- India

- /

- Paper and Forestry Products

- /

- NSEI:RUCHIRA

What Is Ruchira Papers's (NSE:RUCHIRA) P/E Ratio After Its Share Price Rocketed?

It's really great to see that even after a strong run, Ruchira Papers (NSE:RUCHIRA) shares have been powering on, with a gain of 32% in the last thirty days. But shareholders may not all be feeling jubilant, since the share price is still down 49% in the last year.

Assuming no other changes, a sharply higher share price makes a stock less attractive to potential buyers. In the long term, share prices tend to follow earnings per share, but in the short term prices bounce around in response to short term factors (which are not always obvious). So some would prefer to hold off buying when there is a lot of optimism towards a stock. One way to gauge market expectations of a stock is to look at its Price to Earnings Ratio (PE Ratio). A high P/E ratio means that investors have a high expectation about future growth, while a low P/E ratio means they have low expectations about future growth.

View our latest analysis for Ruchira Papers

How Does Ruchira Papers's P/E Ratio Compare To Its Peers?

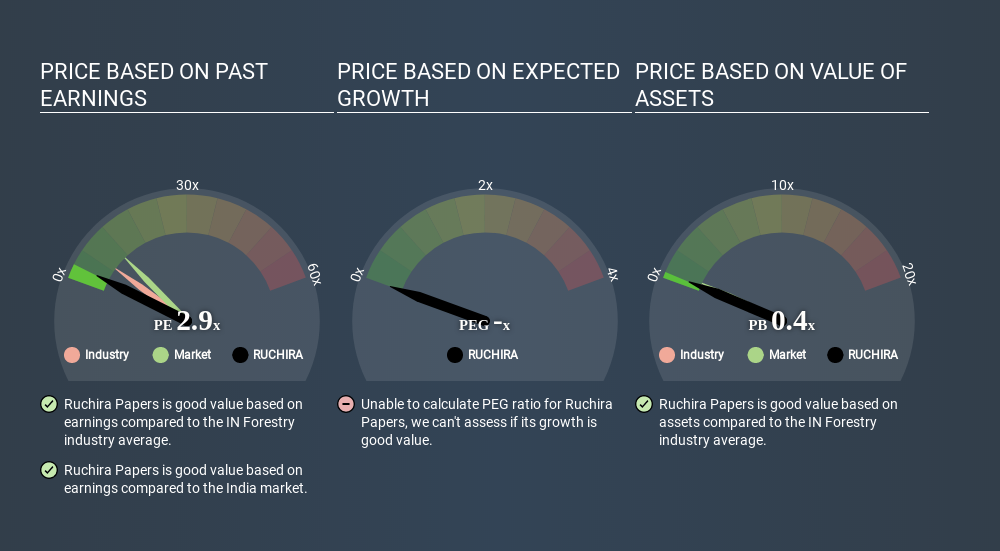

We can tell from its P/E ratio of 3.06 that sentiment around Ruchira Papers isn't particularly high. If you look at the image below, you can see Ruchira Papers has a lower P/E than the average (7.4) in the forestry industry classification.

Ruchira Papers's P/E tells us that market participants think it will not fare as well as its peers in the same industry. Since the market seems unimpressed with Ruchira Papers, it's quite possible it could surprise on the upside. You should delve deeper. I like to check if company insiders have been buying or selling.

How Growth Rates Impact P/E Ratios

Probably the most important factor in determining what P/E a company trades on is the earnings growth. If earnings are growing quickly, then the 'E' in the equation will increase faster than it would otherwise. That means even if the current P/E is high, it will reduce over time if the share price stays flat. And as that P/E ratio drops, the company will look cheap, unless its share price increases.

Ruchira Papers's earnings per share fell by 1.1% in the last twelve months. But EPS is up 22% over the last 5 years.

A Limitation: P/E Ratios Ignore Debt and Cash In The Bank

Don't forget that the P/E ratio considers market capitalization. Thus, the metric does not reflect cash or debt held by the company. The exact same company would hypothetically deserve a higher P/E ratio if it had a strong balance sheet, than if it had a weak one with lots of debt, because a cashed up company can spend on growth.

Spending on growth might be good or bad a few years later, but the point is that the P/E ratio does not account for the option (or lack thereof).

How Does Ruchira Papers's Debt Impact Its P/E Ratio?

Ruchira Papers's net debt is 54% of its market cap. This is enough debt that you'd have to make some adjustments before using the P/E ratio to compare it to a company with net cash.

The Verdict On Ruchira Papers's P/E Ratio

Ruchira Papers has a P/E of 3.1. That's below the average in the IN market, which is 11.3. When you consider that the company has significant debt, and didn't grow EPS last year, it isn't surprising that the market has muted expectations. What we know for sure is that investors are becoming less uncomfortable about Ruchira Papers's prospects, since they have pushed its P/E ratio from 2.3 to 3.1 over the last month. If you like to buy stocks that could be turnaround opportunities, then this one might be a candidate; but if you're more sensitive to price, then you may feel the opportunity has passed.

Investors have an opportunity when market expectations about a stock are wrong. As value investor Benjamin Graham famously said, 'In the short run, the market is a voting machine but in the long run, it is a weighing machine. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

But note: Ruchira Papers may not be the best stock to buy. So take a peek at this free list of interesting companies with strong recent earnings growth (and a P/E ratio below 20).

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About NSEI:RUCHIRA

Ruchira Papers

Manufactures and markets kraft paper, and writing and printing paper products in India and internationally.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives