- United Arab Emirates

- /

- Construction

- /

- DFM:ALEC

Exploring 3 Undiscovered Gems In The Middle East

Reviewed by Simply Wall St

As Gulf markets largely ended in positive territory, buoyed by expectations of a U.S. rate cut and robust non-oil economic activity, investors are increasingly looking towards the Middle East for promising opportunities. In this dynamic environment, identifying stocks that combine solid market fundamentals with growth potential can be key to uncovering undiscovered gems in the region.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| MOBI Industry | 18.09% | 6.66% | 22.02% | ★★★★★★ |

| Payton Industries | NA | 5.14% | 14.54% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 3.26% | 17.17% | 23.30% | ★★★★★★ |

| Najran Cement | 14.76% | -3.67% | -26.79% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 14.58% | 25.09% | ★★★★★☆ |

| Sönmez Filament Sentetik Iplik ve Elyaf Sanayi | NA | 55.06% | 42.78% | ★★★★★☆ |

| MIA Teknoloji Anonim Sirketi | 16.16% | 34.64% | 61.21% | ★★★★★☆ |

| Gür-Sel Turizm Tasimacilik ve Servis Ticaret | 7.00% | 41.89% | 59.39% | ★★★★★☆ |

| Birikim Varlik Yonetim Anonim Sirketi | 59.38% | 42.42% | 36.01% | ★★★★☆☆ |

| Mobiltel Iletisim Hizmetleri Sanayi ve Ticaret | 21.21% | 19.59% | -34.35% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Bank Of Sharjah P.J.S.C (ADX:BOS)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Bank Of Sharjah P.J.S.C., along with its subsidiaries, offers a range of commercial and investment banking products and services in the United Arab Emirates, with a market capitalization of AED3.90 billion.

Operations: The primary revenue streams for Bank Of Sharjah include commercial banking, generating AED450.68 million, and investment and treasury services, contributing AED326.19 million.

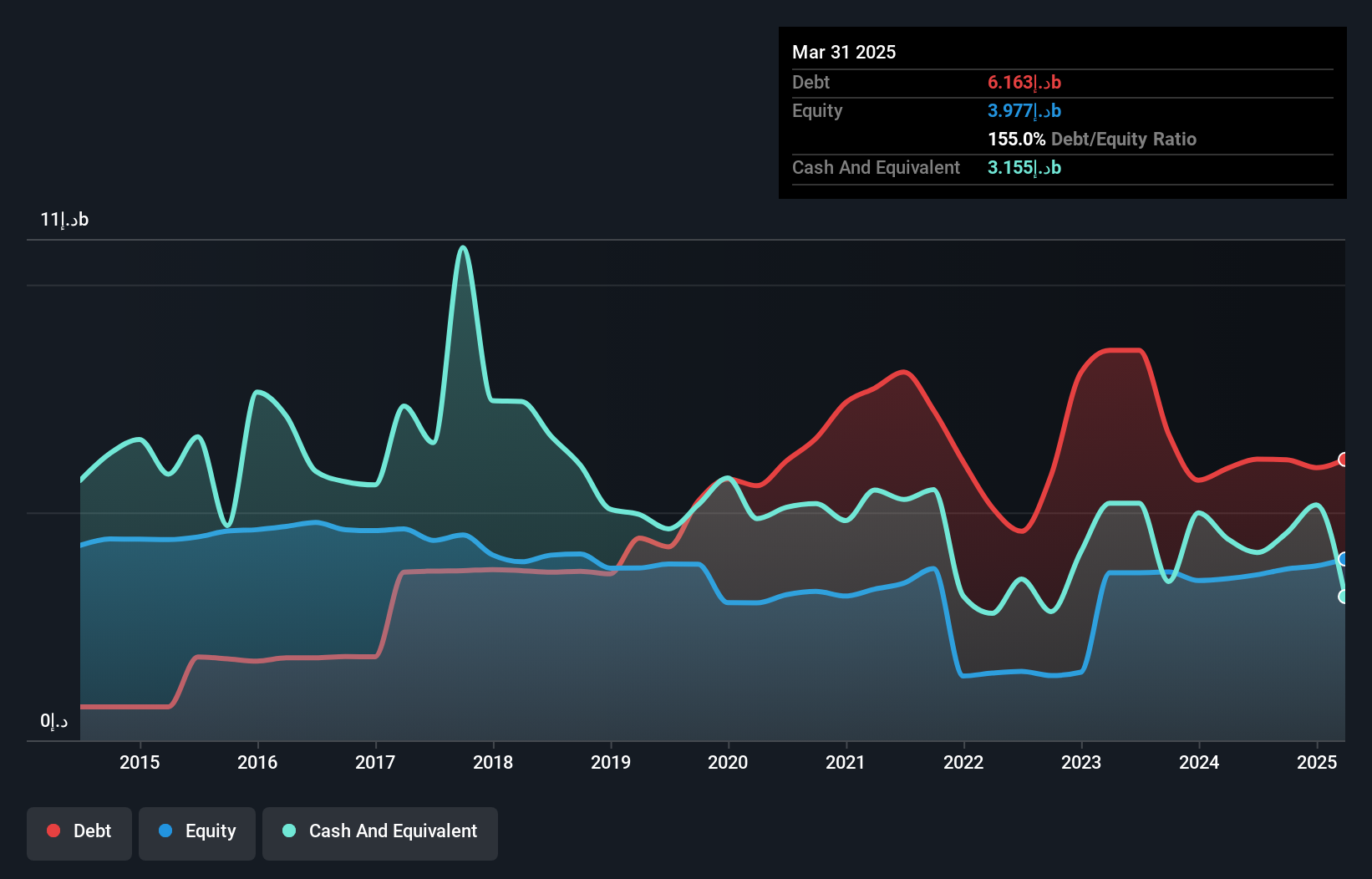

Bank of Sharjah, a notable player in the Middle East's banking sector, showcases a mixed financial profile. With total assets of AED49.6 billion and equity at AED4.3 billion, it holds deposits amounting to AED37.3 billion against loans of AED30.7 billion. Despite an impressive earnings growth rate of 262% over the past year, largely due to a one-off gain of AED101 million, the bank faces challenges with high non-performing loans at 6.6%. Its price-to-earnings ratio stands attractively low at 7.5x compared to the AE market average of 11.9x, suggesting potential undervaluation in its current market position.

ALEC Holdings PJSC (DFM:ALEC)

Simply Wall St Value Rating: ★★★★★☆

Overview: ALEC Holdings PJSC is involved in engineering and constructing building projects, airport infrastructure, industrial, energy, and commercial and flagship projects, with a market capitalization of AED6.95 billion.

Operations: ALEC Holdings PJSC generates revenue primarily from building and infrastructure construction services, totaling AED5.14 billion, and energy projects contributing AED3.65 billion. The related businesses segment adds another AED2.29 billion to its revenue streams.

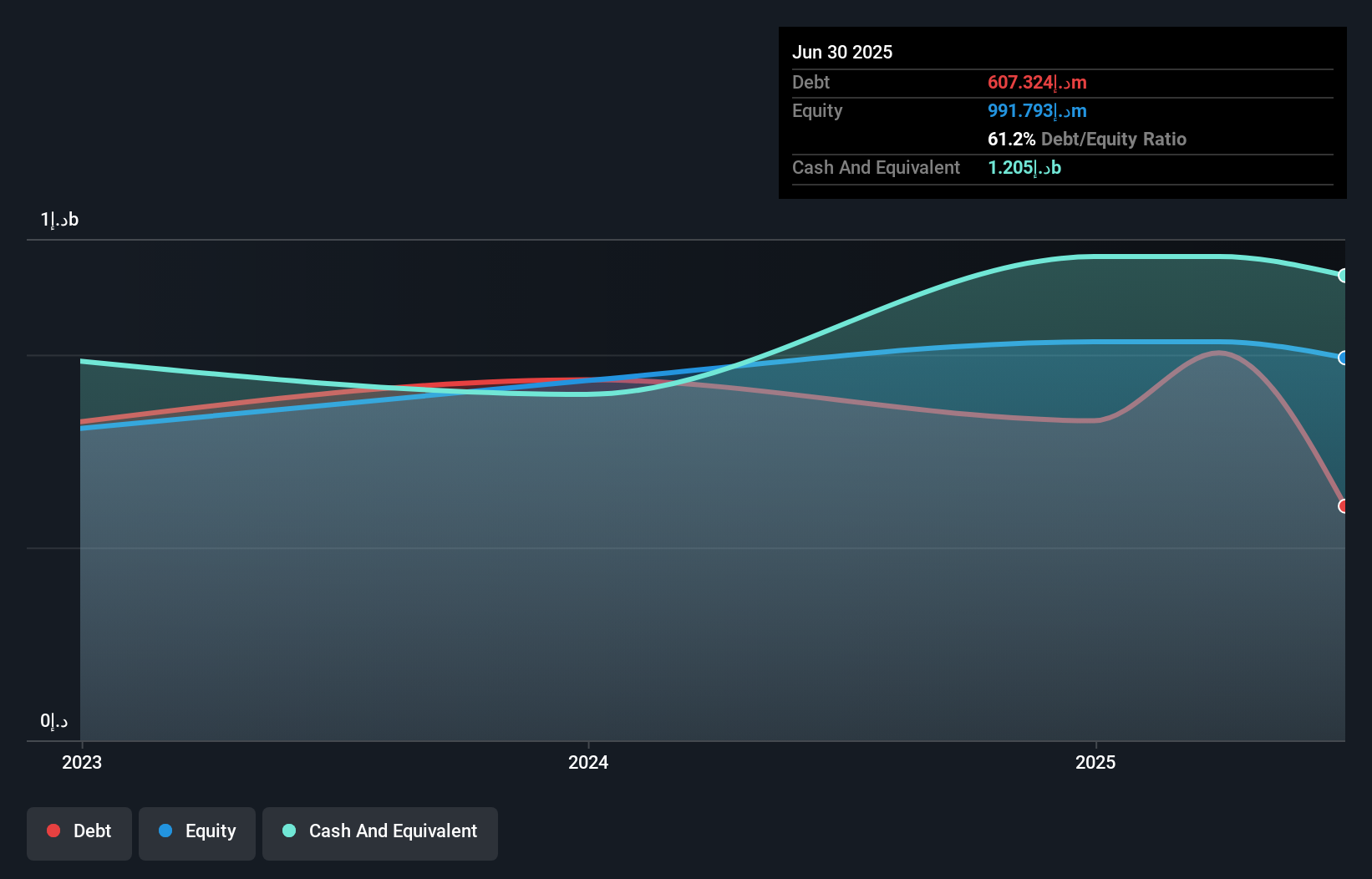

ALEC Holdings PJSC, a small player in the Middle East construction sector, has shown remarkable earnings growth of 57.8% over the past year, outpacing the industry average of 17.2%. The company recently completed an IPO worth AED 1.4 billion, further boosting its financial standing with more cash than total debt on its books. ALEC's interest payments are well covered by EBIT at a multiple of 50.1x, indicating robust financial health despite highly illiquid shares. Trading slightly below estimated fair value suggests potential for future appreciation in this promising yet under-the-radar stock.

More Provident Funds (TASE:MPP)

Simply Wall St Value Rating: ★★★★☆☆

Overview: More Provident Funds Ltd. manages provident and pension funds in Israel with a market capitalization of ₪1.89 billion.

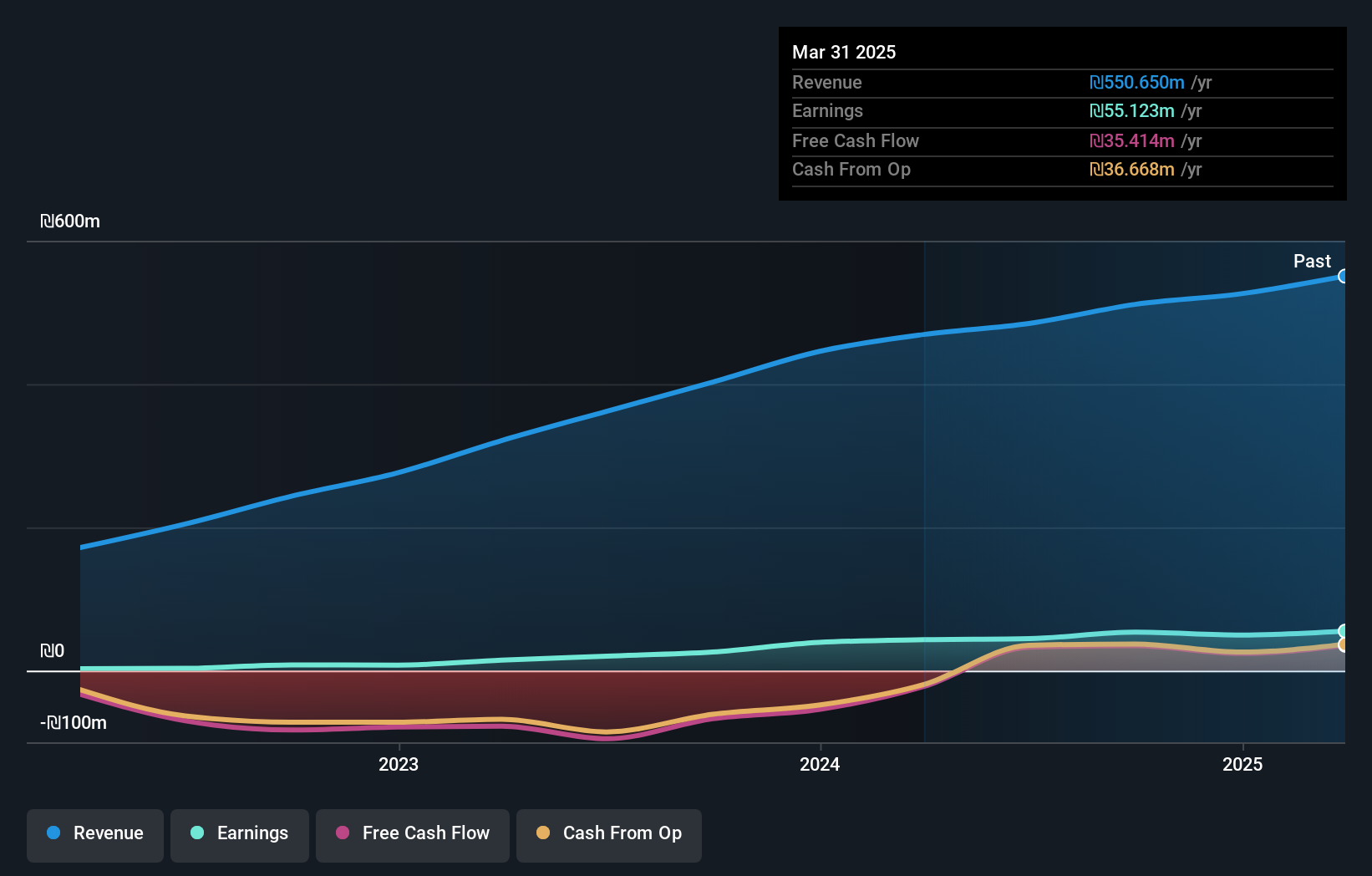

Operations: The company generates revenue primarily from its provident sector, contributing ₪539.64 million, and its pension segment, adding ₪31.73 million.

More Provident Funds, a smaller player in the financial landscape, has shown robust performance with its debt to equity ratio improving from 104.1% to 70% over five years. The company boasts a satisfactory net debt to equity ratio of 19.4%, reflecting prudent financial management. Its interest payments are well-covered by EBIT at 13.5 times, indicating strong earnings relative to its obligations. Recent results highlight impressive growth; second-quarter revenue reached ILS 150.87 million, up from ILS 119.86 million the previous year, with net income doubling to ILS 16.71 million compared to last year's figures, showcasing solid profitability trends amidst market volatility.

- Click to explore a detailed breakdown of our findings in More Provident Funds' health report.

Explore historical data to track More Provident Funds' performance over time in our Past section.

Turning Ideas Into Actions

- Take a closer look at our Middle Eastern Undiscovered Gems With Strong Fundamentals list of 205 companies by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About DFM:ALEC

ALEC Holdings PJSC

ALEC Holdings PJSC engineers and constructs building projects, airport infrastructure, industrial, energy, and commercial and flagship projects.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives