- United Arab Emirates

- /

- Oil and Gas

- /

- ADX:ADNOCGAS

ADNOC Gas PLC (ADX:ADNOCGAS) Investors Are Less Pessimistic Than Expected

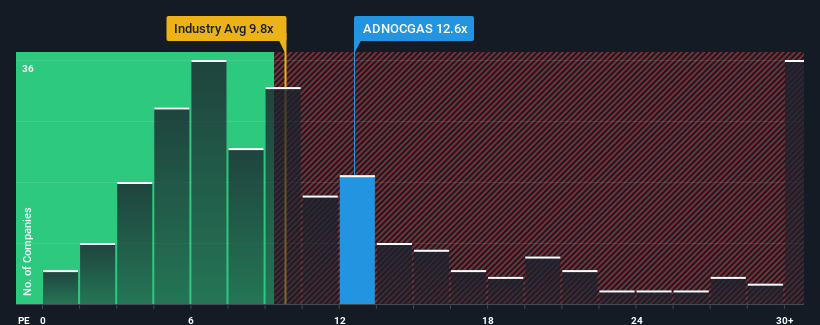

There wouldn't be many who think ADNOC Gas PLC's (ADX:ADNOCGAS) price-to-earnings (or "P/E") ratio of 12.6x is worth a mention when the median P/E in the United Arab Emirates is similar at about 13x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Recent earnings growth for ADNOC Gas has been in line with the market. It seems that many are expecting the mediocre earnings performance to persist, which has held the P/E back. If this is the case, then at least existing shareholders won't be losing sleep over the current share price.

View our latest analysis for ADNOC Gas

How Is ADNOC Gas' Growth Trending?

The only time you'd be comfortable seeing a P/E like ADNOC Gas' is when the company's growth is tracking the market closely.

Retrospectively, the last year delivered a decent 7.3% gain to the company's bottom line. This was backed up an excellent period prior to see EPS up by 39% in total over the last three years. So we can start by confirming that the company has done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 0.6% each year during the coming three years according to the ten analysts following the company. That's shaping up to be materially lower than the 7.8% per year growth forecast for the broader market.

In light of this, it's curious that ADNOC Gas' P/E sits in line with the majority of other companies. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

The Final Word

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that ADNOC Gas currently trades on a higher than expected P/E since its forecast growth is lower than the wider market. Right now we are uncomfortable with the P/E as the predicted future earnings aren't likely to support a more positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Having said that, be aware ADNOC Gas is showing 1 warning sign in our investment analysis, you should know about.

If these risks are making you reconsider your opinion on ADNOC Gas, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ADX:ADNOCGAS

ADNOC Gas

Engages in the processing of associated and non-associated gas from onshore oil and gas productions and transmission of related products in the United Arab Emirates.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives