- United Arab Emirates

- /

- Basic Materials

- /

- ADX:BILDCO

While shareholders of Abu Dhabi National Company for Building Materials PJSC (ADX:BILDCO) are in the black over 1 year, those who bought a week ago aren't so fortunate

It might be of some concern to shareholders to see the Abu Dhabi National Company for Building Materials PJSC (ADX:BILDCO) share price down 20% in the last month. But that doesn't detract from the splendid returns of the last year. During that period, the share price soared a full 156%. So it is important to view the recent reduction in price through that lense. More important, going forward, is how the business itself is going.

In light of the stock dropping 10% in the past week, we want to investigate the longer term story, and see if fundamentals have been the driver of the company's positive one-year return.

Check out our latest analysis for Abu Dhabi National Company for Building Materials PJSC

Abu Dhabi National Company for Building Materials PJSC isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally hope to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Abu Dhabi National Company for Building Materials PJSC grew its revenue by 54% last year. That's a head and shoulders above most loss-making companies. Meanwhile, the market has paid attention, sending the share price soaring 156% in response. That sort of revenue growth is bound to attract attention, even if the company doesn't turn a profit. Given the positive sentiment around the stock we're cautious, but there's no doubt its worth watching.

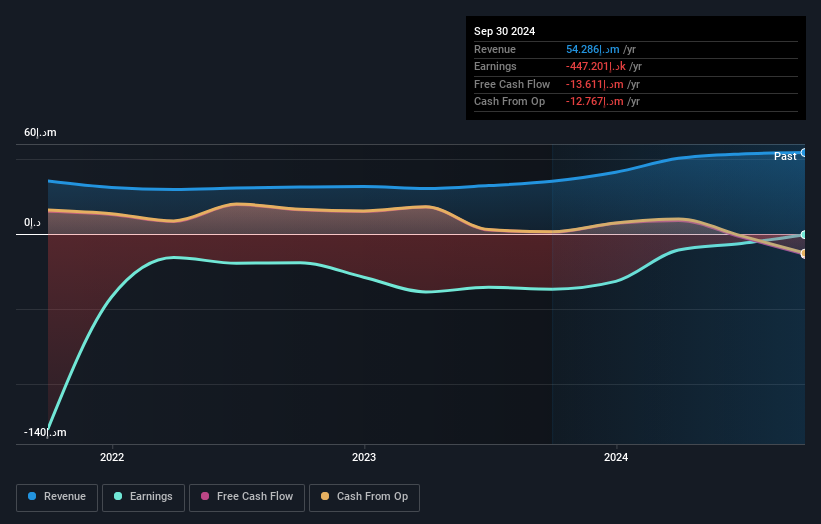

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

We're pleased to report that Abu Dhabi National Company for Building Materials PJSC shareholders have received a total shareholder return of 156% over one year. That's better than the annualised return of 13% over half a decade, implying that the company is doing better recently. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 2 warning signs for Abu Dhabi National Company for Building Materials PJSC you should be aware of, and 1 of them can't be ignored.

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Emirian exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ADX:BILDCO

Abu Dhabi National Company for Building Materials PJSC

Through its subsidiaries, provides steel and cement products in the United Arab Emirates.

Mediocre balance sheet with weak fundamentals.

Market Insights

Community Narratives