- Belgium

- /

- Medical Equipment

- /

- ENXTBR:BCART

What Type Of Returns Would Biocartis Group's(EBR:BCART) Shareholders Have Earned If They Purchased Their SharesFive Years Ago?

We think intelligent long term investing is the way to go. But no-one is immune from buying too high. To wit, the Biocartis Group NV (EBR:BCART) share price managed to fall 67% over five long years. We certainly feel for shareholders who bought near the top. We also note that the stock has performed poorly over the last year, with the share price down 56%. Unhappily, the share price slid 7.6% in the last week.

See our latest analysis for Biocartis Group

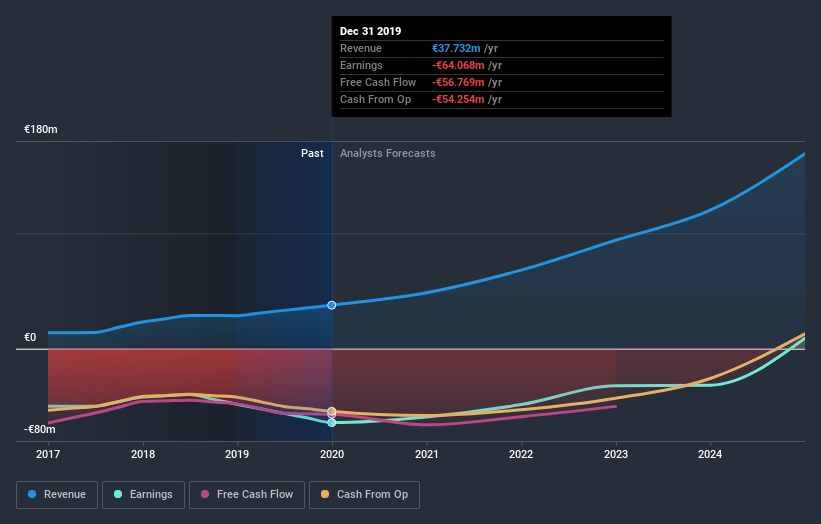

Biocartis Group isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally expect to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Over five years, Biocartis Group grew its revenue at 25% per year. That's well above most other pre-profit companies. In contrast, the share price is has averaged a loss of 11% per year - that's quite disappointing. It's safe to say investor expectations are more grounded now. If you think the company can keep up its revenue growth, you'd have to consider the possibility that there's an opportunity here.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

While the broader market lost about 24% in the twelve months, Biocartis Group shareholders did even worse, losing 56%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 11% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. It's always interesting to track share price performance over the longer term. But to understand Biocartis Group better, we need to consider many other factors. For example, we've discovered 1 warning sign for Biocartis Group that you should be aware of before investing here.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on BE exchanges.

When trading Biocartis Group or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Biocartis Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About ENXTBR:BCART

Low risk with weak fundamentals.

Similar Companies

Market Insights

Community Narratives