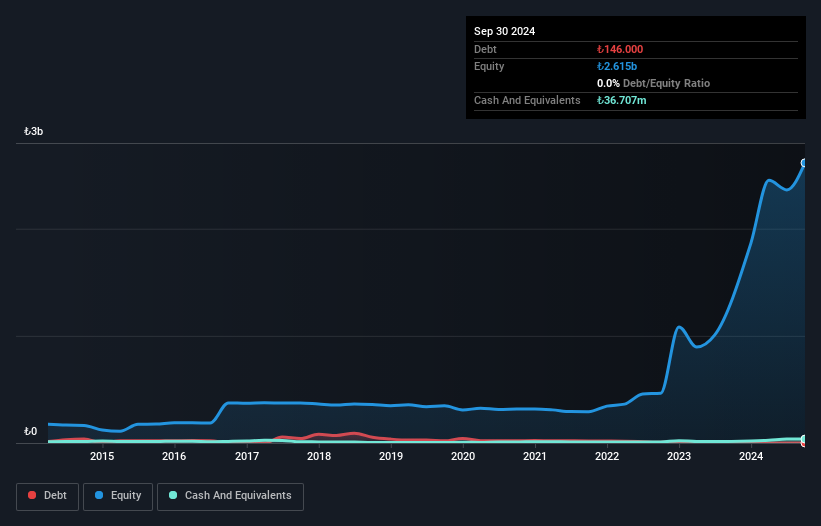

Sharjah Cement and Industrial Development (PJSC) has demonstrated robust financial performance with its recent earnings report showing a significant increase in net income to AED 21.15 million for Q3 2025, up from AED 11.87 million the previous year. The company maintains a satisfactory net debt to equity ratio of 22.9% and has high-quality earnings with well-covered interest payments by EBIT at 17.3 times coverage. Despite low return on equity at 5%, the company’s short-term assets comfortably cover both short- and long-term liabilities, indicating strong liquidity management amidst stable weekly volatility of 3%.

- Dive into the specifics of Sharjah Cement and Industrial Development (PJSC) here with our thorough balance sheet health report.

- Review our historical performance report to gain insights into Sharjah Cement and Industrial Development (PJSC)'s track record.

Metro Ticari ve Mali Yatirimlar Holding (IBSE:METRO)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Metro Ticari ve Mali Yatirimlar Holding A.S. operates as a diversified investment company with various business interests, and it has a market cap of TRY2.59 billion.

Operations: No specific revenue segments are reported for this diversified investment entity.

Market Cap: TRY2.59B

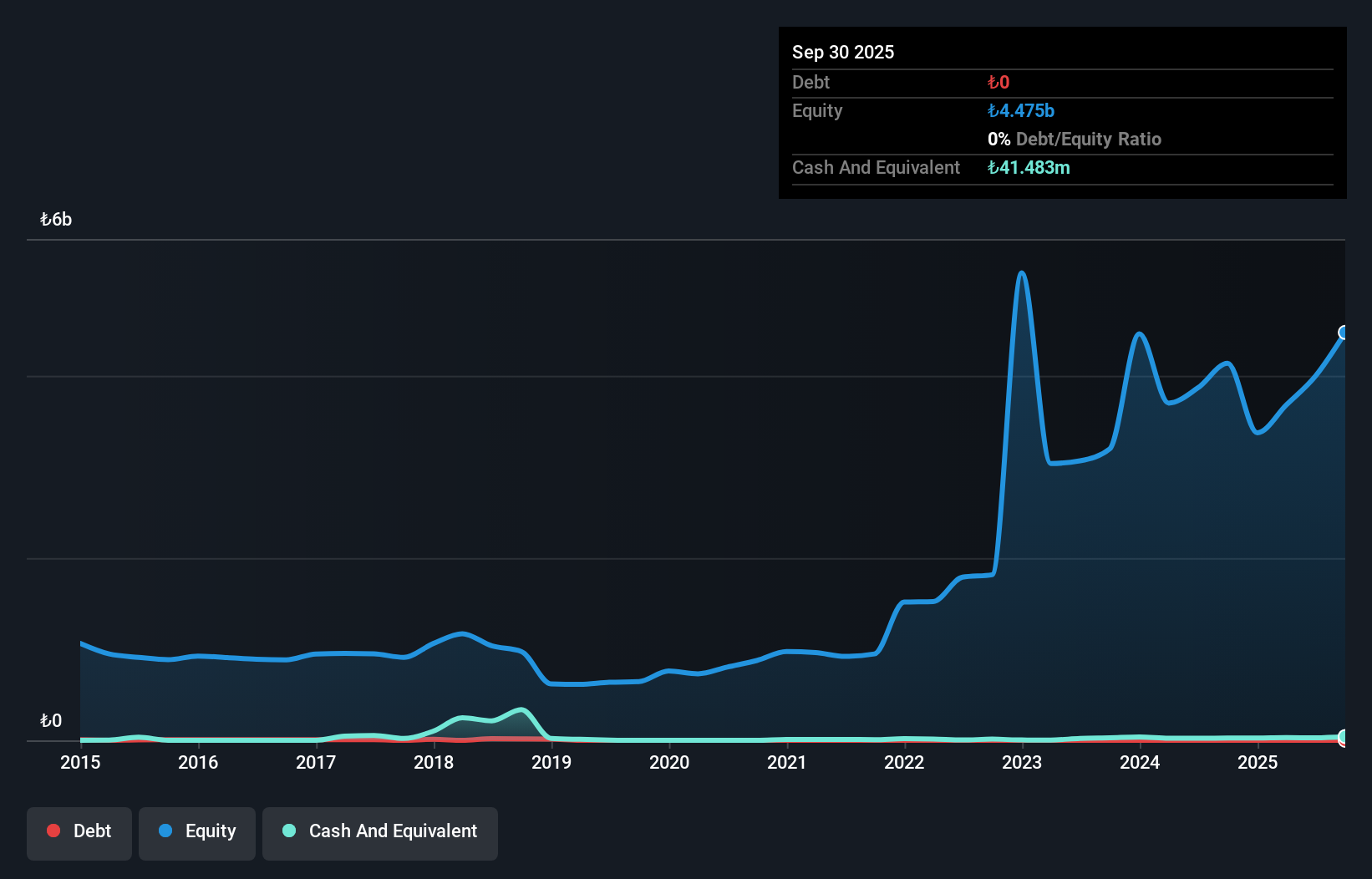

Metro Ticari ve Mali Yatirimlar Holding A.S. has recently reported a turnaround in its financial performance, achieving a net income of TRY 176.84 million for Q3 2025 compared to a net loss the previous year. Despite this improvement, the company remains pre-revenue with less than US$1 million in revenue and is currently unprofitable with negative return on equity. Metro's debt-free status and sufficient cash runway for over three years provide some stability; however, its short-term assets fall short of covering long-term liabilities, highlighting potential liquidity challenges amidst high share price volatility. The board is experienced but management tenure data is insufficient to assess leadership effectiveness fully.

- Click here and access our complete financial health analysis report to understand the dynamics of Metro Ticari ve Mali Yatirimlar Holding.

- Understand Metro Ticari ve Mali Yatirimlar Holding's track record by examining our performance history report.

Yesil Yapi Endüstrisi (IBSE:YYAPI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Yesil Yapi Endüstrisi A.S. is a construction company operating in Türkiye and internationally, with a market cap of TRY2.03 billion.

Operations: There are no reported revenue segments for this construction company operating in Türkiye and internationally.

Market Cap: TRY2.03B

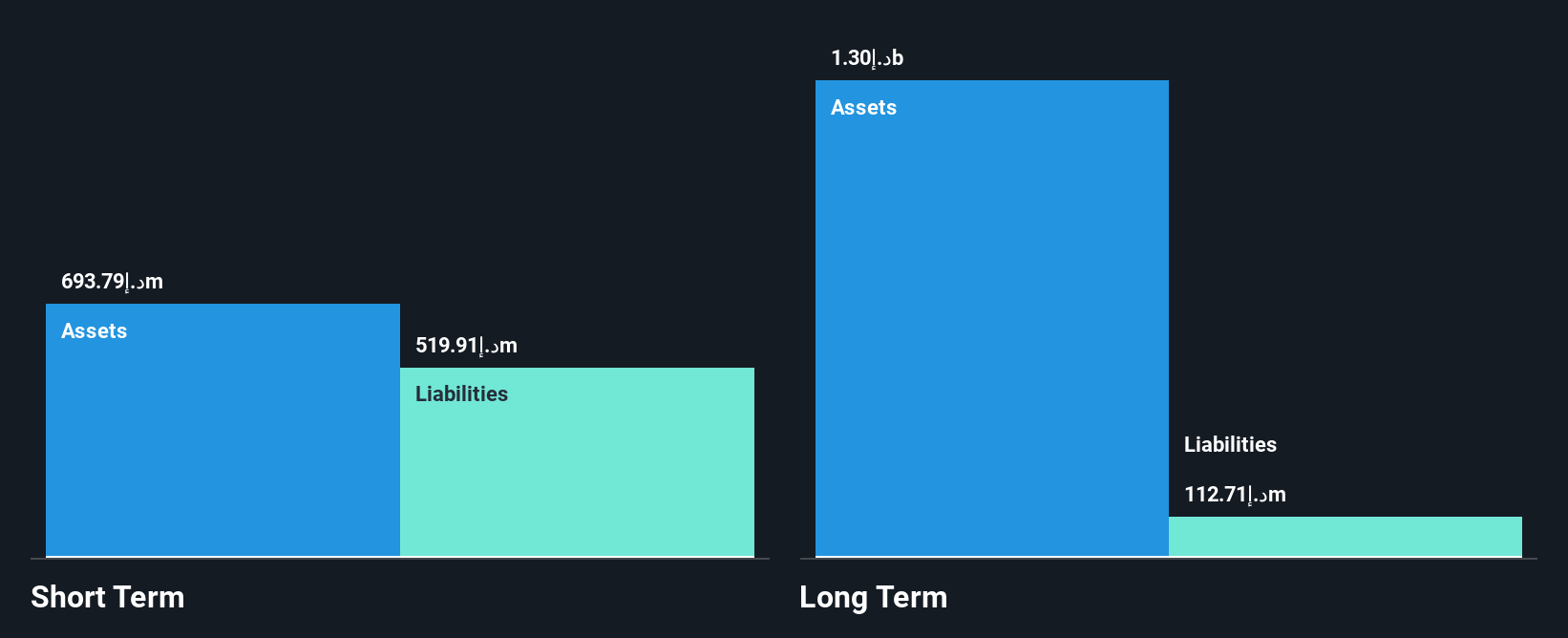

Yesil Yapi Endüstrisi A.S. has demonstrated a significant improvement in profitability, with net income rising substantially despite sales declining to TRY 2.39 million for Q3 2025, indicating it is pre-revenue. The company maintains financial stability with more cash than total debt and a reduced debt-to-equity ratio of 0.01%. Its short-term assets of TRY1.3 billion comfortably cover both short-term and long-term liabilities, although negative operating cash flow suggests challenges in covering debt through cash generation alone. Despite high non-cash earnings contributing to profitability, the stock remains highly volatile with low return on equity and negative recent earnings growth compared to industry averages.

- Click here to discover the nuances of Yesil Yapi Endüstrisi with our detailed analytical financial health report.

- Assess Yesil Yapi Endüstrisi's previous results with our detailed historical performance reports.

Where To Now?

- Dive into all 78 of the Middle Eastern Penny Stocks we have identified here.

- Curious About Other Options? AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:METRO

Metro Ticari ve Mali Yatirimlar Holding

Metro Ticari ve Mali Yatirimlar Holding A.S.

Excellent balance sheet with slight risk.

Market Insights

Community Narratives