- United Arab Emirates

- /

- Industrials

- /

- ADX:ESG

Do Its Financials Have Any Role To Play In Driving ESG Emirates Stallions Group PJSC's (ADX:ESG) Stock Up Recently?

ESG Emirates Stallions Group PJSC's (ADX:ESG) stock is up by a considerable 75% over the past three months. Given that stock prices are usually aligned with a company's financial performance in the long-term, we decided to study its financial indicators more closely to see if they had a hand to play in the recent price move. Particularly, we will be paying attention to ESG Emirates Stallions Group PJSC's ROE today.

Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors’ money. In simpler terms, it measures the profitability of a company in relation to shareholder's equity.

How Do You Calculate Return On Equity?

The formula for ROE is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for ESG Emirates Stallions Group PJSC is:

8.1% = د.إ215m ÷ د.إ2.7b (Based on the trailing twelve months to June 2025).

The 'return' is the amount earned after tax over the last twelve months. So, this means that for every AED1 of its shareholder's investments, the company generates a profit of AED0.08.

Check out our latest analysis for ESG Emirates Stallions Group PJSC

What Has ROE Got To Do With Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Generally speaking, other things being equal, firms with a high return on equity and profit retention, have a higher growth rate than firms that don’t share these attributes.

A Side By Side comparison of ESG Emirates Stallions Group PJSC's Earnings Growth And 8.1% ROE

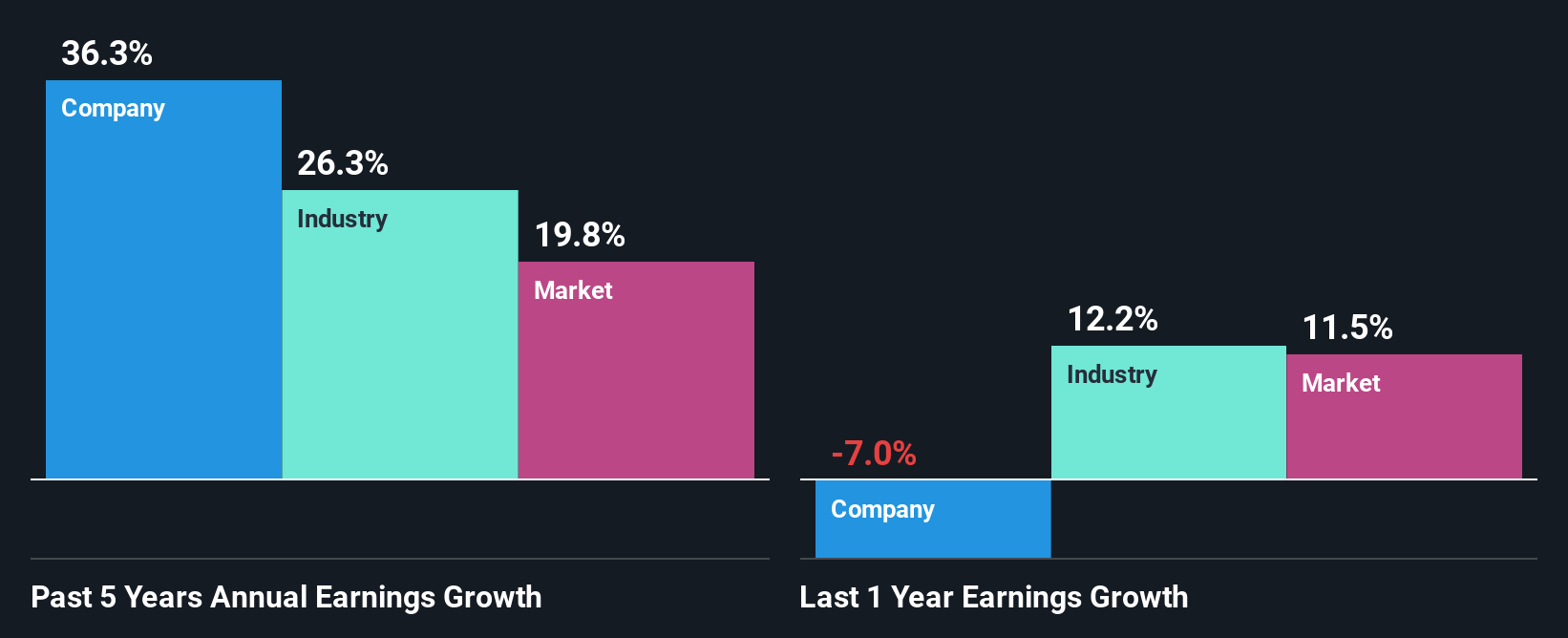

It is hard to argue that ESG Emirates Stallions Group PJSC's ROE is much good in and of itself. An industry comparison shows that the company's ROE is not much different from the industry average of 9.1% either. Looking at ESG Emirates Stallions Group PJSC's exceptional 36% five-year net income growth in particular, we are definitely impressed. We reckon that there could also be other factors at play thats influencing the company's growth. Such as - high earnings retention or an efficient management in place.

Next, on comparing with the industry net income growth, we found that ESG Emirates Stallions Group PJSC's growth is quite high when compared to the industry average growth of 26% in the same period, which is great to see.

The basis for attaching value to a company is, to a great extent, tied to its earnings growth. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. One good indicator of expected earnings growth is the P/E ratio which determines the price the market is willing to pay for a stock based on its earnings prospects. So, you may want to check if ESG Emirates Stallions Group PJSC is trading on a high P/E or a low P/E, relative to its industry.

Is ESG Emirates Stallions Group PJSC Efficiently Re-investing Its Profits?

Given that ESG Emirates Stallions Group PJSC doesn't pay any regular dividends to its shareholders, we infer that the company has been reinvesting all of its profits to grow its business.

Conclusion

On the whole, we do feel that ESG Emirates Stallions Group PJSC has some positive attributes. With a high rate of reinvestment, albeit at a low ROE, the company has managed to see a considerable growth in its earnings. While we won't completely dismiss the company, what we would do, is try to ascertain how risky the business is to make a more informed decision around the company. Our risks dashboard would have the 2 risks we have identified for ESG Emirates Stallions Group PJSC.

Valuation is complex, but we're here to simplify it.

Discover if ESG Emirates Stallions Group PJSC might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ADX:ESG

ESG Emirates Stallions Group PJSC

Engages in the investment, construction, and real estate sectors in the Middle East, Africa, Asia, Europe, and the Americas.

Excellent balance sheet with questionable track record.

Market Insights

Community Narratives