Stock Analysis

- United Arab Emirates

- /

- Hospitality

- /

- ADX:NCTH

National Corporation for Tourism and Hotels' (ADX:NCTH) Dismal Stock Performance Reflects Weak Fundamentals

National Corporation for Tourism and Hotels (ADX:NCTH) has had a rough month with its share price down 13%. We decided to study the company's financials to determine if the downtrend will continue as the long-term performance of a company usually dictates market outcomes. In this article, we decided to focus on National Corporation for Tourism and Hotels' ROE.

ROE or return on equity is a useful tool to assess how effectively a company can generate returns on the investment it received from its shareholders. In other words, it is a profitability ratio which measures the rate of return on the capital provided by the company's shareholders.

View our latest analysis for National Corporation for Tourism and Hotels

How To Calculate Return On Equity?

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for National Corporation for Tourism and Hotels is:

3.2% = د.إ72m ÷ د.إ2.2b (Based on the trailing twelve months to June 2023).

The 'return' is the income the business earned over the last year. So, this means that for every AED1 of its shareholder's investments, the company generates a profit of AED0.03.

Why Is ROE Important For Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Generally speaking, other things being equal, firms with a high return on equity and profit retention, have a higher growth rate than firms that don’t share these attributes.

A Side By Side comparison of National Corporation for Tourism and Hotels' Earnings Growth And 3.2% ROE

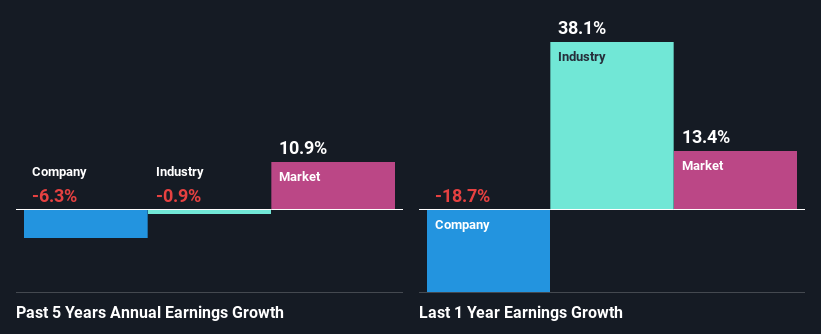

It is hard to argue that National Corporation for Tourism and Hotels' ROE is much good in and of itself. Not just that, even compared to the industry average of 9.5%, the company's ROE is entirely unremarkable. Given the circumstances, the significant decline in net income by 6.3% seen by National Corporation for Tourism and Hotels over the last five years is not surprising. We believe that there also might be other aspects that are negatively influencing the company's earnings prospects. For instance, the company has a very high payout ratio, or is faced with competitive pressures.

Furthermore, even when compared to the industry, which has been shrinking its earnings at a rate of 0.9% over the last few years, we found that National Corporation for Tourism and Hotels' performance is pretty disappointing, as it suggests that the company has been shrunk its earnings at a rate faster than the industry.

The basis for attaching value to a company is, to a great extent, tied to its earnings growth. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). Doing so will help them establish if the stock's future looks promising or ominous. Is National Corporation for Tourism and Hotels fairly valued compared to other companies? These 3 valuation measures might help you decide.

Is National Corporation for Tourism and Hotels Making Efficient Use Of Its Profits?

National Corporation for Tourism and Hotels' declining earnings is not surprising given how the company is spending most of its profits in paying dividends, judging by its three-year median payout ratio of 89% (or a retention ratio of 11%). With only very little left to reinvest into the business, growth in earnings is far from likely. You can see the 2 risks we have identified for National Corporation for Tourism and Hotels by visiting our risks dashboard for free on our platform here.

Moreover, National Corporation for Tourism and Hotels has been paying dividends for at least ten years or more suggesting that management must have perceived that the shareholders prefer dividends over earnings growth.

Summary

Overall, we would be extremely cautious before making any decision on National Corporation for Tourism and Hotels. Because the company is not reinvesting much into the business, and given the low ROE, it's not surprising to see the lack or absence of growth in its earnings. So far, we've only made a quick discussion around the company's earnings growth. To gain further insights into National Corporation for Tourism and Hotels' past profit growth, check out this visualization of past earnings, revenue and cash flows.

Valuation is complex, but we're helping make it simple.

Find out whether National Corporation for Tourism and Hotels is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ADX:NCTH

National Corporation for Tourism and Hotels

Invests in, owns, and manages hotels and leisure complexes in the United Arab Emirates.

Adequate balance sheet with acceptable track record.