- United States

- /

- Insurance

- /

- NasdaqGS:WTW

Willis Towers Watson (NasdaqGS:WTW) Launches Zest Insurance for Australian SMEs

Reviewed by Simply Wall St

Willis Towers Watson (NasdaqGS:WTW) recently launched Zest Insurance, a digital platform targeting SMEs in Australia, and enhanced its leadership, with appointments such as Farah Ismail as Senior Director in North America. These developments reflect a focus on digital transformation and strategic growth in their insurance consulting and technology sectors. Despite these initiatives, WTW's share price was flat over the past week, consistent with the broader market trend. Therefore, while these events potentially strengthen the company's market position and client offerings, they did not affect the stock price significantly within the observed period.

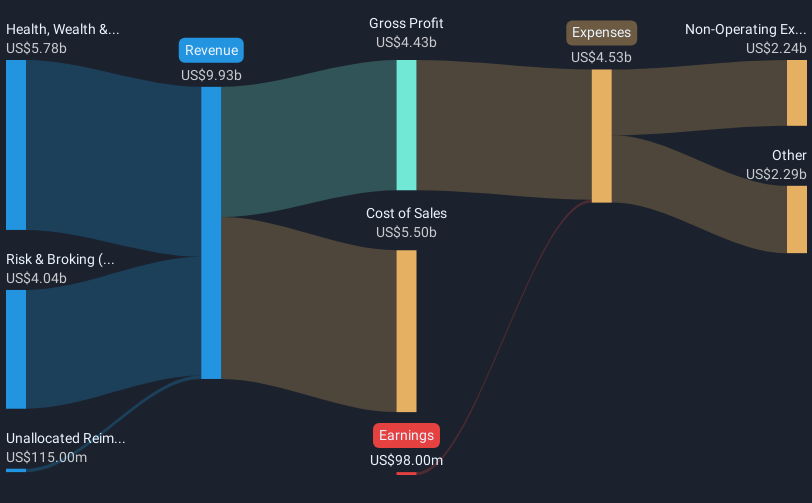

The launch of Zest Insurance and leadership changes at Willis Towers Watson (NasdaqGS:WTW) could bolster its strategic direction and market offerings. These initiatives, while not immediately impacting the short-term share price, align with the company's broader narrative of using digital transformation and specialized solutions to drive revenue growth and operational efficiency. Over the past five years, WTW's total shareholder returns, including dividends, reached 66.78%, suggesting a more resilient long-term performance compared to short-term market fluctuations. Over the past year, WTW outperformed the US Insurance industry average, which returned 14.1%.

The integration of digital platforms could potentially enhance client interaction and service delivery, influencing future revenue streams and earnings growth forecasts. Analysts have projected a 3.1% annual revenue growth over the next three years, with increasing profit margins contingent on continued operational improvements. With WTW’s current share price at US$307.55 and an analyst price target of US$365.79, the stock appears undervalued relative to analyst expectations. Investors should consider how these developments could influence future valuations, though it's essential to conduct personal assessments in light of diverse market conditions and uncertainties.

Review our growth performance report to gain insights into Willis Towers Watson's future.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Willis Towers Watson might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WTW

Willis Towers Watson

Operates as an advisory, broking, and solutions company worldwide.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives