- Hong Kong

- /

- Consumer Services

- /

- SEHK:667

What Percentage Of China East Education Holdings Limited (HKG:667) Shares Do Insiders Own?

A look at the shareholders of China East Education Holdings Limited (HKG:667) can tell us which group is most powerful. Generally speaking, as a company grows, institutions will increase their ownership. Conversely, insiders often decrease their ownership over time. I generally like to see some degree of insider ownership, even if only a little. As Nassim Nicholas Taleb said, 'Don’t tell me what you think, tell me what you have in your portfolio.

With a market capitalization of HK$31b, China East Education Holdings is rather large. We'd expect to see institutional investors on the register. Companies of this size are usually well known to retail investors, too. Our analysis of the ownership of the company, below, shows that institutions are noticeable on the share registry. Let's take a closer look to see what the different types of shareholder can tell us about China East Education Holdings.

Check out our latest analysis for China East Education Holdings

What Does The Institutional Ownership Tell Us About China East Education Holdings?

Institutional investors commonly compare their own returns to the returns of a commonly followed index. So they generally do consider buying larger companies that are included in the relevant benchmark index.

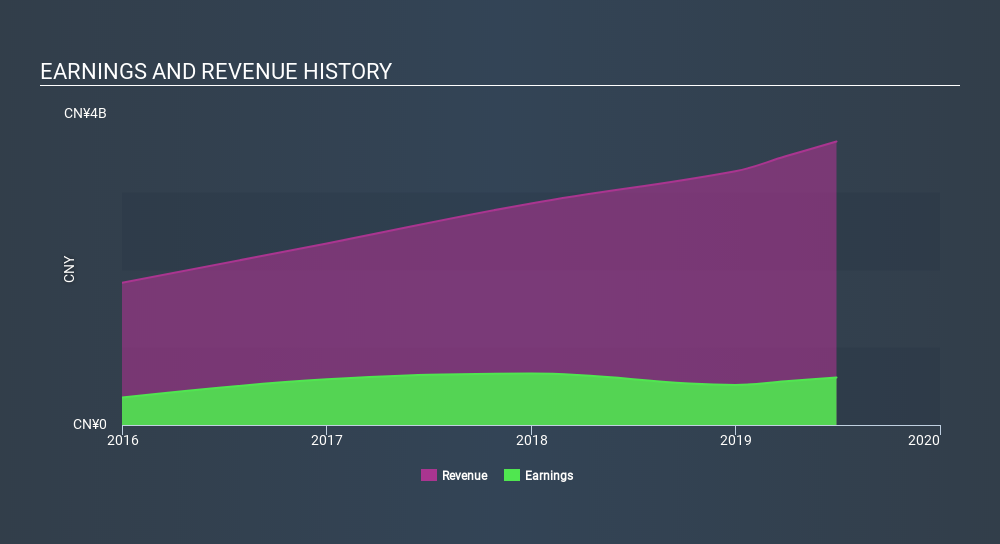

As you can see, institutional investors own 8.7% of China East Education Holdings. This implies the analysts working for those institutions have looked at the stock and they like it. But just like anyone else, they could be wrong. It is not uncommon to see a big share price drop if two large institutional investors try to sell out of a stock at the same time. So it is worth checking the past earnings trajectory of China East Education Holdings, (below). Of course, keep in mind that there are other factors to consider, too.

Hedge funds don't have many shares in China East Education Holdings. Looking at our data, we can see that the largest shareholder is Junbao Wu with 34% of shares outstanding. With 23% and 22% of the shares outstanding respectively, Wei Wu and Guoqing Xiao are the second and third largest shareholders. They also hold the title of Top Key Executive and Vice Chairman, respectively, suggesting that these insiders have a personal stake in the company.

Our analysis suggests that the top 2 shareholders collectively control 57% of the company's shares, implying that they have considerable power to influence the company's decisions.

While studying institutional ownership for a company can add value to your research, it is also a good practice to research analyst recommendations to get a deeper understand of a stock's expected performance. There are a reasonable number of analysts covering the stock, so it might be useful to find out their aggregate view on the future.

Insider Ownership Of China East Education Holdings

The definition of company insiders can be subjective, and does vary between jurisdictions. Our data reflects individual insiders, capturing board members at the very least. Management ultimately answers to the board. However, it is not uncommon for managers to be executive board members, especially if they are a founder or the CEO.

I generally consider insider ownership to be a good thing. However, on some occasions it makes it more difficult for other shareholders to hold the board accountable for decisions.

Our information suggests that insiders own more than half of China East Education Holdings Limited. This gives them effective control of the company. Given it has a market cap of HK$31b, that means insiders have a whopping HK$25b worth of shares in their own names. Most would argue this is a positive, showing strong alignment with shareholders. You can click here to see if they have been selling down their stake.

General Public Ownership

The general public holds a 11% stake in 667. While this size of ownership may not be enough to sway a policy decision in their favour, they can still make a collective impact on company policies.

Next Steps:

While it is well worth considering the different groups that own a company, there are other factors that are even more important.

Many find it useful to take an in depth look at how a company has performed in the past. You can access this detailed graph of past earnings, revenue and cash flow.

If you would prefer discover what analysts are predicting in terms of future growth, do not miss this free report on analyst forecasts.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About SEHK:667

China East Education Holdings

An investment holding company, provides vocational training education services in the People's Republic of China.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives