- United Arab Emirates

- /

- Basic Materials

- /

- ADX:EMSTEEL

Sentiment Still Eluding Ensteel Building Materials PJSC (ADX:EMSTEEL)

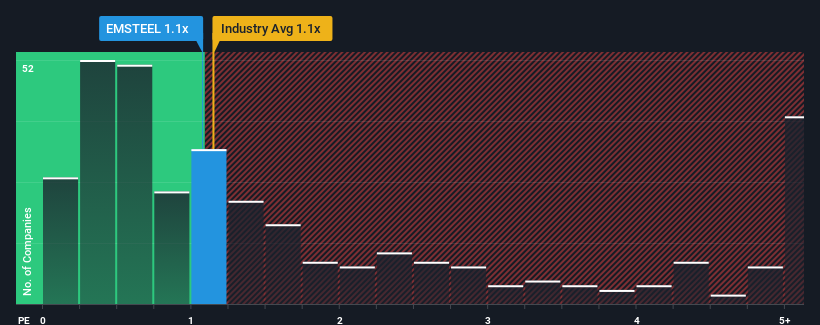

It's not a stretch to say that Ensteel Building Materials PJSC's (ADX:EMSTEEL) price-to-sales (or "P/S") ratio of 1.1x right now seems quite "middle-of-the-road" for companies in the Basic Materials industry in the United Arab Emirates, where the median P/S ratio is around 1.5x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Ensteel Building Materials PJSC

What Does Ensteel Building Materials PJSC's P/S Mean For Shareholders?

For instance, Ensteel Building Materials PJSC's receding revenue in recent times would have to be some food for thought. Perhaps investors believe the recent revenue performance is enough to keep in line with the industry, which is keeping the P/S from dropping off. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Ensteel Building Materials PJSC will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The P/S?

In order to justify its P/S ratio, Ensteel Building Materials PJSC would need to produce growth that's similar to the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 7.7%. The latest three year period has seen an incredible overall rise in revenue, a stark contrast to the last 12 months. Accordingly, shareholders will be pleased, but also have some serious questions to ponder about the last 12 months.

Comparing that to the industry, which is only predicted to deliver 0.9% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised revenue results.

With this information, we find it interesting that Ensteel Building Materials PJSC is trading at a fairly similar P/S compared to the industry. It may be that most investors are not convinced the company can maintain its recent growth rates.

The Key Takeaway

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We didn't quite envision Ensteel Building Materials PJSC's P/S sitting in line with the wider industry, considering the revenue growth over the last three-year is higher than the current industry outlook. There could be some unobserved threats to revenue preventing the P/S ratio from matching this positive performance. At least the risk of a price drop looks to be subdued if recent medium-term revenue trends continue, but investors seem to think future revenue could see some volatility.

The company's balance sheet is another key area for risk analysis. Our free balance sheet analysis for Ensteel Building Materials PJSC with six simple checks will allow you to discover any risks that could be an issue.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if EMSTEEL Building Materials PJSC might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ADX:EMSTEEL

EMSTEEL Building Materials PJSC

Engages in the operation, trading, and investing in industrial projects and commercial business involved in the building materials and steel sectors primarily in the United Arab Emirates.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives