The big shareholder groups in Outcrop Gold Corp. (CVE:OCG) have power over the company. Generally speaking, as a company grows, institutions will increase their ownership. Conversely, insiders often decrease their ownership over time. I generally like to see some degree of insider ownership, even if only a little. As Nassim Nicholas Taleb said, 'Don’t tell me what you think, tell me what you have in your portfolio.

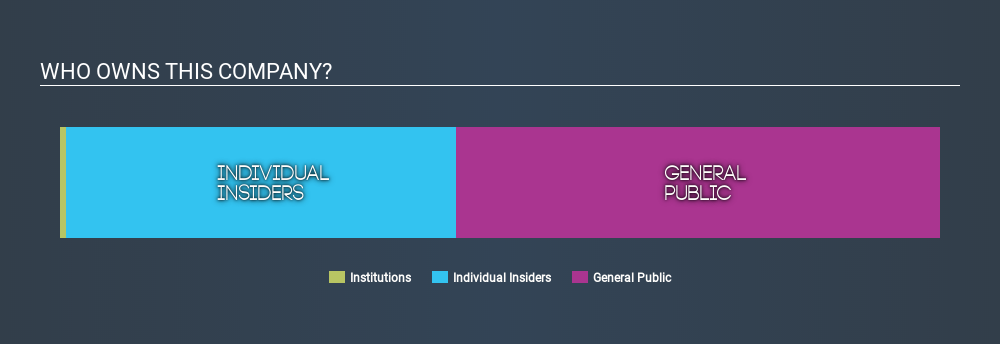

Outcrop Gold is not a large company by global standards. It has a market capitalization of CA$11m, which means it wouldn't have the attention of many institutional investors. Our analysis of the ownership of the company, below, shows that institutions don't own many shares in the company. Let's take a closer look to see what the different types of shareholder can tell us about Outcrop Gold.

Check out our latest analysis for Outcrop Gold

What Does The Lack Of Institutional Ownership Tell Us About Outcrop Gold?

We don't tend to see institutional investors holding stock of companies that are very risky, thinly traded, or very small. Though we do sometimes see large companies without institutions on the register, it's not particularly common.

There are many reasons why a company might not have any institutions on the share registry. It may be hard for institutions to buy large amounts of shares, if liquidity (the amount of shares traded each day) is low. If the company has not needed to raise capital, institutions might lack the opportunity to build a position. On the other hand, it's always possible that professional investors are avoiding a company because they don't think it's the best place for their money. Outcrop Gold might not have the sort of past performance institutions are looking for, or perhaps they simply have not studied the business closely.

Hedge funds don't have many shares in Outcrop Gold. From our data, we infer that the largest shareholder is Ian Slater (who also holds the title of Top Key Executive) with 28% of shares outstanding. Its usually considered a good sign when insiders own a significant number of shares in the company, and in this case, we're glad to see a company insider play the role of a key stakeholder. With 13% and 1.4% of the shares outstanding respectively, Eric Sprott and Kevin Nishi are the second and third largest shareholders. Interestingly, Kevin Nishi is also a Member of the Board of Directors, again, indicating strong insider ownership amongst the company's top shareholders.

Our studies suggest that the top 9 shareholders collectively control less than 50% of the company's shares, meaning that the company's shares are widely disseminated and there is no dominant shareholder.

Researching institutional ownership is a good way to gauge and filter a stock's expected performance. The same can be achieved by studying analyst sentiments. Our information suggests that there isn't any analyst coverage of the stock, so it is probably little known.

Insider Ownership Of Outcrop Gold

The definition of an insider can differ slightly between different countries, but members of the board of directors always count. Management ultimately answers to the board. However, it is not uncommon for managers to be executive board members, especially if they are a founder or the CEO.

Most consider insider ownership a positive because it can indicate the board is well aligned with other shareholders. However, on some occasions too much power is concentrated within this group.

Our most recent data indicates that insiders own a reasonable proportion of Outcrop Gold Corp.. Insiders have a CA$5.1m stake in this CA$11m business. This may suggest that the founders still own a lot of shares. You can click here to see if they have been buying or selling.

General Public Ownership

The general public -- mostly retail investors -- own 55% of Outcrop Gold. With this size of ownership, retail investors can collectively play a role in decisions that affect shareholder returns, such as dividend policies and the appointment of directors. They can also exercise the power to decline an acquisition or merger that may not improve profitability.

Next Steps:

I find it very interesting to look at who exactly owns a company. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 6 warning signs for Outcrop Gold you should be aware of, and 4 of them are a bit concerning.

Of course this may not be the best stock to buy. So take a peek at this free free list of interesting companies.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About TSXV:OCG

Outcrop Silver & Gold

Engages in the identification, acquisition, exploration, and development of mineral properties in Colombia and the United States.

Medium-low with adequate balance sheet.

Market Insights

Community Narratives