- Israel

- /

- Electronic Equipment and Components

- /

- TASE:EEAM-M

Middle Eastern Penny Stocks To Watch In October 2025

Reviewed by Simply Wall St

The Middle Eastern stock markets have shown a mixed performance recently, with most Gulf markets ending higher due to positive earnings and U.S. Federal Reserve rate cuts, while Saudi Arabia's index saw a decline. Despite their outdated reputation, penny stocks remain an intriguing investment area for those seeking opportunities in smaller or newer companies that can offer surprising value. When these stocks are supported by strong financial health, they can present a unique combination of growth potential and stability that might appeal to investors looking for under-the-radar opportunities.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Thob Al Aseel (SASE:4012) | SAR3.57 | SAR1.43B | ✅ 2 ⚠️ 1 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.06 | AED2.1B | ✅ 5 ⚠️ 3 View Analysis > |

| Sharjah Insurance Company P.S.C (ADX:SICO) | AED1.49 | AED225M | ✅ 2 ⚠️ 3 View Analysis > |

| Al Wathba National Insurance Company PJSC (ADX:AWNIC) | AED3.39 | AED703.8M | ✅ 2 ⚠️ 2 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED3.30 | AED381.15M | ✅ 2 ⚠️ 4 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED3.34 | AED14.29B | ✅ 2 ⚠️ 3 View Analysis > |

| Al Dhafra Insurance Company P.S.C (ADX:DHAFRA) | AED4.86 | AED486M | ✅ 1 ⚠️ 2 View Analysis > |

| Union Properties (DFM:UPP) | AED0.804 | AED3.43B | ✅ 3 ⚠️ 2 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.84 | AED510.93M | ✅ 2 ⚠️ 2 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.688 | ₪211M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 75 stocks from our Middle Eastern Penny Stocks screener.

We'll examine a selection from our screener results.

Al Waha Capital PJSC (ADX:WAHA)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Al Waha Capital PJSC is a private equity firm managing assets in sectors such as financial services, fintech, healthcare, energy, infrastructure, industrial real estate and capital markets with a market cap of AED3.16 billion.

Operations: The company's revenue segments include Private Investments (Excluding Waha Land) with AED52.97 million.

Market Cap: AED3.16B

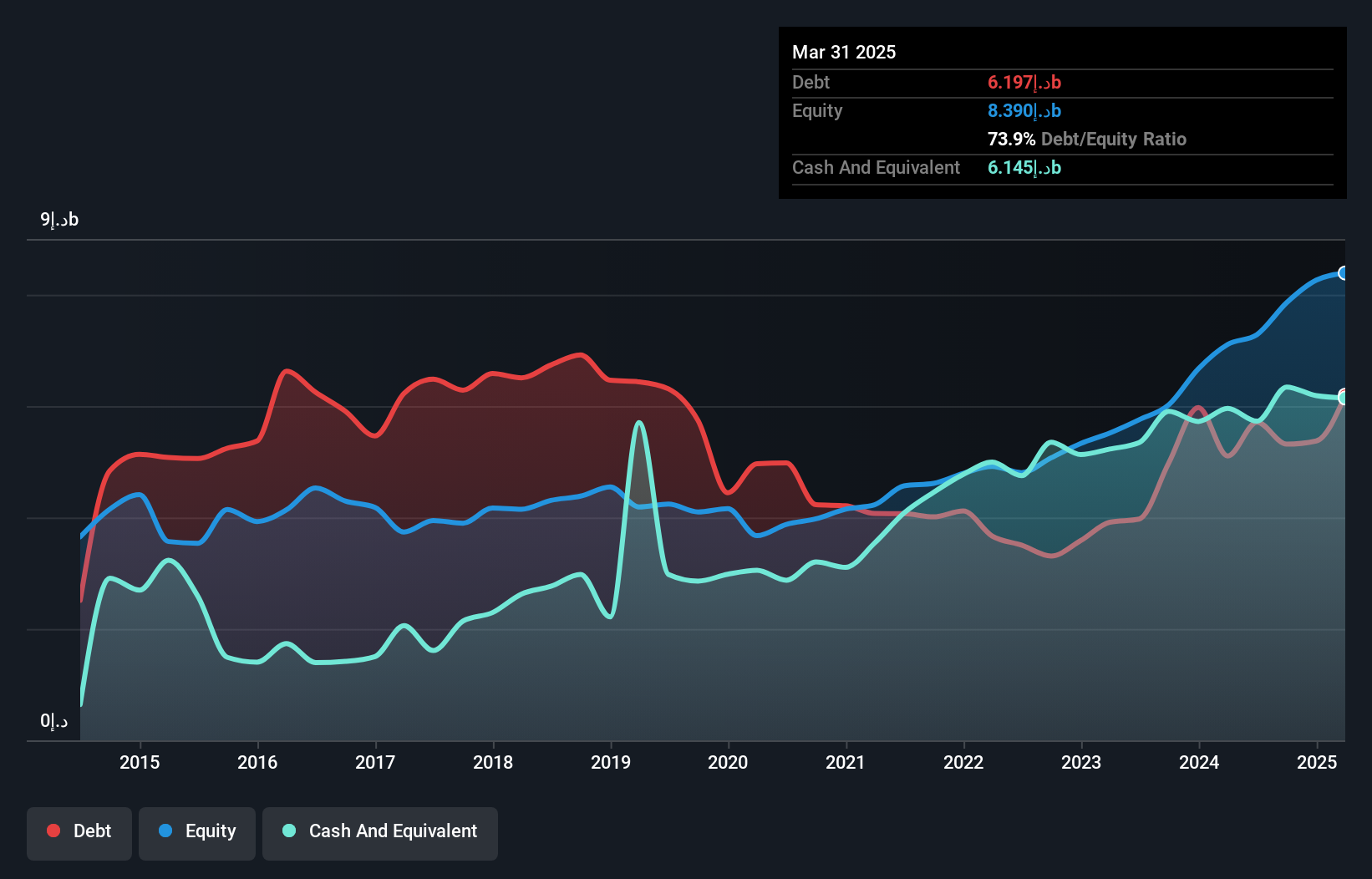

Al Waha Capital PJSC, with a market cap of AED3.16 billion, operates across various sectors including financial services and healthcare. Despite recent negative earnings growth of -19%, the company maintains higher net profit margins than last year at 71.2%. Its management and board are experienced, with average tenures of 2.8 years and 4.6 years respectively. The firm has reduced its debt to equity ratio significantly over five years from 128.4% to 55.1% and holds more cash than total debt, though operating cash flow remains negative impacting debt coverage capabilities while dividends are not well covered by free cash flows.

- Unlock comprehensive insights into our analysis of Al Waha Capital PJSC stock in this financial health report.

- Understand Al Waha Capital PJSC's track record by examining our performance history report.

Mega Polietilen Köpük Sanayi ve Ticaret Anonim Sirketi (IBSE:MEGAP)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Mega Polietilen Köpük Sanayi ve Ticaret Anonim Sirketi is a Turkish company that produces and sells foam sheets, with a market capitalization of TRY1.14 billion.

Operations: The company's revenue is primarily derived from its Textile Operation, which generated TRY13.41 billion, and its Polyurethane Operations, contributing TRY34.52 million.

Market Cap: TRY1.14B

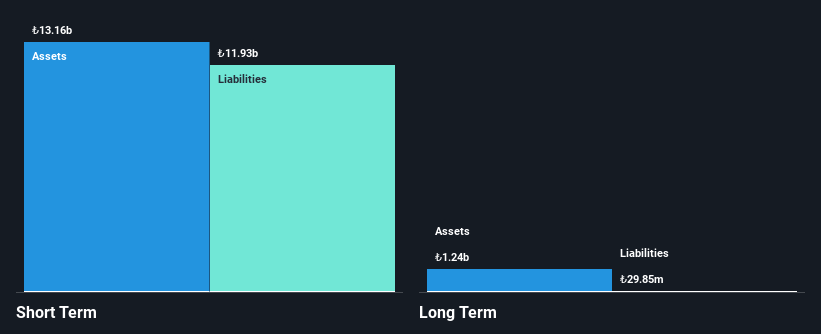

Mega Polietilen Köpük Sanayi ve Ticaret Anonim Sirketi, with a market cap of TRY1.14 billion, has demonstrated robust earnings growth of 270.9% over the past year, significantly outperforming its industry peers. The company's revenue streams from Textile and Polyurethane operations support its financial stability, while short-term assets comfortably cover both short and long-term liabilities. Despite high non-cash earnings impacting quality perceptions, the firm's net profit margin has improved to 4.9%. Debt management is satisfactory with a net debt to equity ratio of 28.6%, though operating cash flow coverage remains weak at 3.4%.

- Get an in-depth perspective on Mega Polietilen Köpük Sanayi ve Ticaret Anonim Sirketi's performance by reading our balance sheet health report here.

- Learn about Mega Polietilen Köpük Sanayi ve Ticaret Anonim Sirketi's historical performance here.

E.E.A.M.I (TASE:EEAM-M)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: E.E.A.M.I Ltd develops, sells, and maintains robotic cleaning solutions for PV modules in Israel, India, and internationally with a market cap of ₪9.81 million.

Operations: The company has not reported any specific revenue segments.

Market Cap: ₪9.81M

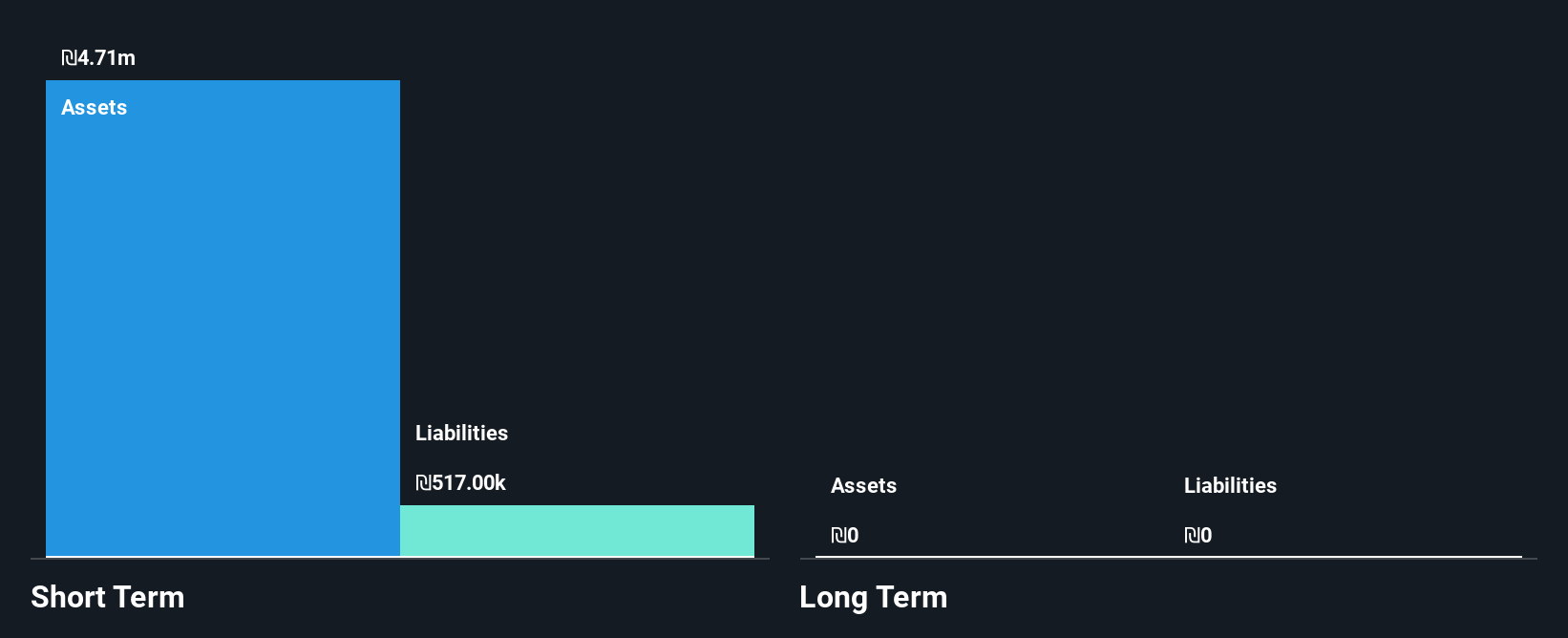

E.E.A.M.I Ltd, with a market cap of ₪9.81 million, operates in the robotic cleaning solutions sector and is currently pre-revenue, generating less than US$1 million. The company has recently become profitable, although this was influenced by a significant one-off gain of ₪3.3 million. E.E.A.M.I's Return on Equity stands at an impressive 51.9%, and it maintains a debt-free position with short-term assets exceeding liabilities by a substantial margin. However, the board and management team lack experience with average tenures of 2.9 years and 1.8 years respectively, which may impact strategic execution moving forward.

- Click to explore a detailed breakdown of our findings in E.E.A.M.I's financial health report.

- Assess E.E.A.M.I's previous results with our detailed historical performance reports.

Summing It All Up

- Reveal the 75 hidden gems among our Middle Eastern Penny Stocks screener with a single click here.

- Looking For Alternative Opportunities? We've found 24 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if E.E.A.M.I might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:EEAM-M

E.E.A.M.I

Engages in the development, sale, and maintenance of robotic cleaning solutions for PV modules in Israel, India, and internationally.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives