- Saudi Arabia

- /

- Basic Materials

- /

- SASE:9601

Undiscovered Gems In Middle East 3 Small Cap Stocks With Strong Potential

Reviewed by Simply Wall St

The Middle East stock markets have recently mirrored gains in Asian shares, with key indices like Saudi Arabia's benchmark index and Dubai's main share index seeing positive movement. This upward trend highlights the region's potential for growth, particularly in small-cap stocks that can capitalize on favorable economic conditions and investor sentiment. Identifying promising small-cap stocks involves looking for companies with robust fundamentals and growth potential, especially as Gulf markets track higher alongside global counterparts.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Al Wathba National Insurance Company PJSC | 10.97% | 10.37% | 3.14% | ★★★★★★ |

| Baazeem Trading | 8.48% | -1.74% | -2.37% | ★★★★★★ |

| MOBI Industry | 18.09% | 6.66% | 22.02% | ★★★★★★ |

| Qassim Cement | NA | 0.78% | -14.90% | ★★★★★★ |

| Sure Global Tech | NA | 10.11% | 15.42% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 3.26% | 17.17% | 23.30% | ★★★★★★ |

| Najran Cement | 14.76% | -3.67% | -26.79% | ★★★★★★ |

| MIA Teknoloji Anonim Sirketi | 16.16% | 34.64% | 61.21% | ★★★★★☆ |

| Etihad Atheeb Telecommunication | 0.97% | 37.69% | 60.25% | ★★★★★☆ |

| Mobiltel Iletisim Hizmetleri Sanayi ve Ticaret | 21.21% | 19.59% | -34.35% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

ESG Emirates Stallions Group PJSC (ADX:ESG)

Simply Wall St Value Rating: ★★★★★☆

Overview: ESG Emirates Stallions Group PJSC operates in the investment, construction, and real estate sectors across multiple regions including the Middle East, Africa, Asia, Europe, and the Americas with a market cap of AED 3.79 billion.

Operations: ESG Emirates Stallions Group PJSC generates revenue primarily from furniture manufacturing, retail and interior fit-out (AED 600.55 million), business process/manpower outsourcing (AED 472.13 million), and contracting and consultancy services (AED 267.71 million). The company also earns from landscaping, agriculture, and maintenance services amounting to AED 269.24 million, while staff accommodation contributes AED 31.85 million to its revenue streams.

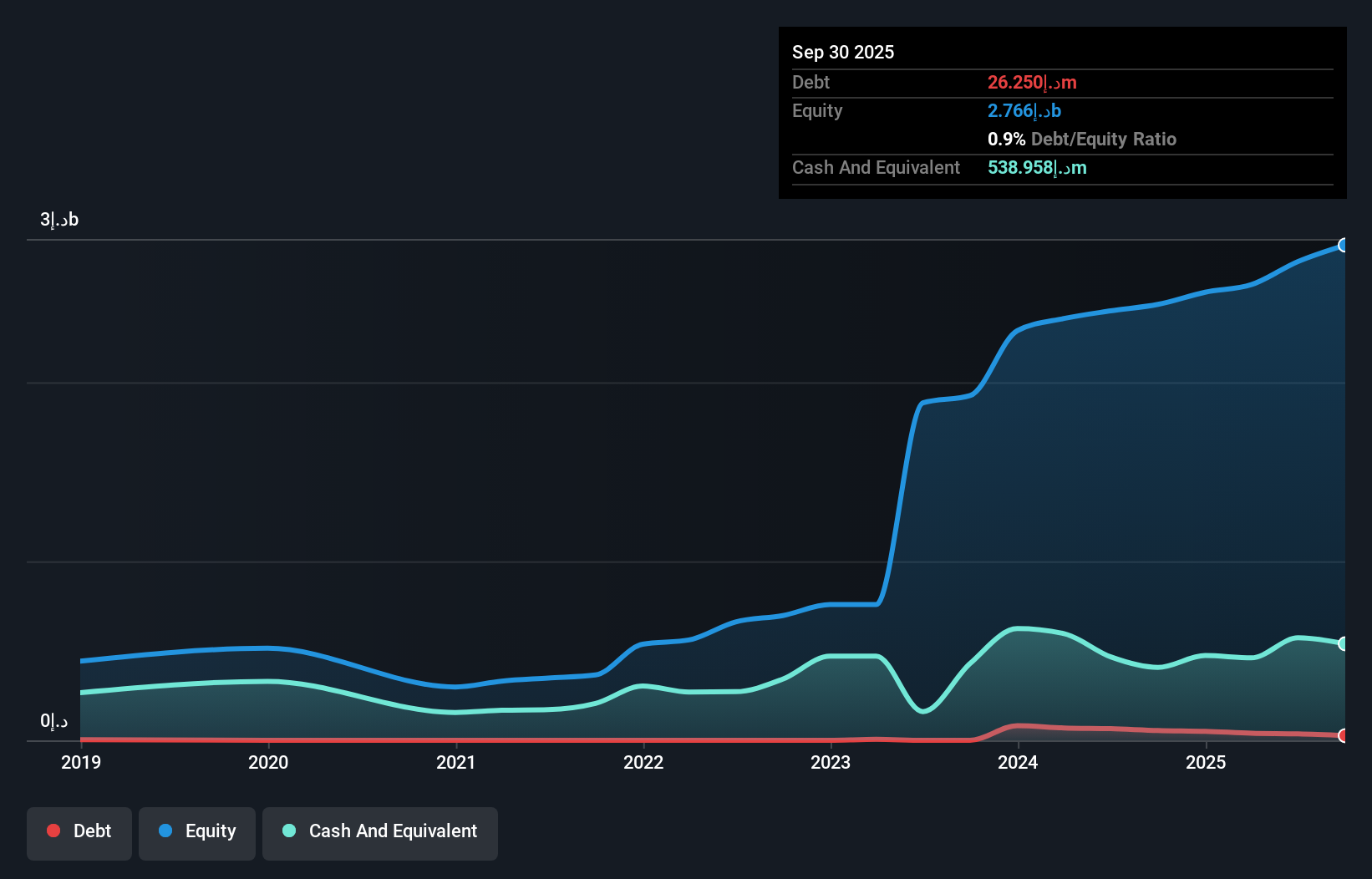

ESG Emirates Stallions Group PJSC, a notable player in the Middle East's real estate scene, has shown robust financial health with earnings growing by 9.6% over the past year, outpacing the Industrials sector's -5.7%. The company boasts more cash than its total debt and maintains high-quality earnings. Recent developments include a significant AED 1.6 billion project on Al Reem Island, enhancing its luxury portfolio with Marriott-branded residences set to complete by late 2028. Despite an increase in debt-to-equity ratio to 0.9% over five years, ESG remains financially sound and strategically positioned for growth.

Ajman Bank PJSC (DFM:AJMANBANK)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Ajman Bank PJSC offers a range of banking products and services to individuals, businesses, and government institutions in the United Arab Emirates, with a market capitalization of AED3.98 billion.

Operations: Ajman Bank generates revenue primarily through its Wholesale Banking and Consumer Banking segments, contributing AED447.74 million and AED279.19 million, respectively. The Treasury segment adds another AED184.52 million to the total revenue stream.

Ajman Bank PJSC, with total assets of AED28.0 billion and equity of AED3.4 billion, has shown a promising turnaround by becoming profitable this year. The bank's liabilities are 89% funded by low-risk customer deposits, reflecting financial stability. Despite a high level of bad loans at 8.9%, the allowance for these is relatively low at 47%. With total deposits of AED22.0 billion and loans amounting to AED15.2 billion, Ajman Bank seems positioned for cautious growth in the banking sector. Its price-to-earnings ratio stands attractively below the market average at 8.1x compared to AE's 12.2x, suggesting potential value for investors seeking opportunities in emerging markets like the Middle East.

- Navigate through the intricacies of Ajman Bank PJSC with our comprehensive health report here.

Assess Ajman Bank PJSC's past performance with our detailed historical performance reports.

Mohammed Hadi Al-Rasheed (SASE:9601)

Simply Wall St Value Rating: ★★★★★☆

Overview: Mohammed Hadi Al-Rasheed Company specializes in the production of silica sand for various industrial applications and has a market capitalization of SAR1.38 billion.

Operations: The company generates revenue primarily from sales, amounting to SAR273.90 million, and contracting services contributing SAR33.12 million.

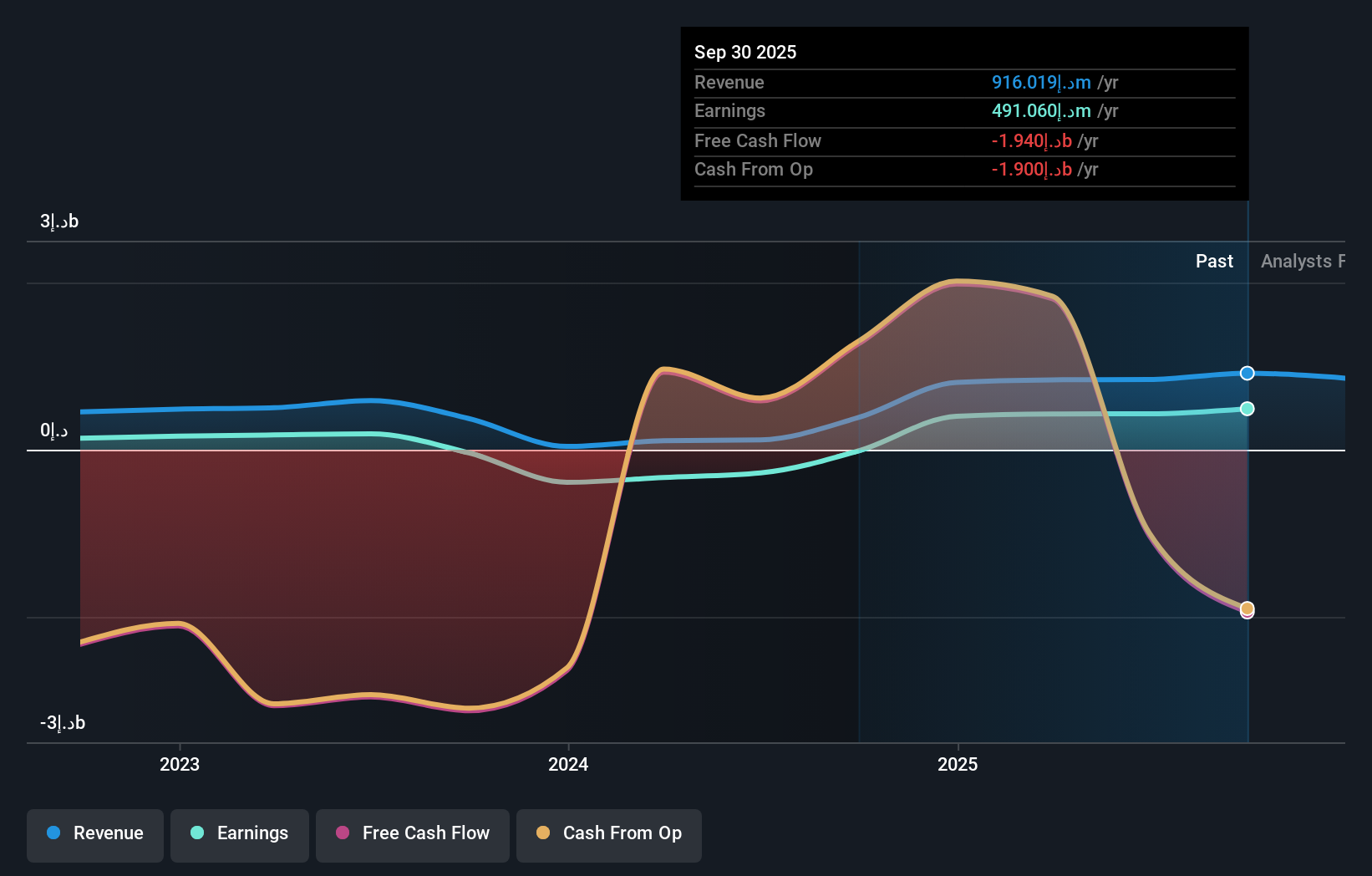

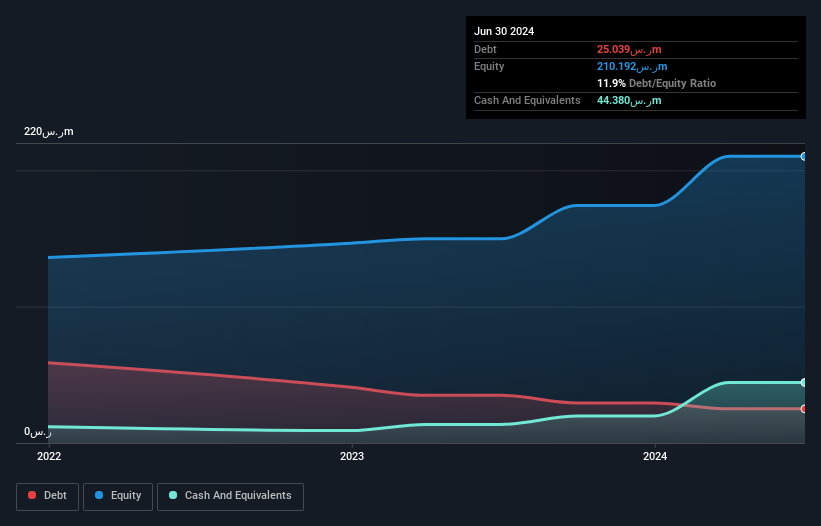

Mohammed Hadi Al-Rasheed, a notable player in the Middle East's industrial sector, showcases robust financial health with cash exceeding its total debt and an impressive 80.6% earnings growth over the past year, outpacing the Basic Materials industry's 20.5%. Its interest payments are comfortably covered by EBIT at 92.7 times, reflecting strong operational efficiency. Despite trading at 50.5% below estimated fair value and having high-quality past earnings, recent volatility could pose challenges for investors. The strategic alliance with Taif Shipping Company highlights potential growth avenues but currently has no immediate financial impact as due diligence is ongoing.

Summing It All Up

- Embark on your investment journey to our 210 Middle Eastern Undiscovered Gems With Strong Fundamentals selection here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:9601

Mohammed Hadi Al-Rasheed

Produces silica sand for various industrial applications.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives