Every investor in Phoslock Environmental Technologies Limited (ASX:PET) should be aware of the most powerful shareholder groups. Large companies usually have institutions as shareholders, and we usually see insiders owning shares in smaller companies. I generally like to see some degree of insider ownership, even if only a little. As Nassim Nicholas Taleb said, 'Don’t tell me what you think, tell me what you have in your portfolio.'

Phoslock Environmental Technologies is not a large company by global standards. It has a market capitalization of AU$795m, which means it wouldn't have the attention of many institutional investors. In the chart below below, we can see that institutional investors have not yet purchased much of the company. Let's take a closer look to see what the different types of shareholder can tell us about PET.

Check out our latest analysis for Phoslock Environmental Technologies

What Does The Institutional Ownership Tell Us About Phoslock Environmental Technologies?

Institutions typically measure themselves against a benchmark when reporting to their own investors, so they often become more enthusiastic about a stock once it's included in a major index. We would expect most companies to have some institutions on the register, especially if they are growing.

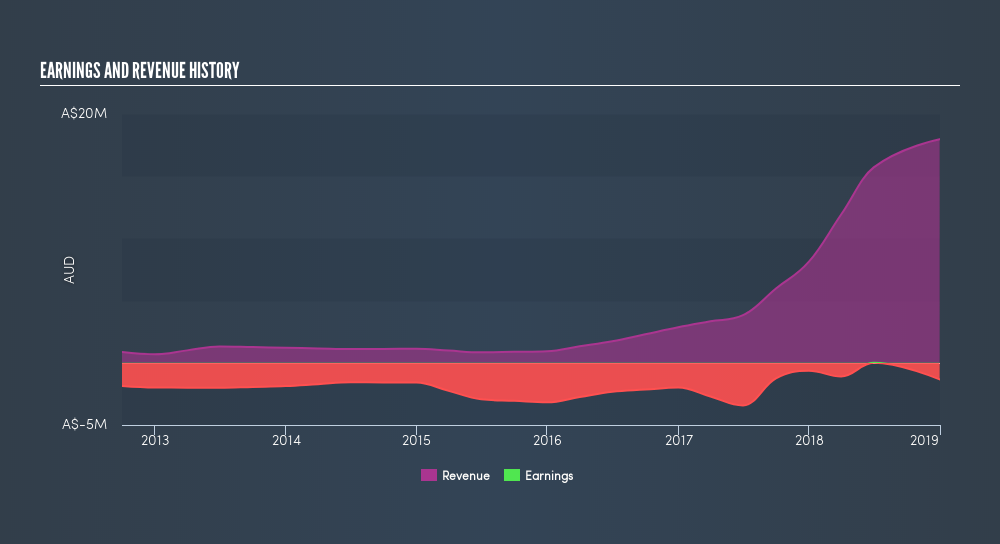

Less than 5% of Phoslock Environmental Technologies is held by institutional investors. This suggests that some funds have the company in their sights, but many have not yet bought shares in it. If the company is growing earnings, that may indicate that it is just beginning to catch the attention of these deep-pocketed investors. When multiple institutional investors want to buy shares, we often see a rising share price. The past revenue trajectory (shown below) can be an indication of future growth, but there are no guarantees.

Hedge funds don't have many shares in Phoslock Environmental Technologies. Our information suggests that there isn't any analyst coverage of the stock, so it is probably little known.

Insider Ownership Of Phoslock Environmental Technologies

The definition of an insider can differ slightly between different countries, but members of the board of directors always count. Management ultimately answers to the board. However, it is not uncommon for managers to be executive board members, especially if they are a founder or the CEO.

Insider ownership is positive when it signals leadership are thinking like the true owners of the company. However, high insider ownership can also give immense power to a small group within the company. This can be negative in some circumstances.

It seems insiders own a significant proportion of Phoslock Environmental Technologies Limited. It has a market capitalization of just AU$795m, and insiders have AU$263m worth of shares in their own names. It is great to see insiders so invested in the business. It might be worth checking if those insiders have been buying recently.

General Public Ownership

The general public, mostly retail investors, hold a substantial 58% stake in PET, suggesting it is a fairly popular stock. With this size of ownership, retail investors can collectively play a role in decisions that affect shareholder returns, such as dividend policies and the appointment of directors. They can also exercise the power to decline an acquisition or merger that may not improve profitability.

Private Company Ownership

We can see that Private Companies own 8.2%, of the shares on issue. Private companies may be related parties. Sometimes insiders have an interest in a public company through a holding in a private company, rather than in their own capacity as an individual. While it's hard to draw any broad stroke conclusions, it is worth noting as an area for further research.

Next Steps:

I find it very interesting to look at who exactly owns a company. But to truly gain insight, we need to consider other information, too.

I like to dive deeper into how a company has performed in the past. You can find historic revenue and earnings in this detailed graph.

Of course this may not be the best stock to buy. So take a peek at this free free list of interesting companies.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Market Insights

Community Narratives