- United Arab Emirates

- /

- Industrials

- /

- ADX:ESG

We Ran A Stock Scan For Earnings Growth And ESG Emirates Stallions Group PJSC (ADX:ESG) Passed With Ease

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like ESG Emirates Stallions Group PJSC (ADX:ESG). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

View our latest analysis for ESG Emirates Stallions Group PJSC

How Fast Is ESG Emirates Stallions Group PJSC Growing Its Earnings Per Share?

Investors and investment funds chase profits, and that means share prices tend rise with positive earnings per share (EPS) outcomes. So a growing EPS generally brings attention to a company in the eyes of prospective investors. It is awe-striking that ESG Emirates Stallions Group PJSC's EPS went from د.إ0.49 to د.إ2.85 in just one year. When you see earnings grow that quickly, it often means good things ahead for the company. This could point to the business hitting a point of inflection.

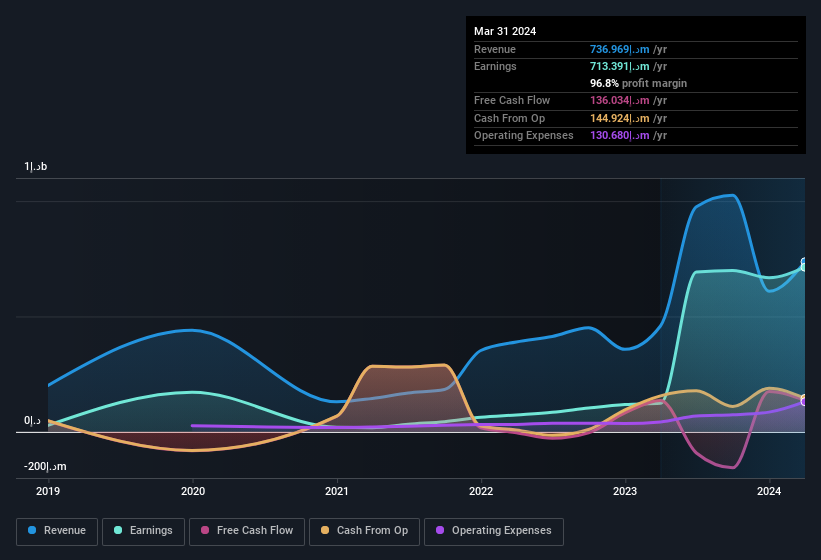

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. ESG Emirates Stallions Group PJSC maintained stable EBIT margins over the last year, all while growing revenue 61% to د.إ737m. That's encouraging news for the company!

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check ESG Emirates Stallions Group PJSC's balance sheet strength, before getting too excited.

Are ESG Emirates Stallions Group PJSC Insiders Aligned With All Shareholders?

It's pleasing to see company leaders with putting their money on the line, so to speak, because it increases alignment of incentives between the people running the business, and its true owners. So it is good to see that ESG Emirates Stallions Group PJSC insiders have a significant amount of capital invested in the stock. Indeed, they hold د.إ136m worth of its stock. This considerable investment should help drive long-term value in the business. Despite being just 5.0% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

Should You Add ESG Emirates Stallions Group PJSC To Your Watchlist?

ESG Emirates Stallions Group PJSC's earnings have taken off in quite an impressive fashion. This level of EPS growth does wonders for attracting investment, and the large insider investment in the company is just the cherry on top. The hope is, of course, that the strong growth marks a fundamental improvement in the business economics. Based on the sum of its parts, we definitely think its worth watching ESG Emirates Stallions Group PJSC very closely. You should always think about risks though. Case in point, we've spotted 2 warning signs for ESG Emirates Stallions Group PJSC you should be aware of, and 1 of them is significant.

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a tailored list of Emirian companies which have demonstrated growth backed by significant insider holdings.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if ESG Emirates Stallions Group PJSC might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ADX:ESG

ESG Emirates Stallions Group PJSC

Engages in the investment, construction, and real estate sectors in the Middle East, Africa, Asia, Europe, and the Americas.

Excellent balance sheet with questionable track record.

Market Insights

Community Narratives